The Subscription Payments Experience

Optimizing Customer Satisfaction and Retention

Subscription companies must be customer obsessed — the special relationships their customers have entrusted with them demand it. Subscription customers have committed to an ongoing relationship where they are paying for regular delivery of products or services, which of course expresses a much deeper level of trust and perceived value than the infrequent, single purchase transactional relationships most businesses have with their customers.

The cost of subscription customer acquisition varies by company, but often the cost to acquire a new customer exceeds 2.5 months of billing. Improving customer satisfaction and loyalty, and by extension retention, directly improves key financial metrics like revenue and profitability. This direct connection between loyalty and subscription business health confirms subscription companies must be customer obsessed.

The irony though is that subscription businesses often have fewer natural points of interaction with their customers than transactional merchants. When you think of it, there are only 3 times where subscription customers interact with the brand, when the customer experience impacts the subscriber’s decisions. These touchpoints are:

- The product or service experience itself

- The customer support experience (when needed)

- The payments experience (which customers experience as either invisible and seamless, or painful and disruptive)

Subscription companies recognize the relationship between the customer experience and loyalty and retention, and put significant resources into optimizing the product experience and the support experience.

Unfortunately, subscription companies don’t often understand that the payments experience is the third critical pillar in the customer relationship, and a key driver of satisfaction and retention.

THE PAYMENTS TECH STACK

Legacy Payment Technology Stack

This tech stack results in a 24% payment decline rate which causes lost revenue and customer churn.

The legacy payments tech stack is built to manage ongoing customer billing and connects active customer accounts with the card payments ecosystem.

Here is a brief overview of the legacy payments tech stack. This is an oversimplification, of course, but there are the two pieces of technology at the core of the legacy payments tech stack:

- The billing or CRM system – Stores customer information and triggers the billing transaction. This system typically contains customer account info, credit card numbers, and account billing info, such as how much to bill, when to bill, what level of service, etc. Billing systems can be hosted by third-parties such as Maxio, Direct Scale or Zuora, or can be custom solutions built in-house.

- The payment gateway – Allows companies to submit credit payment requests to issuing banks and manages payment settlements back into merchant accounts.

DEFINING A GREAT PAYMENT EXPERIENCE.

The ideal payment experience for a subscription customer is completely seamless for the customer and merchant, settling payments without friction. The customer makes their payment and continues to receive the products and services from their subscription without any interruptions.

While the legacy payments tech stack can deliver this experience, it can only do so if there is no existing friction in the payments system.

A POOR PAYMENT EXPERIENCE.

A poor subscription payment experience is created when card payment requests are declined. Not surprisingly, card decline events often lead directly to customer churn.

Unfortunately, the payments system itself often creates friction in the subscription payments process, usually through no fault of the customer or the business. This friction takes the form of failed payments, which are decline decisions on customer cards. Decline decisions can occur in any billing period of the relationship, whether it is the first payment or the twelfth.

These decline decisions often happen because banks score recurring subscription payments as a risk transaction with an increased chance of fraud. False declines occur when banks score transactions from legitimate cards and customers as fraudulent, which

occurs a surprisingly high 24% of of the time for recurring payment submissions. Other types of decline decisions can be caused by expired cards, cancelled cards, NSF, and a variety of other reasons.

The legacy subscription payments stack has no solution to recover failed payments, or to avoid the poor experiences and lost customers caused by failed payments. Some more sophisticated companies have identified the high cost of failed payments and have either created their own internal retry systems or customer collection processes. However, these types of recovery solutions are simply bandaids that can help a little, but they simply can’t deliver a great customer experience when the payments system is the cause of the problem. They don’t solve the failed payments problem or the churn it creates.

DEFINING BEST-IN-CLASS PAYMENT EXPERIENCES.

The ideal payment experience for a subscription customer is seamless, which means transaction settlements complete without visibility by the customer, even if a payment fails. The ideal customer experience following a failed payment quickly resolves the payment problem within the payments system, without needing any customer involvement. As far as the customer is concerned, an ideal experience has been delivered because they never know there was a problem with their payment. The benefit to the customer is clear, but the benefit to the subscription business is even more profound since customer churn related to the failed payment is completely avoided.

