What Subscription CX Professionals Need to Know About Failed Payments and Churn

When handled incorrectly, failed payments harm customer satisfaction and create churn. Here are the best practices CX professionals can start applying today to maintain customer satisfaction and retain subscribers.

Stopping failed payments from causing churn is a challenging problem to solve, requiring multi-disciplinary collaboration. The first step is to recognize it’s a strategic initiative requiring collaboration between retention and CX leaders, finance, payments, and operations teams. Failed payments are closely tied to retention and revenue because unrecovered failed payments make up nearly half of all churn. The CX professional is the ideal leader to ensure CX best practices are applied to failed payment recovery solutions.

Why are subscription rebills not going through?

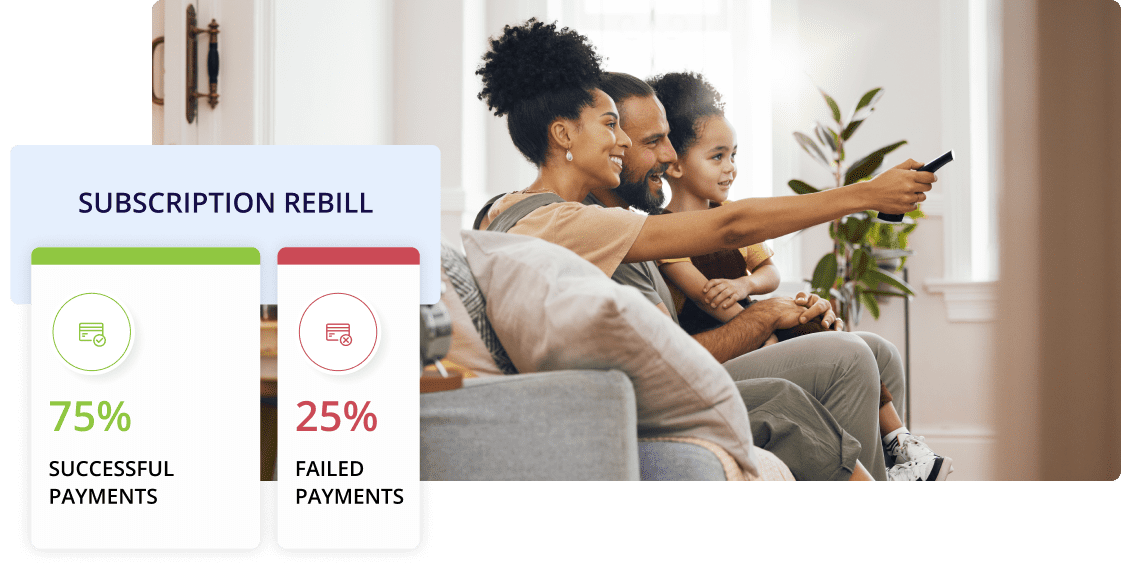

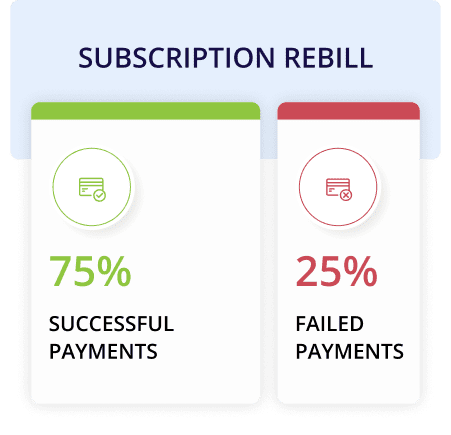

Subscription businesses have a significantly higher rate of declined payments than other types of purchases. Data from Visa shows that only 1% of in-person transactions are declined, but the decline rate jumps to 25% on average for recurring billing payments or payments for subscription services. These declines aren’t the result of fraud or insufficient funds, but are false declines or inaccurate decisions made on legitimate payments.

