FlexPay versus Butter

Choosing the best failed payment recovery solution for your organization is crucial to optimizing your revenue and financial health. When comparing FlexPay and Butter, you’ll need to understand which solution’s AI delivers the most revenue through its failed payment recovery performance, which integrates with your subscription billing system, and which best meets your security and service expectations.

Learn which one is right for you.

Compare FlexPay with Butter

Details

Core AI technology for recovery

Leverages the latest technology appropriate for complex pattern-recognition and decision-making within the payments ecosystem.

FlexPay and Butter are both specialized solutions in the failed payment recovery space using AI technologies like ML.

Transaction data availability

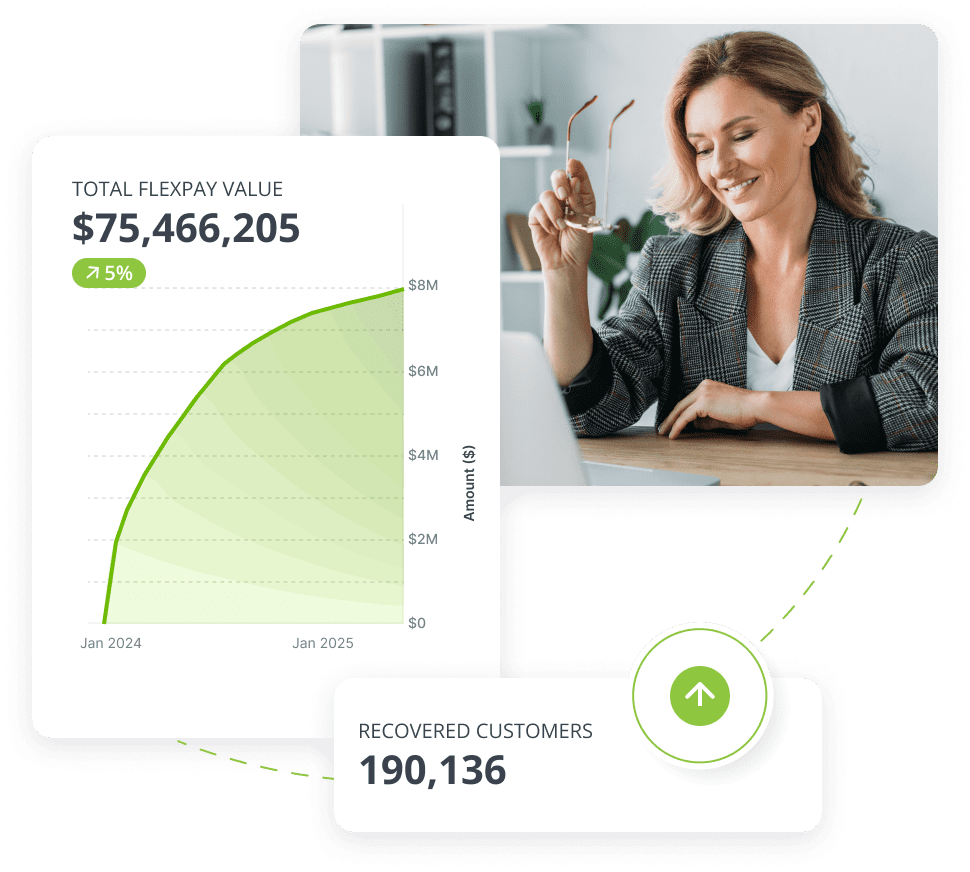

Demonstrates maturity through high data availability to train the ML models, including diverse sources across verticals and issuers.

FlexPay has trained 25+ ML models using over 6B transactions from merchants across all major verticals and issuing banks.

