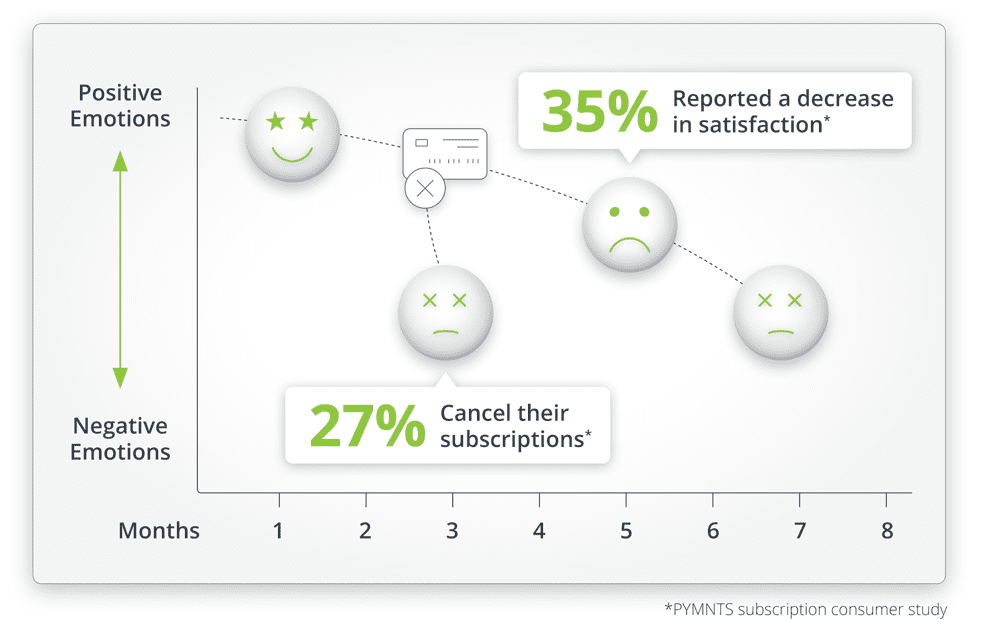

Subscribers expect a smooth payment experience month after month. In fact, it’s an implied brand promise. Just how important is this promise? Our consumer research from 2021 showed that 27% of account holders decided to cancel their subscriptions instead of giving an updated credit card when informed that their payment had failed. On top of that, another 35% reported a decrease in satisfaction, which put them at risk of churning. These customers were satisfied with the product or service they were receiving until someone told them about the failed payment. While it’s a necessary part of your process, this research shows why call center outreach shouldn’t be the first step in failed payment recovery.

Luckily, there’s a better way.

The Ideal Failed Payment Recovery Strategy

You’ll get your best failed payment recovery results when the payment decline is still fresh, using a recovery method that works invisibly in the background. This is critical because using the highest performing form of recovery first will help you maintain a positive customer experience. Starting your failed payment recovery process with in-house strategies actually reduces your chances of a successful recovery.

By using our AI-powered Invisible Recovery™ solution as soon as a payment fails, you can recover 45% more failed payments than simple in-house recovery methods, and your subscriber relationship won’t be harmed because the customer never knows there was a problem with their payment. Their subscription will continue as if nothing had happened.

The Most Effective Way to Reach Out to Customers

There are some types of failed payments that can’t be recovered behind the scenes, however, such as invalid card numbers. This is the time to reach out to the customer through carefully crafted automatic outreach emails or SMS. With the help of an empathetic and encouraging tone, these messages will allow you to continue to provide an excellent customer experience. This is exactly how FlexPay’s Engaged Recovery™ works.

Using Behavioral Science to Improve Your Subscription Customer Retention

Engaged Recovery automatically takes over when a failed payment can’t be fixed by Invisible Recovery. The customer is enrolled in an email and SMS campaign that uses aspects of behavioral science to encourage them to help solve the problem. The customized messages match the look and tone of your brand and highlight the value of your product or service.

Of course, there is still a place for in-house outreach, but this should only be used when you’ve exhausted all other recovery methods. Using FlexPay as the first step in your recovery strategy will maximize your rate of recovery and improve your subscription customer retention.

Read our case study to learn how Alder recovered an additional 34% of subscription failed payments with FlexPay’s Engaged Recovery.