Subscription Churn Solution:

Retention Strategies that Increase LTV

Introduction

Every subscription business must be obsessed with increasing customer retention and LTV. This is critical for the financial health of the business. In fact, there is no greater fiduciary duty for companies with recurring billing customers, from the highest executives to managers and individual contributors.

It’s surprising then to realize just how many subscription businesses aren’t set up to optimize retention and minimize customer churn. Unfortunately, subscription businesses that fail to continuously increase customer retention and LTV — and don’t work to bring all sources of customer churn to absolute minimum levels — will lag far behind the financial performance of their more enlightened competitors. That’s the harsh reality.

The difference between involuntary churn and voluntary churn

Most subscription companies understand the importance of reducing churn caused by subscribers who willingly cancel their subscriptions, or what is called voluntary churn. They invest significantly in initiatives to keep subscribers happy and engaged to avoid cancellation requests — they know these are crucial moments when customers are either saved or lost.

But involuntary churn is different. This churn occurs when the subscriber doesn’t intend to cancel their subscription. It’s accidental. Something — typically a declined credit card payment— gets in the way of the customer’s successful transaction. This failed payment results in customer churn every time the problem isn’t resolved.

While more and more subscription companies are aware of the failed payments problem, they often treat it as a transactional problem with an operational solution. But it’s more than that. It’s a critical moment in the subscriber lifecycle where the customer is either retained or lost. Let’s look at why this is the case.

Involuntary churn occurs when the subscriber doesn’t intend to cancel their subscription. It’s accidental.

The problem with the payments system

The payment system a company uses to manage credit card authorization requests is typically seen as an operational system and managed by a combination of the finance, operations, and IT teams. It’s considered a cost center and is operated as such. The goal of this system is typically to minimize system, processing, and overhead costs.

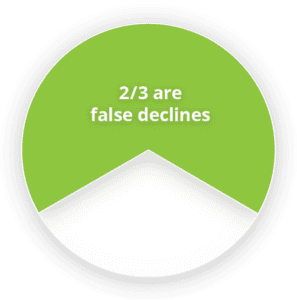

But this mandate to minimize costs only makes sense if the credit card system works as intended, authorizing all legitimate payment requests and declining all fraudulent transactions. Unfortunately, the real-world authorization accuracy of the card system is far from perfect. In fact, data from Visa shows that card payment authorization requests are declined around 20-25% of the time. And about two-thirds of these authorization declines are made in error, meaning they should have been approved. There are many reasons for these decision errors, but they typically result from issuing banks efforts to reduce their fraud losses, and by the technology limitations within issuing bank authorization systems.

Involuntary churn happens when a declined authorization on a subscription payment is not solved, and the subscriber is lost. Understanding this is the starting point for reducing involuntary churn levels and increasing overall subscriber retention.

When you understand the problem, it’s clear that failed payments are not caused by the subscriber, and their card is usually not a bad card. They want to continue their subscription and make the purchase but are being blocked by a card system decision error.

Data from Visa shows that 2/3 of card payment authorization declines are made in error and should have been approved.

Solving all sources of churn with people, processes, and technology

Most subscription businesses make solving voluntary churn a priority and use specialized technology solutions. They implement voluntary churn reduction programs with dedicated team members who manage internal and customer-facing retention processes and systems. Or they create multi-function teams that jointly own the solutions, processes, and reporting systems dedicated to reducing churn. Voluntary churn is taken seriously, and increasing retention rates is viewed as a strategic imperative.

Typical Retention Initiatives

• Feedback programs to measure satisfaction and identify subscribers at risk of churning

• Customer experience programs to increase satisfaction and loyalty

• Reporting, diagnosing, and measuring behaviors and attitudes across the subscriber lifecycle

• Deploying customer save programs when a cancellation request is received

• Win-back promotions to convince churned customers to reactivate

These typical churn reduction programs cannot solve the source of involuntary churn — unrecovered failed payments.

When failed payments are viewed as an operations problem, they are treated with simple payment recovery tactics that prioritize low operating costs over top recovery results. These tactics achieve some results that are accepted as “good enough”. Since the problem is not viewed as a major source of churn, customer losses from unrecovered failed payments are allowed to continue. Examples of operational payment recovery tactics include internally built tools to resubmit failed payments using rules-based logic and forwarding subscribers to customer service teams for outreach, asking them to update their credit card details or submit another form of payment.

