The Path to Growing Subscription Revenue

Reduce customer churn and increase financial profitability

INTRODUCTION

Imagine your subscription business is in the Matrix movie with Keanu Reaves, and Morpheus offers you two choices. You can take the blue pill and go on pretending the card payments system works as it’s supposed to, or you can take the red pill, which exposes the truth that revenue and customer retention across the entire subscription industry is artificially suppressed below what it should be.

Which one would you choose?

While the Matrix is only a movie, there actually is a secret problem in the subscription industry responsible for almost half the churn that you — and all your competitors — experience. Finding the answer to this problem unlocks the most important secret, which is a predictable way to reduce your customer churn by up to 50% and grow your revenue by over 20% within 12 months. Best of all, this revenue growth doesn’t require any additional spend on customer acquisition, so this extra revenue delivers very high margins.

But wait, there’s one more critical secret to share. Perhaps the most important one.

This problem harms every subscription company, so a status quo exists within the industry limiting the total revenue, customer LTV, and profitability a business can earn — a faulty equilibrium that suppresses every subscription company’s performance far below its true potential.

As this secret becomes commonly known over the next couple of years, the status quo will change, and every subscription business will deploy a solution to solve it. This will create a new equilibrium where customer retention, revenue growth, customer LTV, and profitability will be reset at a higher level for everyone in the subscription industry.

This means a short window of opportunity is open now for some businesses who act fast to launch new technology, solve this problem, and unlock financial performance and critical advantages their competitors will not be able to match. This window of opportunity will give these early adopters enormous gains in market share beyond just revenue and profitability. An unfair advantage you could say. This report tells you how to do this.

Unlocking the Opportunity (Phase 1)

Step 1

The first step to grabbing and sustaining your competitive advantage is to start tracking and reporting your failed payments and measuring their impact on your business.

To do this, begin with the easiest calculation, which is your short-term measurement of the costs from failed payments. This is a narrow view of the cost of this problem but it’s the place to start.

Calculating short-term measurement of costs:

- Sum the total dollars of monthly customer card authorization requests that are declined and not resolved.

- This calculation gives you a narrow view of the costs, or the monthly lost transactional revenue.

Step 2

Next, figure out your true costs of this problem.

True cost measurement is built upon the understanding that the full cost of unresolved failed payments requires you to calculate the LTV of customers who churn due to failed payments. Any failed payment that is not resolved results in a churned customer. This is called involuntary churn, which can be as high as 50% of all your churn.

Here is your calculation to measure your true involuntary churn cost:

- Calculate your Average Customer Lifespan (average number of billing cycles before customers churn)

- Calculate lost billing months due to involuntary churn

- Calculate your Average Customer Lifespan (average number of billing cycles before customers churn)

- Calculate lost billing months due to involuntary churn

- Multiply the Customer Order Value by the number of lost billing months to get the total lost LTV for each customer due to the failed payment.

- The total measurement of lost LTV caused by failed payments, or the total lost revenue generated by involuntary churn, is generated by summing the total lost LTV of all customers with unresolved failed payments.

- Multiply the Customer Order Value by the number of lost billing months to get the total lost LTV for each customer due to the failed payment.

- The total measurement of lost LTV caused by failed payments, or the total lost revenue generated by involuntary churn, is generated by summing the total lost LTV of all customers with unresolved failed payments.

Once the true cost of failed payments is accurately measured, you will understand how much potential revenue can be recovered. Remember, it’s never just one month’s billing that’s lost when a payment fails.

The results from your calculations should make it clear that simply implementing a failed payment recovery solution is not enough — you need to optimize your customer retention following recovery. This is crucial because it maximizes the LTV of recovered customers, which creates the highest amount of financial leverage for revenue growth.

Step 3

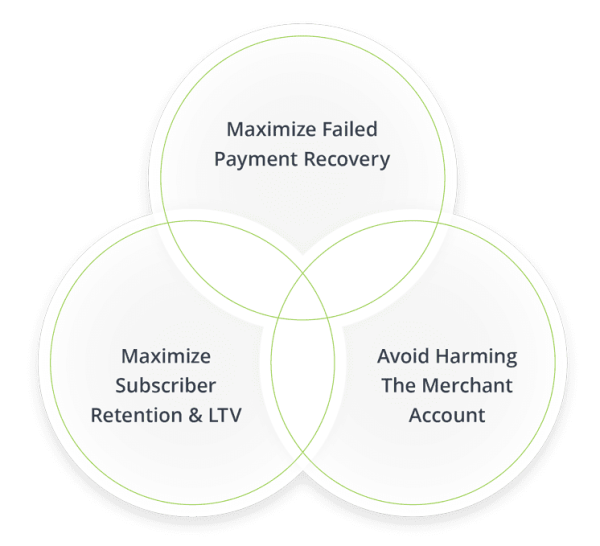

Select and deploy a failed payment recovery solution that provides these 3 critical outcomes:

- Optimized failed payment recovery

- Maximized customer retention following recovery

- Protects the health of your merchant account

Best performing failed payment recovery solutions optimize for three areas

Understanding the problem is critical to choosing the best solution.