Failed payments happen because the payments system was designed for in-person transactions, not the modern recurring billing model. Banks treat recurring billing transactions as being more prone to fraud, leading to legitimate transactions being wrongly declined. This can happen even after a customer has previously billed multiple times. Unfortunately, these bank errors make failed payments an inevitable part of the customer journey and a large source of churn, and they must be handled strategically to recover the payment and preserve customer relationships.

How failed payments disrupt the customer experience

Subscription businesses rely on maintaining long-term customer relationships to become profitable. This means a positive customer experience is essential throughout the journey. Unfortunately, subscription models are uniquely vulnerable to payment issues because they are card-not-present transactions, which are more likely to be flagged by a bank’s fraud detection system. They are an unfortunate cost created by an antiquated payments system and not the fault of the customer or the merchant. However, merchants now have the opportunity to leverage AI and CX technology to minimize the harm that failed payments cause.

Any awareness of the failed payment is a problem, and dissatisfaction increases when the customer feels that the brand is making the customer responsible for the problem. For example, they may feel anxious about why their credit card “didn’t work”, experience financial stress because they don’t understand why the payment didn’t go through, or feel dissatisfaction with the brand because they are involved in a problem they didn’t create. Any wrong word from the merchant can make the subscriber feel like they are being blamed for the problem, even though the failed payment wasn’t their fault. In fact, simple awareness of the failed payment by your customers gives them the opportunity to decide whether to stay or end their subscription, creating a potential churn trigger which must be managed to avoid negative outcomes.

