Why AI is the Best Tool for Failed Payment Recovery

Failed payments are a complex problem that requires a solution sophisticated enough to manage this complexity.

Specialized Solutions Most Effective in Reducing Involuntary Churn

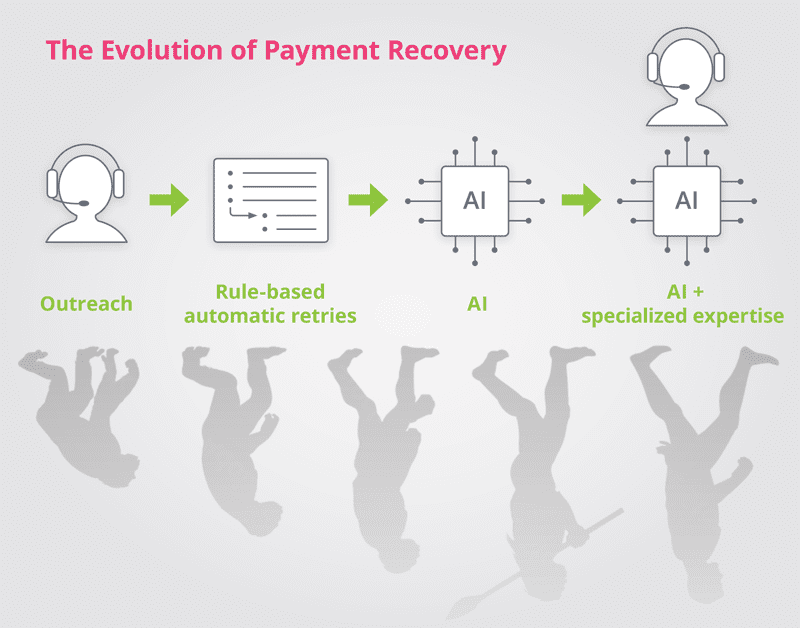

Many subscription companies start by solving failed payments with an in-house solution thinking they are doing all they can. These solutions include rules-based automatic retry systems that run on specific schedules or using a customer service outreach approach. While these initiatives do an okay job at recovering some failed payments, they simply can’t achieve the same high level of recovery that a third-party solution can. In fact, research has shown that virtually all top performing companies outsource their failed payment recovery to companies delivering specialized solutions, as opposed to only 14.3% of bottom performers.

This data validates both the correlation between the effectiveness of specialized solutions, and the revenue performance these solutions deliver. It also shows that top-performing companies recognize that optimizing the recovery of customers from failed payments is more important than minimizing the cost of recovery. Companies that don’t take advantage of specialized solutions are paying the price by losing hard-earned customer revenue, and missing the full growth potential that exists in the customer base that they have built. Top performers focus on revenue, not costs.

What is Artificial Intelligence and Machine Learning?

In a nutshell, Artificial Intelligence (AI) uses computer science and robust datasets to create expert systems that can analyze data and make decisions capable of solving complex problems, in this case recovering failed credit card payments. It also includes Machine Learning and Deep Learning, which are fields of inquiry that teach the AI what it needs to learn to uncover the underlying patterns within the data that are not easily found by humans. Machine Learning algorithms make predictions based on the data provided and can be used to determine why a subscription payment has failed and how to best recover it.

There are billions of possible data combinations that must be considered to create a unique recovery strategy for each failed payment. Because the problem is so complex, AI is the most effective solution. Machine Learning models use a rich library of data points to evaluate a failed transaction against the hundreds of reasons why it might have failed. These algorithms use data to create an optimal recovery solution for each failed payment optimizing variables such as the issuing bank, card type, merchant type, many other variables. And it works directly with the payments system, so the customer never knows their payment failed. A rules-based recovery system or a customer service team simply can’t compete. Machine Learning is a powerful tool, but it’s only as good as the data it is trained on. Machine Learning algorithms require industry expertise and billions of data records with current information to deliver top results. Any insight that leads to even a tiny performance improvement can have a massive impact on company revenue.

As the Machine Learning model takes in more data, it will learn from it, which leads to improvements in recovery success rates. However, the data it uses needs to come from a variety of sources to be the most valuable — using information from only one ecosystem isn’t enough. FlexPay partners with several financial institutions to ensure our AI and machine learning models have the ideal data needed to create optimal failed payment recovery strategies.

Combining Artificial Intelligence Technology with Human Ingenuity

Technology is needed to solve the problem of failed payments, but you also need a deep understanding of the payments ecosystem too. The most effective AI combines deep industry expertise with Ph.D. level mathematical and computer science skills. This level of expertise on staff is simply out of reach for most companies, and even most companies attempting to solve the failed payment problem.

FlexPay combines over four decades of payments industry experience with an expert data science team to continuously improve our current modelling algorithms. These data scientists leverage the latest technologies to create new Machine Learning models, regularly upgrading our currently existing models to optimally improve recovery rates.

Our Machine Learning solution draws from a rich amount of data equalling 7% of all US annual transactions. This data gives our AI and Machine Learning solution deep knowledge about the specific decline codes, types of cards, MCC behavior, and changes based on geography that are needed to optimize the recovery strategy for each failed payment. We understand the changing Visa and Mastercard guidelines and our solution creates a strategy to preserve the health of your merchant account. Since every decline damages your account a little bit, our system works to minimize this harm.

Other companies may offer a failed payment recovery solution as one of their many product offerings, but FlexPay is 100% dedicated to solving the failed payment problem, and reducing involuntary churn to zero. We are constantly improving our Machine Learning models and innovating our solution to ensure we always deliver optimal results. This focus has paid off — we have achieved an impressive 68% recovery rate for some customers. These numbers prove why AI is the best tool for failed payment recovery.