Integrate Failed Payment Recovery

Add powerful strategies to retain more subscribers

systems to maximize failed payment recovery and customer retention.

FlexPay creates unique payment recovery strategies, working within your payment stack to protect against churn and retain the full customer lifetime value

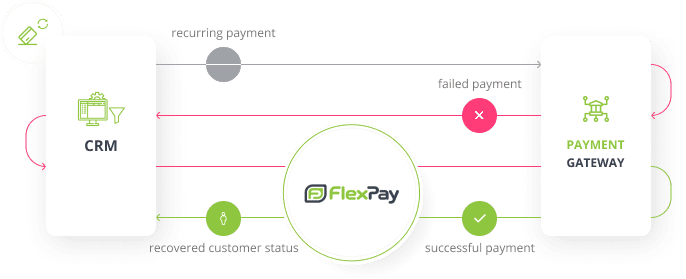

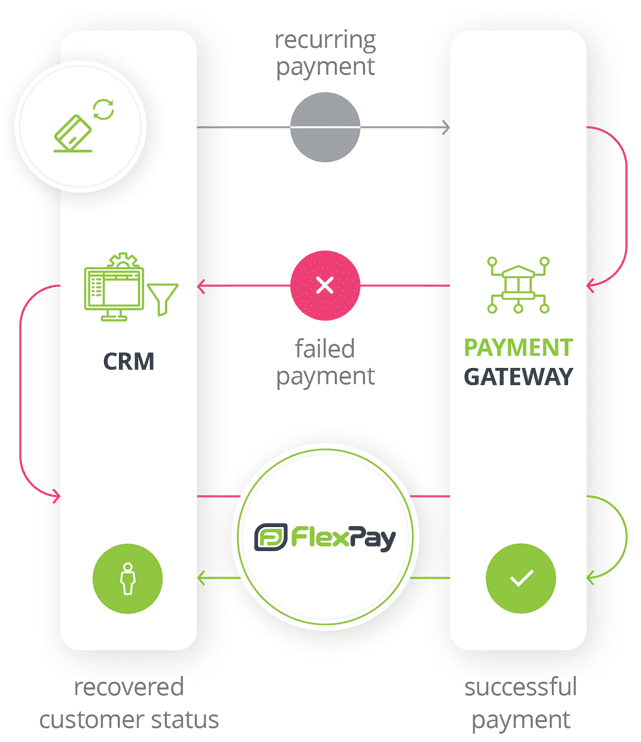

How integrating with FlexPay works

Your 3rd party CRM upgraded with strategic authorization management

Your CRM or subscription management system needs to route details about the failed transactions and customer status to FlexPay for recovery via API. Most CRMs can be integrated with FlexPay.

Your gateways - working harder for more approvals

FlexPay listens to gateway responses and works in tandem with the gateway to improve authorization performance. We’re integrated with most gateways and can quickly add new ones.

Your custom CRM - with 70% more recovered payments

Adding a dedicated failed payment recovery solution will bring in more revenue that could ever be achieved with simple retry technology. Our experts support your in-house team to easily connect FlexPay’s AI-powered failed payment recovery solution to your specialized CRM system.

Ready to add FlexPay to your payment stack?

Leave your email below to get started.

Frequently Asked Questions

FlexPay accesses transaction information from failed payments and the status of the subscription. Our AI model analyzes each transaction and creates the optimal recovery strategy for each failed payment by determining why it was declined and finding the ideal solution.

FlexPay receives the results of your transaction requests, such as the response codes. The AI model then uses this information to create a dedicated recovery strategy for each failed payment.

FlexPay plugs into any CRM and payment gateway to coordinate AI-powered strategies that recover failed payments from recurring transactions, such as subscriptions or installments. We combine powerful technology with high-touch support and consultancy from payment industry experts to help merchants achieve maximum performance, given their specific business context and payment stack.

The duration of an integration project depends on what CRM or billing system you are using. If you’re using a CRM we’re already integrated

with – such as Stripe or Chargify — we can configure your account in just a few hours.

If you are using a custom CRM or other unique setups on systems of record, integrating with our API typically takes from 10-30 days to complete.

We’re already integrated with most popular gateways, and we add new gateways in as little as 3 days.

All integrations are supported by our integrations team and are led by a dedicated Project Manager, who will be your tech team’s main point of contact. We support your team in making the correct choices for your business, including payment system architecture, MCC optimization, active monitoring, support, and documentation.

Once the integration is complete, your Client Success Manager will monitor and improve your account’s performance and create reports that keep you informed.

Integration and support are provided at no extra cost.