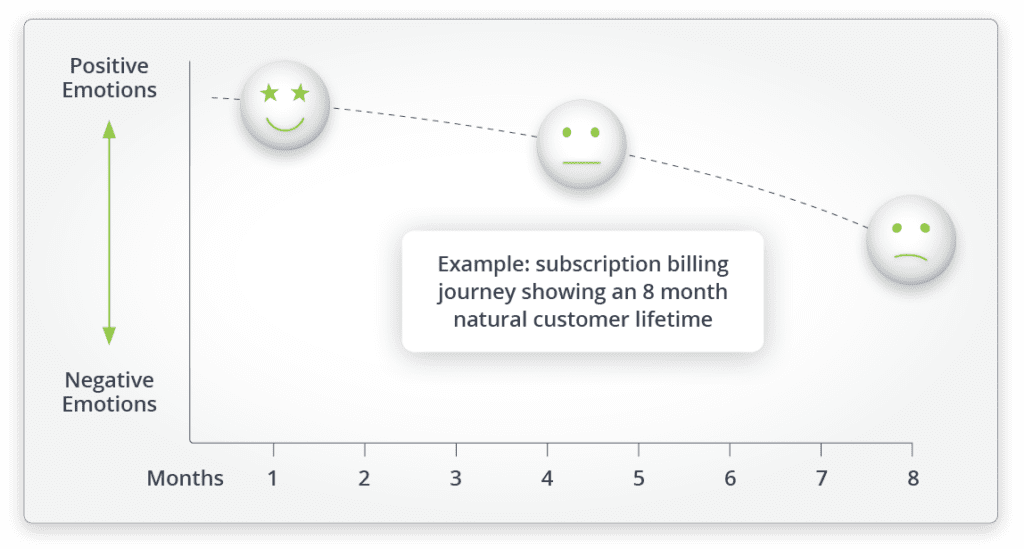

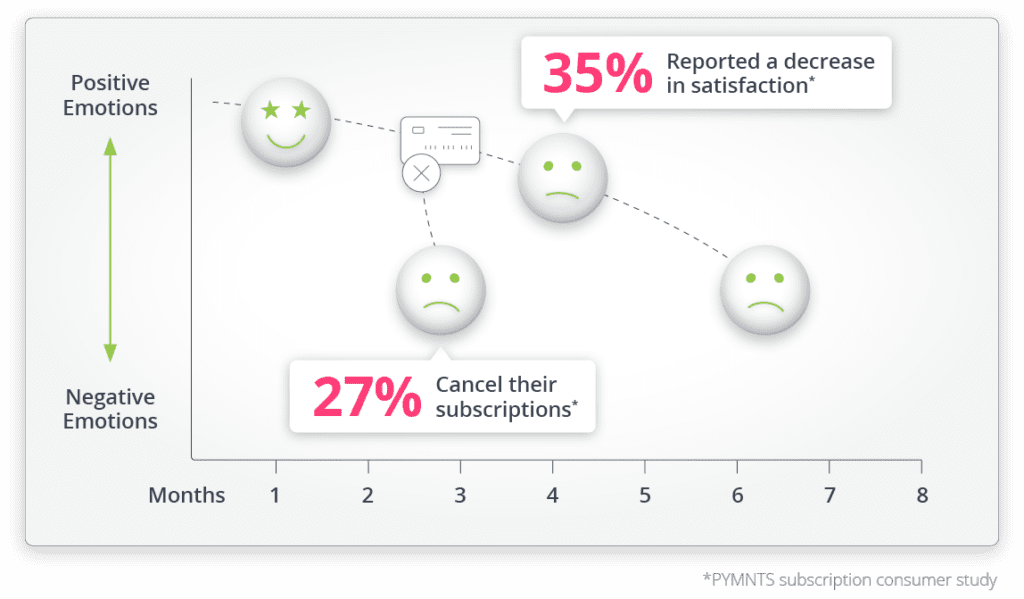

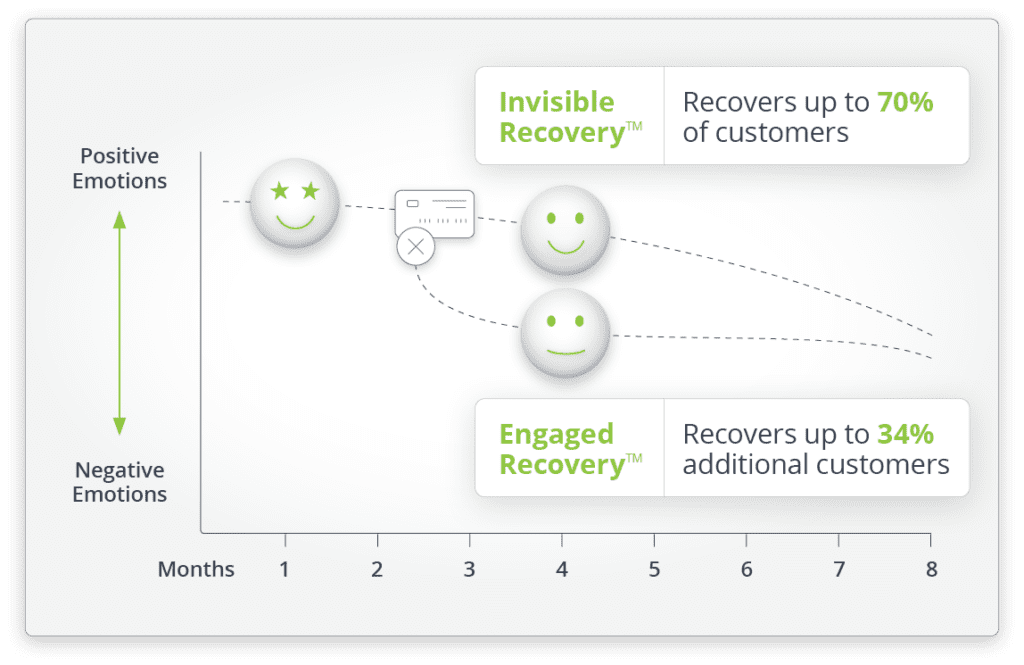

Using an emotional curve graph, let’s compare the effects of a payment disruption. Without any disruption, this example has an average subscriber lifetime value of 8 months.

PYMNTS and FlexPay conducted research to learn more about typical recovery outcomes. We found that 27% of account holders decide to cancel their subscription when notified about a failed payment. In fact, 35% customers who updated their payment information after a decline still reported a drop in satisfaction.

Plotted on the emotional curve graph, it’s easy to see how the customer journey ends prematurely either when the failed payment occurs, or earlier than the expected customer lifespan. This is how failed payments contribute to a loss of revenue and profitability.

