Insurance

Delivering highest failed payment recovery and churn reduction to Insurance companies

Remove the largest source of policy holder churn and dissatisfaction for insurance customers by applying FlexPay’s AI-powered Invisible Recovery™ solution for failed payments

FlexPay Invisible Recovery™ optimizes insurance premium failed payment recovery

Insurance policy holders must avoid policy interruptions because of the potential for interruption of policy coverage. One of the biggest causes of policy interruption is failed payments, which also creates policy holder churn. Invisible Recovery™ works quickly and without any customer contact, avoiding churn while maximizing revenue from industry-best failed payment recovery.

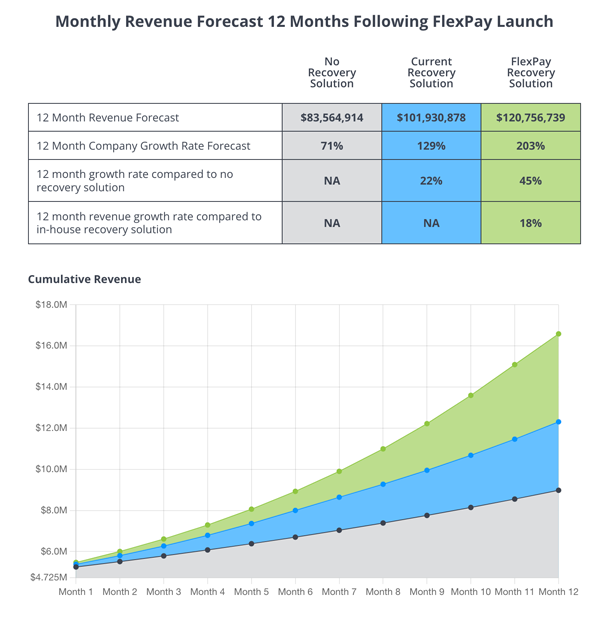

Grow company revenue by 33%!

Failed credit card payments cause customer churn by interrupting policies. Policies interrupted by payment issues reduce revenue and growth by eliminating future premium payment cycles. FlexPay Invisible Recovery™ increases customer LTV by recovering current month’s payment, and unlocking future premium billings which increases policy LTV. FlexPay allows insurance policy holders to choose when they want to end their policy, and avoid having a failed payment make this decision for them.

Learn how FlexPay subscription clients experience an average 33% increase in total revenue collected in the first 12 months, and accelerate customer acquisition.

Unique payment recovery strategy optimized for each failed policy payment

Premium payments are declined by card authorization systems for hundreds of reasons, so payment recovery solutions must intelligently adapt to each failed payment. The FlexPay AI-Powered Invisible Recovery™ solution creates a unique recovery strategy for each failed premium payment, maximizing recovery rates.

Avoid policy disruption caused by failed premium payments

FlexPay’s Invisible Recovery™ solution delivers the highest failed payment recovery performance while avoiding policy disruptions, creating longer lasting and more satisfied policy holders.

Increase policy holder LTV by reducing the largest cause of involuntary churn

- Reduce up to 75% of policy churn caused by failed payments

- Earn future premium payments that are lost after a failed payment interrupts policy coverage, creating cumulative revenue growth and increasing customer LTV

- Accelerate future customer growth with excess customer acquisition budget gained from the recovered revenue

FlexPay Integrations

Insurance

CRM Integrations

FlexPay has integrations with most of the major subscription billing platforms, including Stripe and Chargify, allowing quick and easy deployments.

Gateway Integrations

FlexPay has integrations with over 115 payment gateways, including Chase and FIS.

Custom Integrations

FlexPay’s API supports integrations with custom billing and payments systems, supporting deployments on virtually any platform.