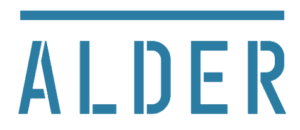

How Alder recovered an additional 34% of subscription failed payments with FlexPay’s Engaged Recovery™

Challenge

Jake Palmer has been instrumental to Alder’s growth over the last 11 years, having worn many hats: Finance, Customer Experience, Revenue, and most recently leading Technology as President of Pando, their proprietary CRM system. This experience gives Jake an intimate knowledge of Alder’s strategic business needs. He explains why customer retention and loyalty are crucial for Alder: “The alarm world is a unique business model because it takes many years for a customer to become profitable. After the initial acquisition costs, setting up each household requires a significant upfront investment in equipment, labor, and acquisition cost (either sales commission or web marketing). If we don’t do our job right, we can’t stay in business.”

This understanding is the driving factor behind their vertical integration strategy. However, one of the biggest customer experience disruptions came from an unanticipated source — processing credit cards.

Originally, Alder accepted payments through ACH (direct bank transfers). Since most of their initial customers were acquired in person by sales representatives, ACH payments were easy to acquire. As they built their internal sales team and DIY systems, however, credit card processing became more prevalent. Alder quickly realized that processing a credit card (CC) was far different than processing an ACH debit. One of the first mysteries they had to solve was why the first payment would process successfully, but subsequent payments would decline at an abnormally high rate.

Jake recalls how steep the team’s learning was when analyzing their ACH to CC success rates: “We did everything wrong. We didn’t validate card CVV or AVS, and we allowed gift cards and prepaid cards for recurring payments.” Even after covering these basics, their billing success rates were still not optimal.

They’re great to work with, and I can text if there’s something urgent and get a response. They’ve been an excellent partner.”

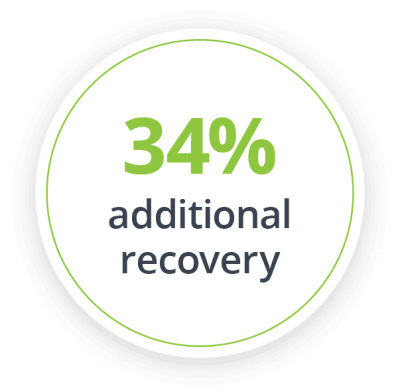

* The State of Subscription Business: Best Practices and Business Performance Drivers

Solution

Jake researched the failed payment issue and discovered technology companies that specialize in solving this little-known problem that causes big pain to subscription companies. He quickly found there was a lot more to learn, and he was getting conflicting advice from the different vendors. However, one company that set itself apart by providing clear guidance was FlexPay. FlexPay’s Customer Success team took the time to explain the problems in the payment ecosystem that caused failed payments and provided best practice recommendations to help Alder optimize its payment infrastructure. With FlexPay’s support, Alder integrated their in-house CRM (Pando) with FlexPay, which allowed them to send declined credit card transactions as soon as they happened.

Results

After successfully integrating with FlexPay’s Invisible Recovery™ system, Jake was thrilled with the results: “FlexPay delivered on their promise. They’re great to work with, and I can text if there’s something urgent and get a response. They’ve been an excellent partner.” Invisible Recovery works within the payments system to recover the payment quickly. This is the most discreet method because it avoids customer visibility to the payment issues.

Always eager to improve even further, Jake’s team at Alder was the first to activate FlexPay’s Engaged Recovery™ solution, which extended the recovery flow through customer outreach channels. Working in concert with Invisible Recovery, Engaged Recovery sends out a fully branded and customized email sequence indistinguishable from Alder’s brand and tone. Messaging is informed by behavioral science to drive recovery and retention. Engaged Recovery immediately delivered results for Alder, with 34% of customers completing a new payment within a month. Engaged Recovery helped Alder reduce their churn rate even more.

All in all, FlexPay has recovered approximately $1.7M over the past 12 months, without counting the Lifetime Value of recovered customers that carry on billing month after month after recovery. Jake is thrilled with the results: “I could categorize FlexPay as an internal department because they play a huge role in capturing revenue for our business.”

About Alder

Alder is a leading home security provider in the USA, having protected over 300,000 households from burglaries, fires, floods, and medical emergencies. Thanks to their commitment to reliability and excellence, Alder has invested heavily in controlling all aspects of their business, thus making them vertically integrated and agile. Alder designs, manufactures, and owns all of their alarm equipment, and manage their customer base with a CRM designed and developed in-house. Customer service is provided by call centers and staff in Utah, Guatemala, and the Philippines, which are all owned by Alder. Distribution of DIY orders and additional equipment are handled by Alder’s fulfillment center in Memphis, TN.