Subscription CX professionals can rescue customers with the ideal recovery journey

There is good news: CX subscription leaders are in a unique position to solve this problem. Most companies underestimate the impact failed payments have on retention and customer LTV. Research shows that only 44% of subscription professionals think a seamless payment experience is important to customers. Over two-thirds of subscription companies recognize the negative impact failed payments have on customer retention, yet only about a quarter of them consider it the most significant contributor to churn.

Every subscription customer expects that their card will successfully bill month after month, and when a payment fails, a negative reaction is almost inevitable. This makes a seamless payments experience an implied part of your brand promise that shouldn’t be broken. When the payments experience is interrupted by a failed payment, recovering the customer improves profitability, both from the successful current billing cycle as well as from future lifetime value.

Let’s dive into what the ideal recovery solution looks like from a CX perspective.

The ideal CX for failed payment recovery

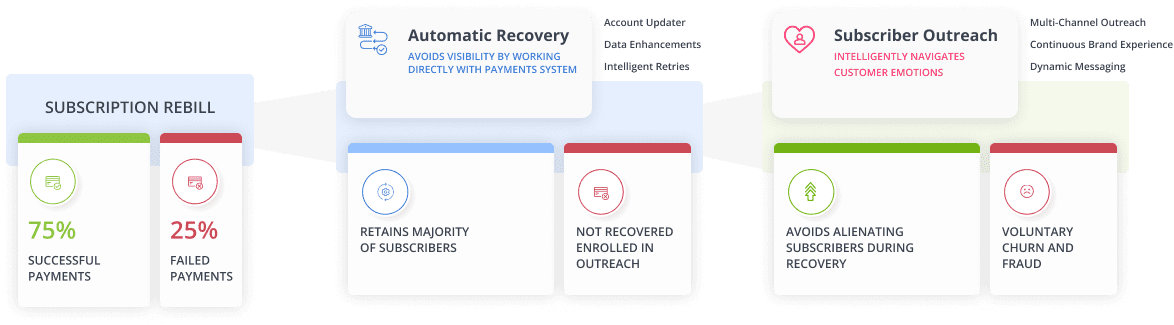

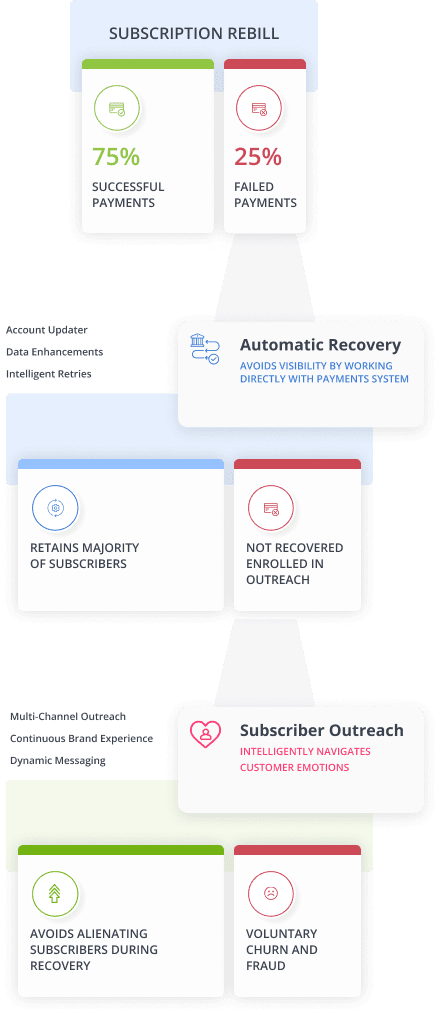

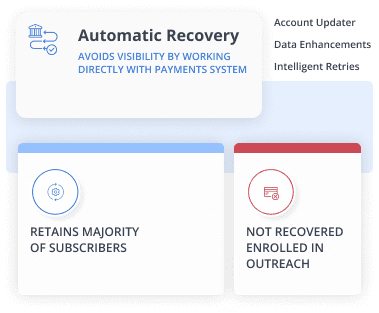

Automatic Recovery

Avoid unwanted customer visibility by recovering directly with the payments system

To avoid churn, your payment recovery strategy should avoid customer involvement whenever possible.