These approaches are a logical first step if failed payments are viewed as an operational problem rather than a customer retention problem. They do make some sense if the mandate for the payments system is to minimize the cost of operations rather than maximize retention and customer LTV.

The danger of these solutions, however, is that they can create a false sense of security for companies with in-house solutions and lead them to believe they are solving the problem.

Typical attitudes with these companies are:

• The problem has been solved and results cannot be improved.

• We cannot reduce our churn by improving our payments recovery.

• Payment recovery results are “good enough” and more effective solutions aren’t needed.

• There is no need to invest in a specialized solution that can deliver better results because internal solutions don’t create costs.

Good results aren't good enough

Too many subscription companies are settling for low payment recovery results because they think what they’re doing is “good enough”. Or they don’t understand the large percentage of customer churn that’s coming from unrecovered failed payments, so they don’t use the right tools to fight it. In either situation, companies are losing customers — and the resulting revenue and profit losses — when they don’t have to.

In-house solutions create a false sense of security, leading businesses to believe more effective solutions aren’t needed.

Changing the failed payment paradigm

Solving involuntary churn begins by shifting the definition of the issue. This means thinking of failed payments as a customer retention problem, not an operations problem. You also need to change the definition of a positive outcome. The goal is not to recover failed payments, it is to recover the highest number of customers who would otherwise be lost to involuntary churn. Just like with voluntary churn, the failed payment either results in a recovered customer or causes a churned customer.

When these insights are understood, the perspective on failed payments immediately changes to the following:

• Reducing involuntary churn must be given the same level of attention and importance as fighting voluntary churn.

• The same strategic approaches used to fight voluntary churn should also be applied to solving involuntary churn, such as bringing in your retention and CX experts to ensure the failed payment recovery process maintains a positive customer experience to optimize recovery and retention following recovery.

• Your organizational structure, KPI goals, and accountability for delivery must be aligned to achieving high recovery rates and reducing rates of involuntary churn, maintaining customer satisfaction, and optimizing retention following recovery.

• The quickest and most cost-efficient way to increase customer retention and reduce churn rates is to reduce your involuntary churn.

• The cost of recovery should not be the key factor when evaluating involuntary churn solutions. Maximizing the recovery, retention and LTV of customers following recovery must be the primary measurement of success. You will likely find that investing in specialized technology solutions to solve involuntary churn will deliver a radically positive ROI.

The ideal solution for involuntary churn

Payments fail for many reasons and need to be solved in a way that is most effective for each particular failure reason. In most cases, declines from bank errors and NSF can be solved directly with the payments system. But some failed payments, such as hard declines caused by cancelled or expired cards, will usually require customer involvement. No single method will solve all failed payments, so the top failed payment recovery solutions apply several technologies and approaches.

For example, the FlexPay failed payment recovery platform applies multiple approaches to solving failed payments. Our platform assesses each individual failed payment and uses AI to determine if recovery can be achieved by working directly with the payments system or if customer engagement is necessary. Solving the failed payment directly with the payments system is always preferred, because it avoids the risk of a negative brand experience. This can happen when a customer is aware of the failed payment. Our Invisible RecoveryTM solution creates a highly effective recovery strategy for each individual failed payment, working directly with the payments system. The customer never knows their payment failed.

Sometimes customer help is needed to solve the failed payment. Our Engaged RecoveryTM solution uses behavioral science to engage customers in a positive way across several channels, such as email and SMS. Every subscriber reacts differently to an outreach program, so Engaged Recovery applies multiple positive messaging approaches to find the one that prompts each customer to act. This approach maintains customer satisfaction and improves retention.

Conclusion

Most companies recognize voluntary churn is a complex problem that requires a sophisticated solution, but don’t treat involuntary churn with the same level of care and attention. This attitude must change if you want to achieve the highest overall levels of revenue and profitability for your business. Internal recovery strategies aren’t enough. You need a specialized solution that will deliver optimal recovery rates, maintain customer satisfaction during the recovery process, and improve retention and LTV following recovery. Remember, “good enough “results are never enough when it comes to customer retention and LTV!