The Importance of Calculating Recovered Revenue

The Problem of Customer Loss

How churn affects revenueWhen you have a subscription business or a business with a recurring billing model, your priority for revenue growth focuses on acquiring and retaining customers. Subscription companies need to retain customers to create profitable relationships, which requires lifespans long enough to fund both the Cost of Goods Sold (COGS) of the product or service delivery and the significant customer acquisition costs. Thus, customer retention is the biggest factor affecting company revenue growth and profitability.

Subscription businesses of course understand the importance of customer retention, and invest significant resources in their product and support experiences to reduce churn.

Unfortunately for subscription businesses, friction in the payments system is a major source of unwanted involuntary churn, ending customer relationships when customer card payments are declined. In fact, FlexPay research validates that up to 48% of all subscription customer churn is due to failed payments, causing enormous customer and revenue losses to the subscription industry.

When you understand the direct relationship between failed payments and customer churn, it becomes obvious the total cost of unrecovered failed payments must be thought about in a new way. Failed payments need to be calculated by measuring the revenue lost from all future payments a customer would have made if their subscription hadn’t ended prematurely, and not simply measured by the cost of a single declined payment This way of thinking about calculating recovered revenue is a new consideration for many subscription businesses.

The Fastest, Most Effective Way to Increase Revenue

How customer recovery speeds financial growthCredit card fraud has a huge impact on the financial industry. It passes an enormous cost to subscription businesses who rely on the card payment system to clear customer payments. The banks that issue credit cards are also responsible for authorizing card payment requests, but unfortunately their fraud detection algorithms make mistakes which cost banks over $30B from mistakenly approving fraudulent transactions.

As a result, issuing banks will often decline legitimate transactions in their attempt to avoid approving fraudulent ones. Since they are the ones making the decisions on payment requests, these banks feel it is better to be safe than sorry. Unfortunately, these false declines on legitimate transactions cost merchants more than $455B in global lost revenue each year.

As painful as those numbers are, the cost to any business with a recurring billing model is actually much higher than it looks when only the dollar value of declined payments is being measured. This is because failed payments cause customer churn, both direct and indirect. Direct churn occurs when a subscription immediately comes to a hard stop due to an uncovered failed payment, while indirect churn occurs when customers are made aware of the failed payment and then choose to end their subscription.

Many businesses believe a failed payment is simply the loss of one month’s payment. They think of it as missing one transaction. In reality, the actual cost of churn is the full calculated loss of all future billing cycles. Subscription businesses don’t just lose transactions when a card payment is declined, they often lose customers. With this thought in mind, it’s clear that calculating recovered revenue is critical to understand the appropriate investment to make to recover customers lost to failed payments, and to to ensure your subscription business maximizes revenue and profitability.

Calculating Recovered Revenue and the Cost of Failed Payments

The huge impact of lost revenueCalculating recovered revenue and discovering the total cost of failed payments requires a bit of math but understanding the total cost— and making failed payment recovery a priority — is incredibly strategic for subscription businesses.

Let’s use the example of a business that has 10,000 active customers who each pay $50 per month for their subscription. Let’s also assume this business has a failed payment rate of 15% per month. This may seem like a %, but this is a common failed payment rate; in fact Mastercard estimates that the monthly failed payment for subscription businesses averages almost 24%. The average customer lifespan for this business is 10 billing cycles. When properly measuring the true cost of failed payments, the single-month revenue lost with this failed payment rate is $75,000, but the cumulative monthly cost of lost customers after 6 months is a staggering $1,580,000.

Why so high? That’s because the cost of customers lost to failed payments continues to accrue over the span of the natural lifecycle that was interrupted.

It’s never just one month of lost revenue — it’s the loss of revenue each month added to the loss of revenue the next month and so on for 6 months. The losses snowball and become an avalanche.

In the end, this business loses more than 50% of its current revenue due to the cumulative cost of failed payments.

This example proves how looking at a failed payment as only the loss of one transaction is short-sighted and doesn’t consider the total amount of revenue a business loses over time. The collective impact of failed payments on overall revenue is hidden in plain sight.

After going through the calculation process, subscription businesses begin to consider payment recovery in a new way. They begin to think of it as a way to recover customers instead of simply recovering transactions, which is a completely different mindset for most subscription businesses. When calculating recovered revenue, you are measuring the full value of the recovered customer, which is the value of all future payments the customer will make on their subscription.

Recovered customers deliver ongoing revenue for your subscription business because they bring in additional periods of successful billing which accelerates overall growth in active customer counts and total company revenue.

These benefits can be realized without spending any additional money on customer acquisition, which is typically the largest expense for subscription businesses. In fact, almost no other investment will accelerate subscription revenue growth more than a high-performing failed payment recovery solution.

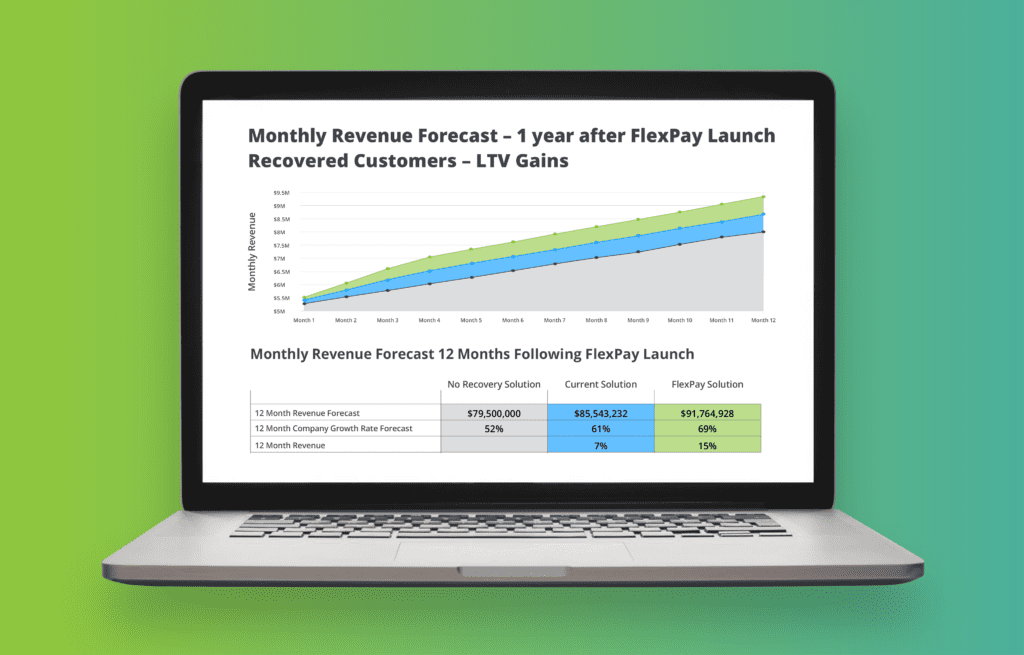

We can calculate the acceleration of overall company growth rate when you use FlexPay’s solution. Our platform will not only recover more customers from failed payments, but customers will have a longer lifecycle after recovery because our solution can recover all types of failed payments, including hard declines and soft declines.

| In-House Customer Service Recovery |

FlexPay’s Invisible Recovery™ |

|

|---|---|---|

| 12-month cumulative Revenue Forecast | $39.9M | $47.5M |

| Active Customer counts after 12 months | 80,631 | 108,405 |