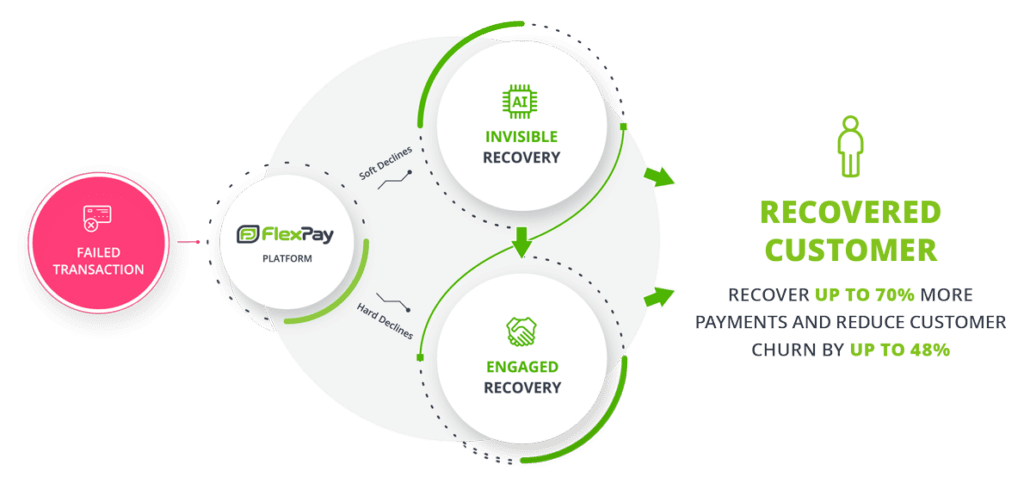

An easy way to deliver this ideal customer experience is by using the FlexPay Invisible RecoveryTM platform, an AI-powered solution that works directly with the payments system to recover failed payments. The machine learning models in the solution are programmed to generate unique recovery strategies for each failed payment, optimizing for key variables such as which issuing bank delivered the decline decision, the reasons why the payment failed, the type of card itself, and many other variables. Invisible RecoveryTM delivers the ideal customer experience following a failed payment by quickly recovering the payment and avoiding customer awareness of the problem. The subscription product or service is delivered as usual, and churn is avoided.

Of course, some failed payments will require customer involvement to solve. Subscription companies need to be just as committed to delivering a great customer experience in this situation as they are when using Invisible RecoveryTM. Remember, a moment of truth is created in the customer relationship when the customer is made aware of a failed payment and you ask them to help solve the problem. In this moment, the customer is given the opportunity to either resolve the problem or simply let the subscription relationship end.

Subscription businesses need to put as much thought and care into delivering a great experience when interacting with customers to resolve a failed payment as they do in delivering a great product or service in the first place. Any engagement process that confronts the customer aggressively, treats them as a credit problem, or applies a dunning or collections approach does not meet this standard.

Since there is such a high risk of losing the customer when a payment fails, payment recovery outreach should really be thought of as an exercise in customer recovery. This is your opportunity to build a stronger customer relationship and develop more trust. To do this, all customer engagement should be delivered as a collaboration between the business and the customer. You are working together to solve this problem so the customer can continue to receive a great product or service without any interruptions.

The FlexPay Engaged Recovery solution is a perfect example of how to deliver a great customer recovery experience when customer involvement is required to solve a failed payment. Engaged Recovery is powered by an AI engine trained by behavioural science and psychology which automatically creates a positive, collaborative experience using multiple touchpoint channels optimized for both maximum recovery and an empathetic customer experience.

THE MODERN PAYMENTS TECH STACK

Modern Payment Technology Stack

The modern three-tier payment tech stack incorporates a payment authorization management solution such as FlexPay, and closes the failed payment gap.The modern payments tech stack expands upon the legacy architecture of the billing/CRM system and payments gateway. The optimal tech stack integrates with a failed payment solution and recovers all kinds of failed payments, delivers great customer experiences, and minimizes the customer churn that occurs when payment frictions prevent legitimate customer payment approvals.

The good news for subscription businesses is that solutions exist to upgrade the payments tech stack, solve the failed payment problem, and deliver the ideal customer experience for all types of failed payments.

BUILDING RECOVERY SOLUTIONS IN-HOUSE, VERSUS THE INTEGRATION OF SPECIALIZED SOLUTIONS

- There are literally billions of permutations in a failed payment that must be addressed to deliver optimal recovery rates. Specialized knowledge and technology are required to solve this level of complexity.

- Simple recovery solutions, such as automated retry engines, often cause unwanted damage to merchant account health. There is a direct negative connection between the number of retry attempts and how the payment authorization systems treat the merchant account. The more retry attempts are made, the more likely future payment requests will be declined, which makes the problem worse.

- Internal recovery teams that engage with customers to solve failed payments are expensive to maintain and require specialized training to effectively engage with customers during recovery processes. In short, customer outreach through collections or customer support often results in negative recovery experiences, inadvertently creating negative moment-of-truth results and high rates of customer churn.

- FlexPay’s analysis validates that up to 48% of subscription churn is caused by failed payments and is not caused by customers voluntarily ending their subscription relationship. This is a quantified measurement that proves the relationship between failed payments and subscription churn.

- Your core business is the delivery of great products or services, and you need to enhance customer satisfaction through this experience. However, solving complex payments issues is expensive, requires specialized skills, and is outside the core skills of any subscription business.

CONCLUSION:

Subscription businesses need to put as much thought and care into delivering a great customer experience as they do in developing a great product or service. A large part of a great customer experience is providing a smooth, frictionless payment experience, however legacy tech stacks run into problems when a payment fails. Subscription businesses need to resolve these failed payments without giving the customer the opportunity to churn, ideally in a way that doesn’t require any customer involvement. When customer involvement can’t be avoided, companies need to reach out to the customer in a positive way that encourages collaboration. Fortunately, payment recovery solutions, such as FlexPay’s platform, integrate seamlessly into existing CRM/billing systems and payment gateways so subscription businesses can recover all types of failed payments and deliver the ideal customer experience.

The Complete FlexPay Platform

The FlexPay platform maximizes revenue recovery, delivers the longest retention rates following recovery, and the highest customer LTV.