Failed payments are a pain: they disrupt the customer journey and put a dent in your carefully crafted customer experience, not to mention how much they cost you in lost revenue. And if that wasn’t bad enough, your risk of churn increases dramatically if you even let your customer know their payment didn’t go through. Luckily, using the right failed payment recovery strategy can improve subscription CX and fix subscription billing issues.

Customer Satisfaction is Vulnerable

FlexPay consumer research from 2021 shows that when customers are told their payment has failed, 27% of the account holders cancel their subscriptions instead of giving an updated credit card.

This statistic is particularly painful because these customers were satisfied with their product or service until the failed payment occurred and only decided to cancel their subscription when someone from the company reached out to them. While another 68% of customers did go on to update their payment information when contacted, 35% of these customers reported feeling less satisfied with their subscription, making it likely they would churn in the future.

So, what exactly are you supposed to do to combat failed payments?

The Ideal Failed Payment Recovery Strategy

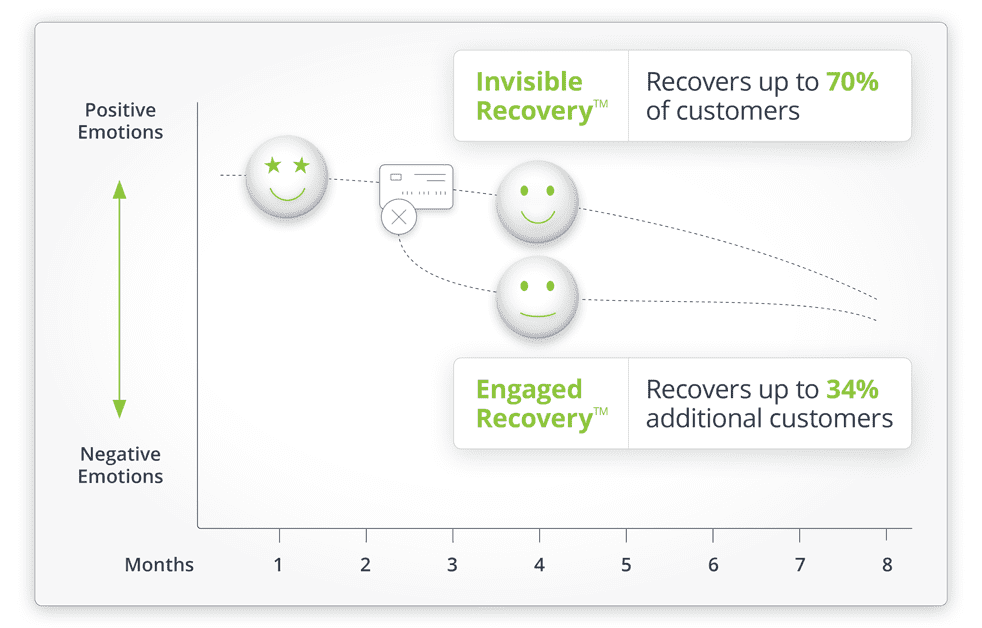

The first step in your ideal failed payment recovery process is to use a solution that avoids customer visibility to the problem and minimizes the impact on customer satisfaction. This type of recovery doesn’t affect the customer journey and actually gives the best recovery results because you use this method while the decline is still fresh. Doing re-tries in-house might seem to be an effective recovery method, but you’re missing out on the best opportunity to fix your subscription billing issues.

Maintaining Your Customer Relationship

FlexPay’s AI-powered Invisible Recovery™ recovers 45% more failed payments than what you can achieve on your own, and we typically solve the failed payment in an average of 2.9 days, which is great for your bottom line. Most customers won’t even notice that their payment occurred a bit later than usual and their subscription will keep going as if nothing had happened. Your customer relationship remains intact, and the revenue keeps coming.

For the times when a payment can’t be recovered behind the scenes— such as when a card number is invalid — you reach out to the customer through Engaged Recovery™, a carefully designed email and SMS strategy that uses aspects of behavioral science to encourage them to take ownership of the problem and help solve the failed payment.

Fix Subscription Billing Issues for a Seamless Payment Experience

Subscription billing issues jeopardize the success of your business, but you can’t solve the problem on your own. Your customers expect a seamless payment experience as part your brand promise to them and this just can’t happen if you’re only relying on in-house outreach strategies. Remember: you need to ensure your recovery process is seamless and won’t negatively impact your subscription CX.

Read our case study to learn how Alder recovered an additional 34% of subscription failed payments with FlexPay’s Engaged Recovery.