Your gateway — working harder to recover payments

Harmonize recovery efforts across all gateway technology

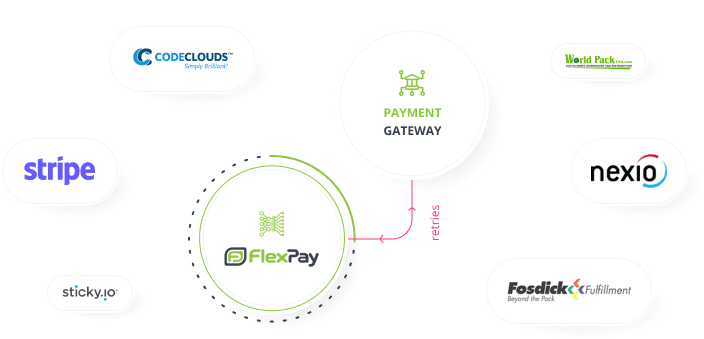

FlexPay’s AI enhances gateway technologies, such as transaction data optimization, card account updater, and 3DS2 to get most of your recurring payments approved.

Whether you use one gateway or multiple gateways, FlexPay connects to all of them to recover failed payments. Scroll down to see our full list of gateways.

Failed Payment Recovery for 3DS2

3D Secure 2.0 (3DS2) is an additional verification layer to reduce risk when authorizing credit cards. Card holders must complete a verification step to validate a purchase. The validation details are sent through the 3DS2 network, referencing a 3DS2 token attached to the transaction in the normal authorization flow.

3DS2 is being more widely used, but it’s impact on recurring payments is not often understood. Expert payment knowledge is required so the rich data can pass through without harming your recurring acceptance rates. If you want to combine 3DS2 and failed payment recovery strategies, our team can help you correctly implement the technology.

Gateways we are integrated with

These are the gateways we are currently integrated with. Click your gateway to access integration requirements. If your gateway is not here, let us know and we can easily add a new one for you.

Can't find your favourite payment gateway?

Leave your email below to register your interest.

Frequently Asked Questions

FlexPay accesses transaction information from failed payments and the status of the subscription. Our AI model analyzes each transaction and creates the optimal recovery strategy for each failed payment by determining why it was declined and finding the ideal solution.

FlexPay receives the results of your transaction requests, such as the response codes. The AI model then uses this information to create a dedicated recovery strategy for each failed payment.

FlexPay plugs into any CRM and payment gateway to coordinate AI-powered strategies that recover failed payments from recurring transactions, such as subscriptions or installments. We combine powerful technology with high-touch support and consultancy from payment industry experts to help merchants achieve maximum performance, given their specific business context and payment stack.

The duration of an integration project depends on what CRM or billing system you are using. If you’re using a CRM we’re already integrated

with – such as Stripe or Chargify — we can configure your account in just a few hours.

If you are using a custom CRM or other unique setups on systems of record, integrating with our API typically takes from 10-30 days to complete.

We’re already integrated with most popular gateways, and we add new gateways in as little as 3 days.

All integrations are supported by our integrations team and are led by a dedicated Project Manager, who will be your tech team’s main point of contact. We support your team in making the correct choices for your business, including payment system architecture, MCC optimization, active monitoring, support, and documentation.

Once the integration is complete, your Client Success Manager will monitor and improve your account’s performance and create reports that keep you informed.

Integration and support are provided at no extra cost.

FlexPay is PCI DSS level 1 compliant so it is secure. FlexPay will not harm merchant account health. Our technology is designed to minimize retry counts, which protects your Merchant Account health while achieving high revenue recovery.