Diverse recovery methods

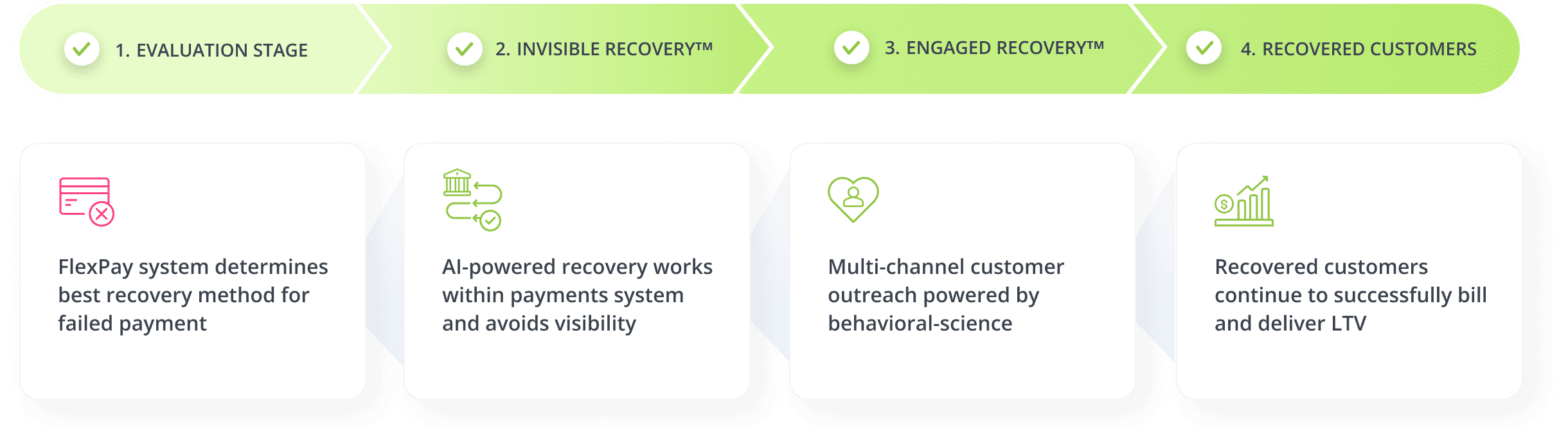

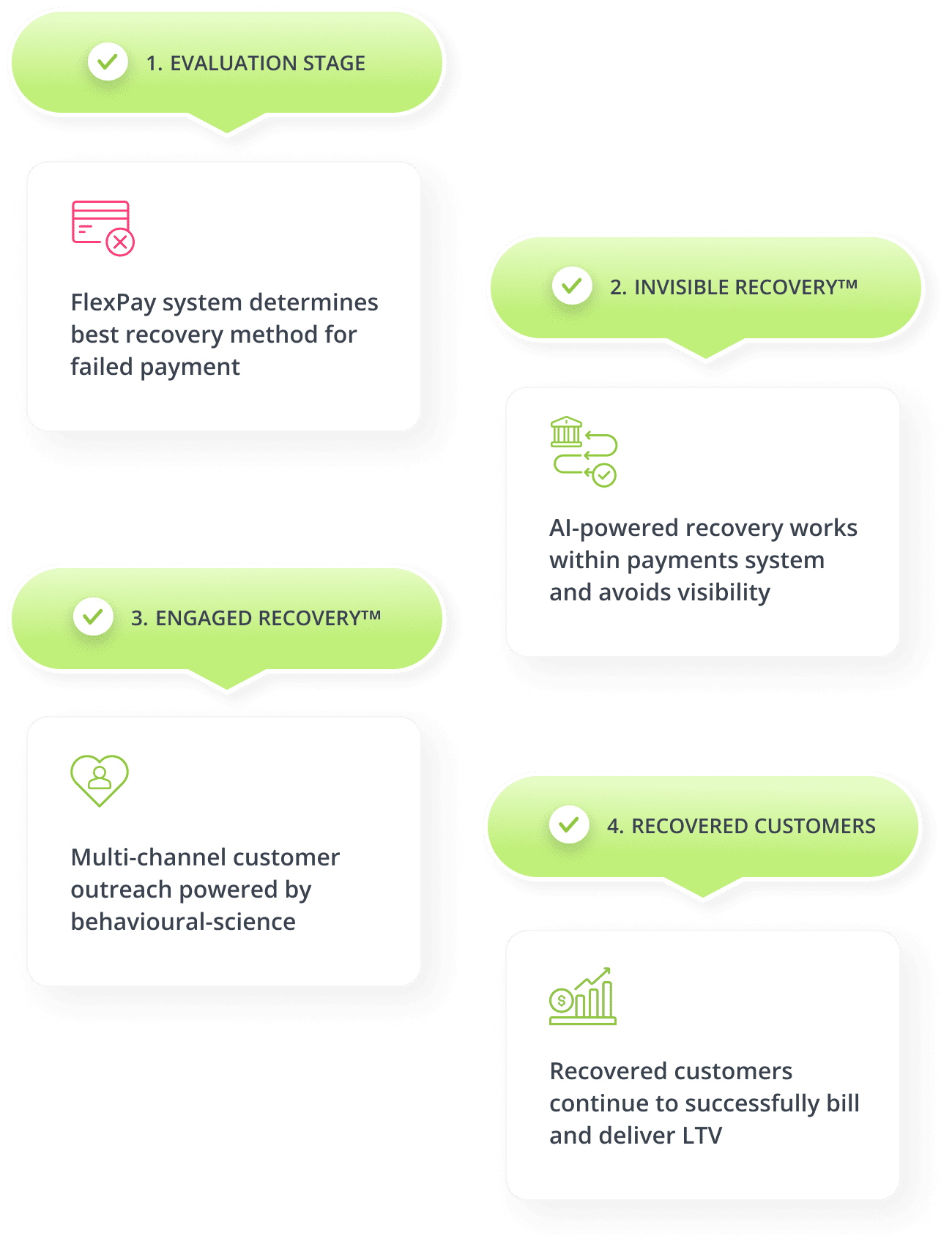

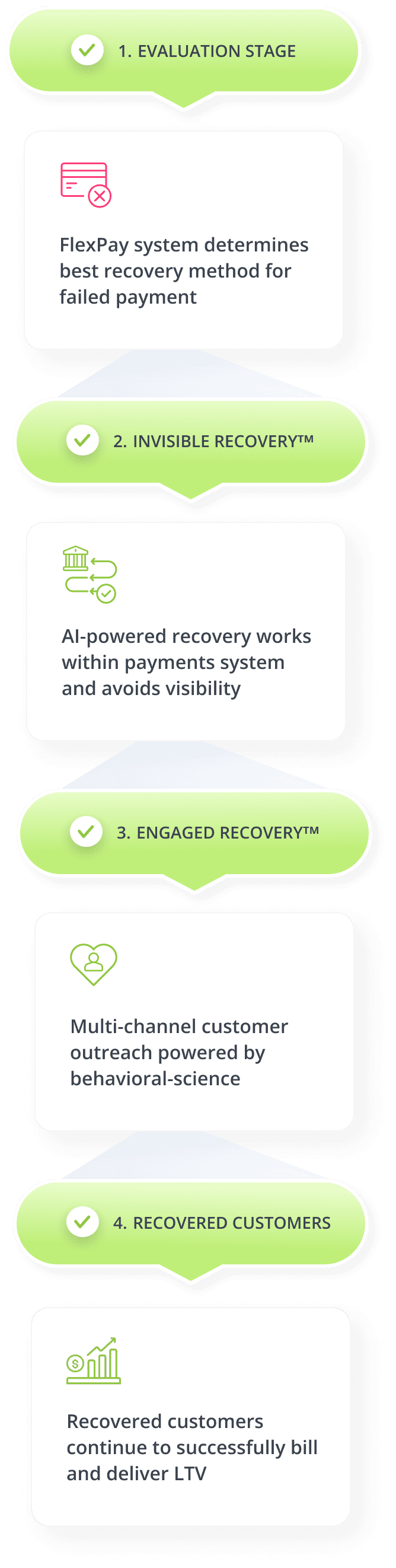

Depending on the cause of the failed payment, the best recovery method is chosen to address the root cause of the decline.

FlexPay achieves top recovery results by supplementing its AI with data enhancements, account updater, and customer outreach.

PCI Level 1

Meets the highest payment security standards to protect customer data and minimize risk.

While FlexPay has the highest level of PCI compliance, Butter’s compliance only covers 83k – 500k transactions per month, across their whole system.

Easy integrations

Able to integrate with your system, whether custom CRM, third-party subscription CRM or any gateways and orchestrators.

FlexPay has acquired vast experience from integrating with over 100 CRMs and gateways.

Custom CRM integration

FlexPay is the only choice for enterprise-grade buyers

FlexPay integrates with most major recurring billing platforms and payment gateways. And if your CRM was created in-house, we can connect to that too.

Since we’re certified to be PCI level 1 compliant, you know your transactional data is safe with us. Creating a secure environment to protect cardholder data is of utmost importance for us.

