How Hooked on Phonics increased subscription profitability and customer LTV with FlexPay’s high performance recovery solution

LTV as the organization’s guiding light

Failed payments on recurring billing was causing involuntary churn

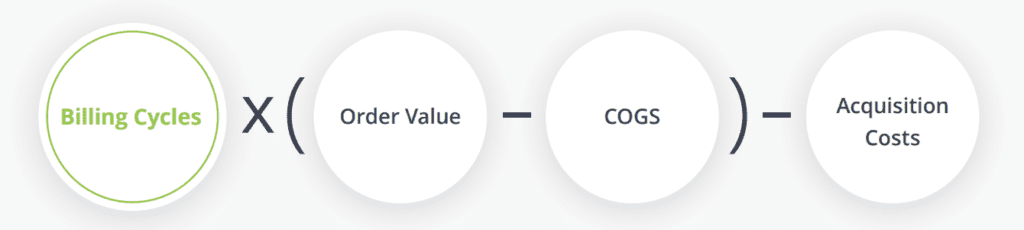

Robert Israel, Co-founder and President, has extensive experience managing subscription companies dedicated to serving families. He prefers consumer products that operate on a subscription model because of the highly predictable revenue potential of the business model. He explains that subscriptions require an upfront investment in the acquisition of new customers and that subscriber retention is vital in recovering these costs and reaching profitability. Therefore, subscription professionals need to optimize for relationship longevity and subscriber LTV. Robert adds “At Hooked on Phonics everyone knows the LTV for all products, per channel thanks to our CRM”.

Customer Lifetime Value (LTV) Equation

Increasing retention leads to higher LTV

Ever-improving performance, powered by technology

Hooked on Phonics developed their CRM in-house, and refined it over years of experimentation.

It’s built with connectivity in mind, so they can easily plug-in third-party solutions where external expertise is required. To combat subscription billing issues, they had built their own failed payment system which consistently delivered a recovery rate of 14%. This is a common problem in subscription organizations, where an antiquated payments system is holding up 15%-25% monthly payments from legitimate customers. Even so, Robert aspired to retain more customers by reducing the involuntary churn rate.

Originally, Robert decided to send FlexPay only transactions that the internal recovery system couldn’t recover, after they had already been retried up to 10 times. His initial assumption was that these payments were harder to recover because the customers no longer wished to continue their subscription. However, he was shocked to find that the customers FlexPay recovered — an additional 10% — had a similar LTV to unaffected customers.

Putting the best customer

recovery tool forward

About 8 months into the partnership, Robert saw an opportunity to increase revenue and retention by giving FlexPay declined transactions soon after their initial disruption. Hooked on Phonics started sending failed payments to FlexPay after two internal retry attempts to see if this delivered better recovery rates and a positive ROI. The analysis team calculated that an 18% recovery rate was required to break-even when factoring in recovery fees.

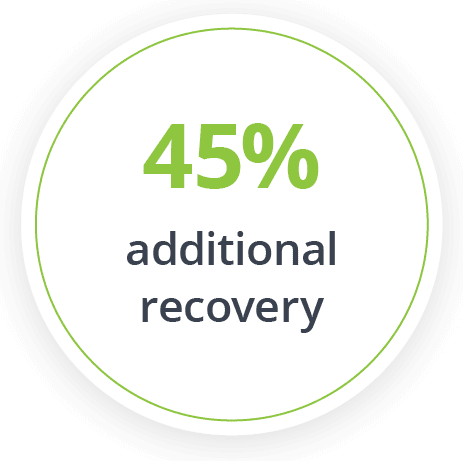

After just one month, it was evident that sending failed payments to FlexPay closer to the initial decline decision was a huge success. FlexPay was recovering an additional 45% beyond their in-house recovery. Based on Hooked on Phonics’ break-even calculation, FlexPay’s recovery results outperformed expectations by 150%.

About Hooked on Phonics

Hooked on Phonics is an e-learning provider that offers parents support in developing their children’s reading, writing and math skills by publishing age-appropriate materials including books, activities, and access to interactive apps. The organization has a tradition going back 35 years, having helped over 5 million children to read.