Forced Deposits: What are they and why should you avoid this practice?

Failed payments are an unfortunate part of every business, especially those that use a subscription or recurring billing model with card-not-present payments. While there are many ways to recover failed credit card payments, some recovery methods will hurt your merchant account. For example, forced deposits are sometimes used as a quick way to recover a payment, but this practice comes at a cost: fines from the card networks, increased churn from unhappy customers, loss of your merchant account, and/or higher chargeback rates, to name a few.

What are forced deposits?

A forced deposit (also known as a forced capture) is the practice of running a pre-authorization — commonly called a pre-auth — for a lower value to eventually recover the full payment amount. If the first pre-auth is successful, that same pre-auth code is then used to capture the larger amount. This is permitted in some cases where there are additional charges not included in the initial transaction (e.g., hotels charging for room service, or car rentals charging for damage), but isn’t meant to be used to authorize a higher amount.

Example of a forced deposit

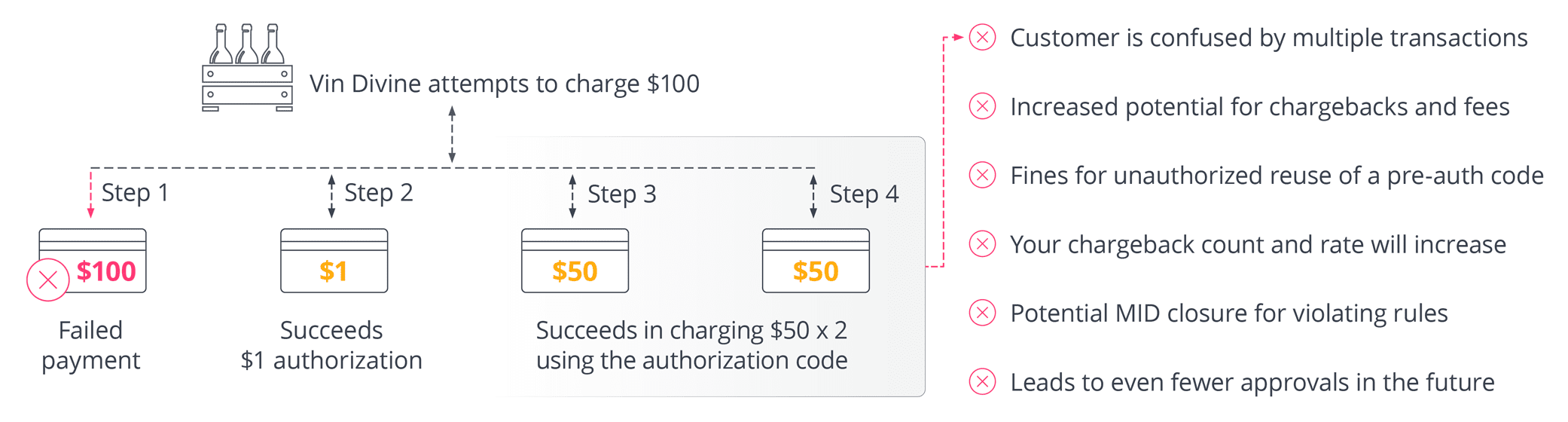

Let’s use the example of a $100.00 recurring payment for Vin Divine, a monthly wine subscription service. The payments team doesn’t realize how harmful forced deposits are, so they take the following steps to recover a subscriber’s failed payment:

- A lower amount of $1.00 is used as a pre-auth, instead of the actual $100.00 they intend to bill.

- This amount is approved, so Vin Divine uses the same pre-authorization approval code capture the full $100.00 payment. Or they capture only $50.00, with the intent of using the pre-authorization code a second time for another $50.00.

Forced deposit transactions generally succeed at a modest rate and can seem to be a good way for a business to receive payment for the full amount of the recurring subscription payment. The idea sounds great, and you’ve got your money. So, what’s the problem?

The problem with forced deposits

Forced deposits go against regulations for both card networks and acquirers and put your merchant account at risk. Forced deposits also significantly increase your chargeback liabilities since every transaction can result in a chargeback. And your company may be subject to a costly non-compliance assessment for misusing a code. Forced deposits are an especially dangerous practice for high-risk merchants that don’t need added risk stacked against their account or the threat of MID closure.

Forced deposits also harm your customer relationships. Credit card fraud is common, and seeing multiple charges on their credit card statement may make the account owner suspicious, believing the charges aren’t legitimate. They may lose trust in your company and decide to cancel their subscription. Even though it’s possible to recover payments this way, forced deposits damage the positive customer experience you’ve worked hard to create.

The consequences of forced capture

Here are the consequences you face based on our $100.00 example:

- The customer may now have multiple transactions on their statement in unusual amounts for their $100.00 payment and may believe the transactions are fraudulent.

- A chargeback initiated by the customer is more likely to succeed because the pre-auth code was used again.

- Visa/Mastercard may fine you for unauthorized reuse of a pre-auth code.

- You will have to pay multiple chargeback fees instead of one, and your chargeback count and rate will increase.

- You face potential MID closure by your acquirer for violating Visa/Mastercard rules.

- Your transaction approval rates may go down the more times you attempt a recovery, which hurts the health of your MID and leads to even fewer approvals in the future.

Best practices for payment recovery

Forced deposits have no place in legitimate failed payment recovery. When researching failed payment recovery solutions, ask the company if this is part of their recovery strategy and avoid solutions that use it because of the long-term risks. Forced deposits are not a practice that needs to be implemented to successfully recover failed payments.

Solutions that use AI and machine learning models to recover failed payments are much more effective. They have processed huge amounts of data that enable the transaction to be recovered based on an optimal recovery strategy. This results in significantly higher approval rates with no harm to your merchant account. This type of failed payment recovery begins by working directly with the payments system to recover most failed payments without any customer involvement. When customer outreach is needed — such as when a credit card has been lost or stolen — the solution uses aspects of behavioral science to encourage the subscriber to solve the problem. Using this type of combined recovery strategy effectively increases revenue, retention, and LTV and maintains a great customer experience without putting your ability to process credit card payments at risk.

Want to learn more about FlexPay’s failed payment recovery solution? Our team is ready to answer your questions.