Artificial Intelligence

A Powerful Tool to Solve the Problem of Failed Payments

INTRODUCTION TO FAILED PAYMENTS

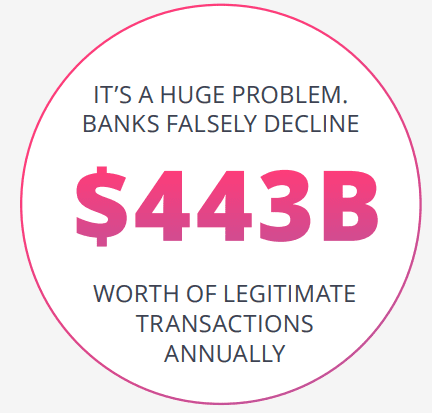

Every type of business struggles with failed payments, but there are two reasons why this problem is particularly painful for subscription businesses.

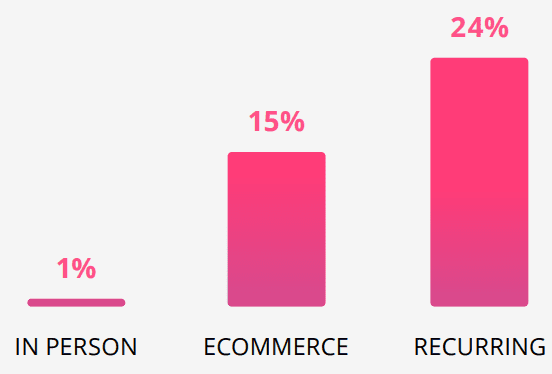

1. Subscription transactions have the highest failed payment rates of all card transaction types, averaging 24%

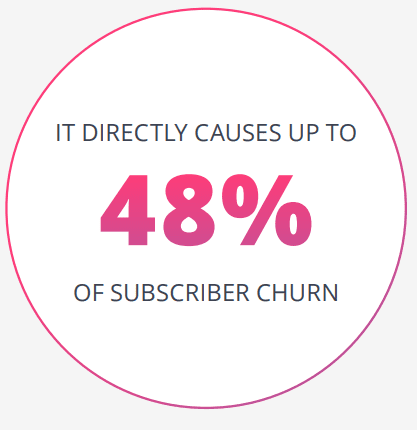

2. Unrecovered failed payments on subscriptions result in lost customers, causing the loss of all future payments that the customer would have made if their subscription hadn’t ended prematurely

In fact, failed payments are the single largest source of customer churn for subscription businesses, causing up to 48% of customer losses.

To solve this, subscription businesses must fully understand the problem and know which technologies are ideally suited to solving it. As a primer, subscription businesses should read this introduction to Payment Authorization Management, the category of technology solutions optimized for solving failed payments.

FOR SUBSCRIPTION BUSINESSES,FAILED PAYMENTS CAUSE UP TO 48% OF LOST CUSTOMERS.

THE CAUSES OF FAILED PAYMENTS

The problem of failed payments is not unique to any one subscription merchant, and it is not caused by fraudulent transactions, customer credit issues, or subscription businesses. Declined credit card payments on legitimate transactions, or false declines, are a structural problem within the payments industry.

False declines are primarily caused by the banks that issue credit cards to consumers and make the authorization decision on payment requests submitted by merchants. These issuing banks act in their own best interests to reduce fraud losses and in doing so, overcompensate by declining legitimate transactions.

Subscription businesses cannot solve the failed payment problem on their own. They can chip away at it bit by bit to reduce its impact, but solving the problem requires powerful, optimized technology built specifically for this purpose.

SOLVING THE PROBLEM REQUIRES POWERFUL, OPTIMIZED TECHNOLOGY BUILT SPECIFICALLY FOR THIS PURPOSE.

FAILED PAYMENTS INSIGHTS

COST IMPACTS RECURRING PAYMENTS MOST HEAVILY

YOUR RECOVERY STRATEGY GOAL

When trying to recover failed payments, your goal should be to recover as many customers as possible in the fewest number of attempts. Unrecovered failed payments result in the loss of the customer, so businesses must treat this problem with the same sense of urgency they give to reducing the voluntary customer churn created by customers cancelling their subscriptions.

Since you are recovering a customer, not simply a transaction, failed payment recovery must be done using methods that deliver the longest uninterrupted lifecycles following recovery. Methods that make the customer decide if they want to continue their subscription or not should be avoided since this contributes to churn.

Recovery should be made with the fewest possible attempts or the fewest number of customer interactions, if interactions are needed. The ideal number of interactions being zero, since there is a direct relationship between the quantity of payment resubmissions and the rate of failure. More attempts damage a merchant account because banks identify the account as a risk, resulting in higher fees and more declines. Transactions are scrutinized more closely, which increases the chance a payment may fail.

THE BENEFITS OF ARTIFICIAL INTELLIGENCE

Artificial Intelligence (AI) is best suited to solve this challenge. It can evaluate a transaction against the hundreds of reasons why a payment might fail, and act silently behind the scenes, so the customer never knows there was a problem with their payment. Other approaches, such as a company’s rules-based system and customer service outreach, are not up to this challenge.

There are over 8,000 card-issuing banks in North America alone, which all use their own unique algorithms to decide which payment transaction requests are approved, and which are declined. There are also hundreds of reasons why a payment might fail, as shown by the hundreds of reason code values returned with a failed payment. Plus, every different type of card, such as corporate cards, rewards cards, and ATM cards, are all evaluated for approval using different rules. There are literally billions of permutations of factors that must be optimized to create unique recovery strategies for each failed payment.

Clearly, rules-based systems cannot operate effectively in such a complex environment. Unfortunately, companies that think rules-based recovery is adequate are usually the same companies with very high churn rates. They don’t recognize that almost half of their churn is caused by failed payments.

NOT ALL ARTIFICAL INTELLIGENCE IS CREATED EQUAL

AI and machine learning are algorithms that must be trained, allowing them to adapt to make independent decisions based on an individual situation. To do this effectively, they need to be trained by industry experts with deep system knowledge, and be trained with extremely large, giga-sized data sets.

Machine learning is only as good as the data it’s trained on and having access to the right data is the number one challenge to adopting machine learning. Data scientists must work with SME businesses and other relevant stakeholders to create trained and effective AI solutions. Applying AI on top of a poor execution model will result in flawed output and unintended consequences. Remember: garbage in, garbage out.

CONCLUSION: Machine learning is only as good as the data it’s trained on and having access to the right data is the number one challenge to adopting machine learning. Data scientists must work with SME businesses and other relevant stakeholders to create trained and effective AI solutions.

Introducing

INVISIBLE RECOVERYTM

The FlexPay Invisible Recovery™ platform is an AI-powered solution that optimizes customer recovery from failed payments and delivers proven long-term customer retention following recovery.

Invisible Recovery™ produces the highest rate of customer recovery by creating an individual strategy for each failed payment, resulting in optimal customer and revenue recovery.

Invisible Recovery™ works quickly while completely avoiding customer visibility to the failed payment, which eliminates the customer churn created when subscription customers are made aware of the payment issue.

FLEXPAY RESEARCH SHOWS INVISIBLE RECOVERY™ DELIVERS THE HIGHEST RECOVERY, AND SUSTAINED RETENTION:

- Up to 70% improvement in failed payment recovery rates compared to other recovery solutions

- Up to 45% longer customer retention following recovery compared to other failed payment recovery solutions