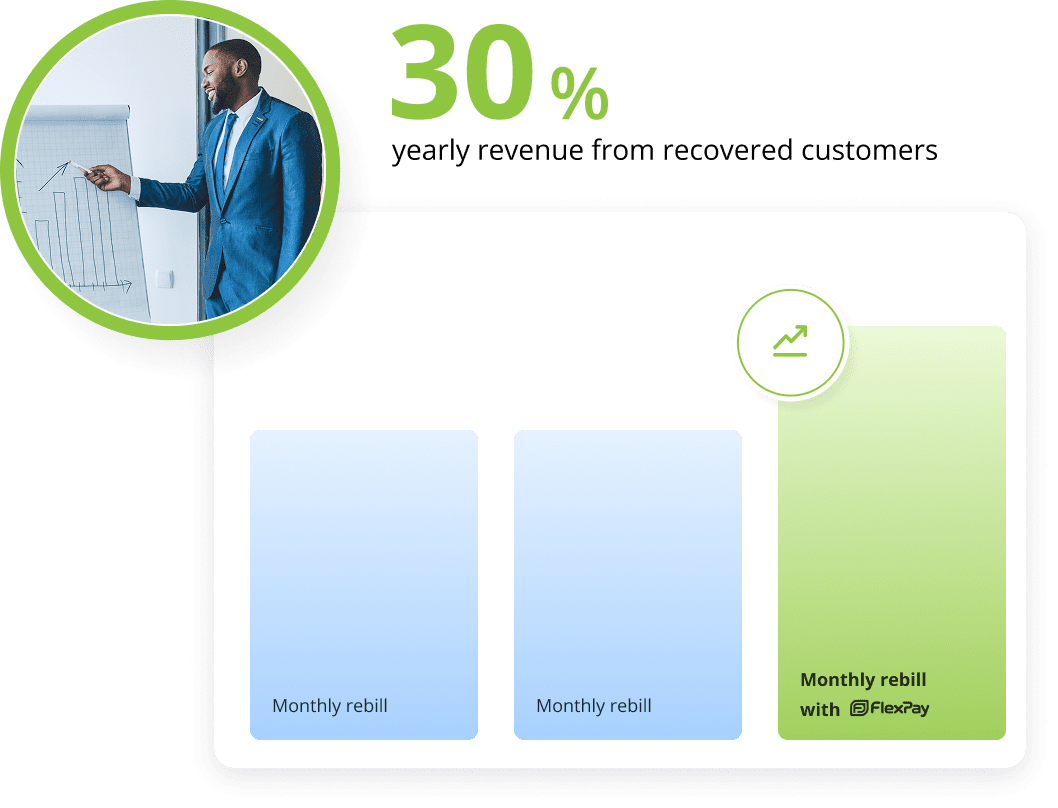

Stop failed payments from causing churn with a recovery system that avoids service disruptions, intelligently navigates customer emotions, and improves retention rates.

Why our clients choose FlexPay

Top performance

We achieve near-perfect scores in head-to-head tests and show meaningful improvements over competing recovery methods.

White-glove service

Servicing our merchants is our highest priority, from the sales process to integration and ongoing use.

Payments expertise

Our payment experts and analysts have knowledge beyond failed payment recovery and are happy to suggest improvements.

Good stewardship

FlexPay empowers merchants to maximize their subscription revenue while staying on the right side of best practice.

Alder Holdings, a leading home security provider in the USA, increases subscription rebill rate by 60% using Invisible Recovery and Engaged Recovery by FlexPay.

"FlexPay plays a huge role in capturing revenue for our business."

Jake Palmer

Senior Vice President, Alder Holdings, LLC

Truly Free, an eco-friendly cleaning product company, improved their recovery rate by 240% with FlexPay, compared to their in-house recovery system.

"FlexPay recovered thousands of dollars that we would have otherwise thrown away. I trust FlexPay. They go beyond what a normal partner would."

Chad Buckendahl

Chief Growth Officer, Truly Free

Invisible Recovery helped ClinicSense, a B2B SaaS company, achieve a 69% recovery improvement, allowing them to fuel their growth.

"The advantage of FlexPay is that I don’t have to think about customers whose payments are failing, I know that they are taking care of it for me."

Daniel Ruscigno

CEO, ClinicSense

Hooked on Phonics, an e-learning provider, recovered an additional 45% beyond their in-house recovery, and increased their subscription profitability and customer LTV.

"FlexPay has been a key partner in our effort to improve our subscription profitability. The customers FlexPay has been successfully reactivating for us keep coming back month after month."

Robert Israel

Co-Founder and President

How it works

Book your call with a payments expert today

We’re happy to help you understand your data better. As part of our process, we provide you with an analysis so you understand how much revenue you would recover with us and the full ROI you gain by retaining your customers.