The ideal payment recovery strategy works directly within the payments system to solve the failed payment without customer involvement and doesn’t negatively affect the customer journey. Customers never know their payment failed and the customer relationship carries on without interruption to achieve maximum LTV. Solutions that leverage specialized technologies like AI and work directly with the payments system will deliver top recovery solution results, and can be even be enhanced with additional tools such as account updater and data enhancements.

Subscriber Outreach

Intelligently navigate customer emotions with thoughtful outreach

Recovering failed payments through outreach is a difficult balancing act. At best, asking a customer to update their payment method is just another task required from your mentally exhausted customers to deal with, where inaction is the easiest path for them to take. At worst, a failed payment can reduce satisfaction and trigger a blame game. Being hyper-aware of the psychological and sociological implications of messaging is critical if you want to avoid decreasing satisfaction and increasing churn. The brand experience throughout the recovery journey should be indistinguishable from your other customer communications. The outreach should also adapt to each individual situation, such as the cause of the failed payment. Should your customer add a new card or try again the existing one? How long has it been since the payment failed and how much is due? These all impact what you should say and how you should communicate.

Measuring failed payments on the emotional curve

A FlexPay and PYMNTS study from 2023 shows that only 44% of subscription professionals think a smooth payment experience is important to customers. Most companies just don’t realize how significant payments are to the customer experience.

Data from the same study shows that over two-thirds of subscription companies recognize the negative impact failed payments have on customer retention, yet only about a quarter of them consider it the most significant contributor to churn. In other words, most companies underestimate the impact failed payments have on retention and customer LTV.

Best practices in action

Imagine the impact on revenue and profits for your subscription business if failed payments were reduced to an incidental level.

These superior results are all possible when the failed payment problem is seen as an CX issue that you have the power to solve. But it’s hard to do it all by yourself.

At FlexPay, this is what we specialize in. We’ve built a recovery flow that protects your subscriber experience from payment disruptions, and preserves your customer’s natural LTV, so you get the results you want and need.

CX and retention leaders should partner with finance, payments, and operations teams to deliver the best possible failed payment recovery and customer LTV. Applying CX practices to the technology and process design will enhance recovery results, ensure great customer experiences through the recovery process, and maintain high customer satisfaction and retention levels. The ideal solution for resolving failed payments and reducing churn should include technology capable of swiftly addressing payment issues without customer involvement to reduce negative feelings about the brand. When customer participation is necessary, the CX strategy must be carefully designed to engage customer’s in a way that promotes participation while maintaining satisfaction and retention.

Read the full guide on best practices here.

See how our customers eliminate involuntary churn

Case studies

Alder Holdings, a leading home security provider in the USA, increases subscription rebill rate by 60% using Invisible Recovery and Engaged Recovery by FlexPay.

"FlexPay plays a huge role in capturing revenue for our business."

Jake Palmer

Senior Vice President, Alder Holdings, LLC

Case studies

Truly Free, an eco-friendly cleaning product company, improved their recovery rate by 240% with FlexPay, compared to their in-house recovery system.

"FlexPay recovered thousands of dollars that we would have otherwise thrown away. I trust FlexPay. They go beyond what a normal partner would."

Chad Buckendahl

Chief Growth Officer, Truly Free

Case studies

Invisible Recovery helped ClinicSense, a B2B SaaS company, achieve a 69% recovery improvement, allowing them to fuel their growth.

"The advantage of FlexPay is that I don’t have to think about customers whose payments are failing, I know that they are taking care of it for me."

Daniel Ruscigno

CEO, ClinicSense

Case studies

Hooked on Phonics, an e-learning provider, recovered an additional 45% beyond their in-house recovery, and increased their subscription profitability and customer LTV.

"FlexPay has been a key partner in our effort to improve our subscription profitability. The customers FlexPay has been successfully reactivating for us keep coming back month after month."

Robert Israel

Co-Founder and President