Failed payments are caused by authorization decision errors when your customers’ cards are submitted for payment. The banks who issue credit cards are trying to avoid the high cost of fraud, and incorrectly flag a legitimate card as fraudulent. The result is a false decline. This is a widespread problem, with Visa themselves measuring a failure rate of up to 24% for recurring billing transactions. While the actual rate your company experiences will vary, this problem affects every single subscription business. Subscription businesses need to understand that the customers themselves are not usually to blame for the failed payment. They are not bad credit risks. So, how you handle these customers can harm your retention.

If you automatically send customers who experience a failed payment into a collections or dunning process for example, you are putting your customer relationship at risk. This knee-jerk reaction isn’t the best failed payment recovery approach for several reasons: you can’t connect with every customer through outreach; you are creating a negative experience by accusing your customer of causing the problem; and you are giving your customer the opportunity to simply walk away and not help you resolve the problem.

Failed Payment Recovery Best Practices

- Select a failed payment solution that can employ multiple recovery techniques, optimizing for each type of failed payment.

- Whenever possible, resolve payments directly with the payments system to avoid making customers aware of the failed payment because this creates indirect churn.

- Use sophisticated technology — such as AI — that can create individualized recovery strategies for the billions of permutations of data behind the reason a card was declined.

- When it becomes necessary to engage with a customer to recover a failed payment, create a positive and empathetic experience for your customer. Build a sense of partnership so the customer feels you are working with them to ensure their subscription delivery isn’t interrupted.

- Avoid failed payment recovery solutions that use brute

force retry attempts:

- The authorization systems used by issuing banks track retry attempts by merchant account and increase merchant account risk scores when high numbers of retry attempts are observed. Higher merchant account risk scores are associated with higher declined payment rates, accelerating the failed payment problem.

- Both Mastercard and Visa are imposing new penalties and charges in 2023 on certain quantities and types of retry attempts, which will result in new costs for merchants who aggressively resubmit failed payments.

- Internally built rules-based retry systems don’t deliver recovery results comparable to more sophisticated purposebuilt technologies and can generate higher failed payment rates in the future.

Deploying the right failed payment solution provides an instant reduction in failed payments and an overall reduction in customer churn as the rate of involuntary churn comes down.

A Powerful Growth Driver

There is another huge benefit you need to be aware of: failed payment recovery delivers compounding financial benefits. This is because each properly recovered customer has a full and complete lifespan following failed payment recovery. A recovered customer delivers new revenue the month of recovery, and the month after that, and the month after that, and so on. Businesses that deploy a best-in-class failed payment solution optimized for maximum customer retention will continue to see revenue and profit grow month after month. It’s like the power of compounding interest, but delivered by higher customer retention. This fundamentally raises the bar for your company’s financial performance and creates a world of opportunity.

When this happens, the barrier suppressing your revenue and profits is removed. The status quo that your business has been operating in is smashed.

Your business now has a higher customer LTV and more cash flow. Plus, your profitability is significantly increased because the revenue that comes from reducing involuntary churn doesn’t cost you any new acquisition dollars. As you know, acquisition costs are always one of the largest costs for subscription businesses, so this recovered revenue is basically free money for your business.

Unlocking the

Opportunity (Phase 2)

The early adopter companies that recognize and solve the failed payment problem will gain these financial benefits before their competitors get on board. The simple act of reducing involuntary churn before your competitors do creates a window of opportunity for you to capture and maintain market share years before anyone else does.

Deploy a failed payment solution now and you can begin reducing involuntary churn right away. This creates the opportunity to use your steadily growing revenue and profits to deliver sustained benefits, which will further strengthen your competitive edge.

Here are examples of strategic investments that become possible:

- Increased acquisition budgets

Reinvesting new profits in acquisition will accelerate growth. Plus, new customer acquisition options will increase as the overall increase in customer LTV and profitability opens new cohorts of customers that weren’t previously profitable.

- Upgraded product and service experience:

Investing in an improved experience benefits all customers, including those customers who don’t experience failed payments. This means that the total value you deliver is higher than your competitors, which typically leads to overall improvements in customer retention and LTV, and creates a positive customer satisfaction feedback loop, further improving revenue, LTV, and profitability.

CONCLUSION

Implementing a failed payment recovery solution that dramatically reduces your rate of involuntary churn is the secret to gaining a competitive edge for years to come. Early adopters who recognize the strategic opportunity that’s created by solving involuntary churn also recognize that speed is paramount. The sooner a failed payment recovery solution is implemented, the greater the edge gained over the competition. Once you do this, you can see more than 20% revenue growth within 12 months. Your window of opportunity is open now. Don’t let it pass you by

If you have any questions or want to talk to an expert in the payments industry, reach out to our team here.