Offset Subscriber Losses By Reducing Involuntary Churn

INTRODUCTION

The entire subscription industry is facing significant

new challenges as the 2022 macro business

environment has changed dramatically compared to

the last two years. The acceleration of subscription

services and SaaS solutions created during the

pandemic has ended. Consumers have reacted to

rising costs fueled by inflation by both reducing

their purchases of new subscriptions, and voluntarily

canceling subscriptions that they view as discretionary.

These challenges to subscription businesses are

compounded by the increasing costs businesses

themselves are facing because of inflation.

This downturn is affecting subscription businesses

across the board, from big businesses to small ones.

Even industry giants such as Netflix have reported

slowing acquisition and increased customer churn.

Netflix had forecast Q1 2022 customer growth of

2.5M new subscribers, but instead lost 200,000

customers. They are now predicting another 2.0 M

subscribers to churn in Q2.

The current business environment has created new challenges, but it has also created new opportunities for businesses to create long lasting operational efficiencies by making strategic investments in technology and other areas.

Economic data shows businesses that strategically invest in new technologies to improve operational efficiency and deliver better customer experiences will outpace their peers in growth and profitability during downturns and after economic conditions improve.

Understanding how and why customers churn is particularly important in times of economic upheaval. Unfortunately, many subscription businesses don’t have a deep grasp of their different sources of churn and therefore don’t treat their sources of churn as unique challenges that need to be solved. It’s vital for subscription businesses to understand and manage all sources of customer churn in order to reduce its financial cost.

Customer retention and customer churn are core KPIs that every subscription business seeks to optimize. Improving customer retention increases LTV, which leads directly to revenue and profitability growth. The high cost of subscription customer acquisition (often >2.5 months of billing cycles) requires long customer life cycles for businesses to earn back the cost of acquisition, and to create profitable relationships.

This paper will help subscription businesses understand all sources of customer churn and provide recommendations for investing in payments tech stack upgrades to immediately reduce a key source of customer churn, and improve both short term revenue and long-term LTV.

A DEEPER UNDERSTANDING OF CHURN

Many subscription businesses assume that most or all churn is voluntary, and invest resources to improve the customer experience to reduce churn. Unfortunately, voluntary churn is accelerating due to factors outside the control of businesses. According to the Subscription Commerce Conversion Index (a PYMNTS and sticky.io collaboration), data showed that by March 2022, roughly 46 million consumers had voluntarily canceled or paused retail subscriptions over the preceding year. Consumers gave several reasons for this voluntary churn, with inflation being a large contributor. The index showed that 54% of consumers who canceled subscriptions did so to save money.

Involuntary churn causes a significant portion of all

churn, and is caused by failed payments (also known

as declined credit card transactions). According to

Visa, two thirds of failed payments are caused by false

declines, which are authorization decline decisions

made on legitimate credit cards. These problems hit

subscription businesses particularly hard: an average

of 24% of recurring payment requests made by

subscription businesses are declined.

It is crucial to understand that while failed payments

can also lead to voluntary churn, most involuntary

churn occurs without a customer choosing to end the

relationship.

INVOLUNTARY CHURN CAN BE REDUCED

A large untapped opportunity exists for subscription businesses, however, because while higher rates of voluntary churn will continue to be a problem until economic conditions improve, the rates of involuntary churn these businesses experience are only indirectly related to current economic conditions. Even better, involuntary churn can be directly and significantly reduced by making strategic technology investments that solve the problem at its source.

Developing a Better Understanding of Involuntary Churn

Subscription businesses should start measuring and tracking voluntary and involuntary churn separately. It is important to recognize that when calculating the total cost of involuntary churn, businesses should measure the total LTV of customers lost to involuntary churn, and not limit their calculation to only measuring the value of the single month’s transaction when the failed payment occurred. By measuring the total LTV value of customer losses caused by involuntary sources, companies can easily justify the business case for making strategic investments in payments stack upgrades to solve this problem. The immediate and long-term benefits gained by reducing involuntary churn and improving the LTV of customers otherwise lost from failed payments builds the business case for this investment.

INVOLUNTARY CHURN IS CAUSED BY FAILED PAYMENTS, WHICH ACCOUNT FOR UP TO 48% OF ALL CHURN.

ACCORDING TO VISA, UP TO 67% OF ALL FAILED PAYMENTS ARE CAUSED BY FALSE DECLINES.

FlexPay data shows involuntary churn causes up to 48% of all customer churn. According to Visa, up to 67% of all failed payments (the cause of involuntary churn) are the result of false declines, or card authorization declines made on legitimate cards. The connection between failed payments and involuntary churn is clear – any failed payment that is not recovered creates a churned customer because the active subscription relationship cannot be maintained.

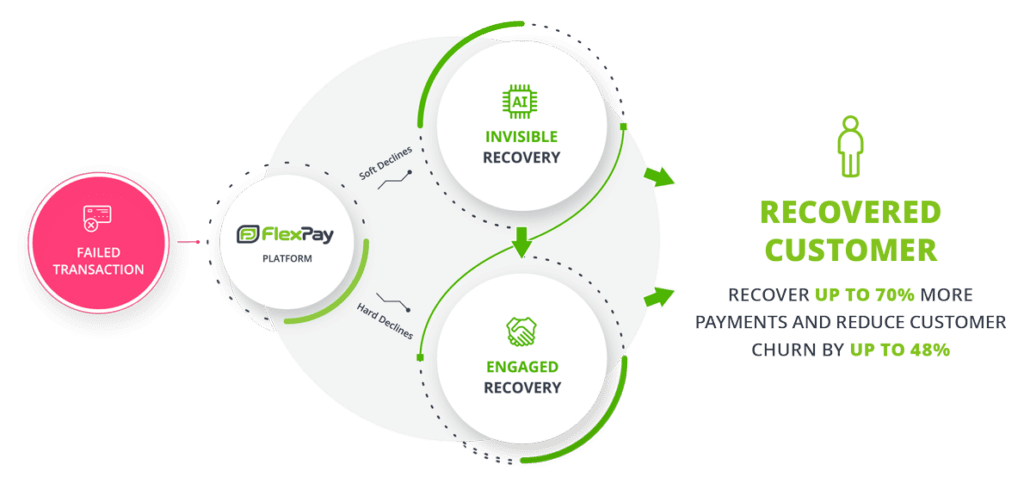

FlexPay’s customers recover up to 70% of declined transactions. With the understanding that up to 48% of all churn is caused by failed payments, it is easy to see how much churn is reduced and how much extra revenue is earned over the lifespan of each recovered customer by deploying the FlexPay solution.

GETTING STARTED

- Calculate your historical and ongoing involuntary churn rates and the percentage of churn caused by failed payments. This will give you a measurement of the initial revenue lost to failed payments.

- Make the strategic investment in your payments tech stack to integrate a failed payment recovery solution, such as FlexPay.

- Start measuring the first-month revenue recovered, and the total lifecycle of customers following recovery. This will measure the true value of a recovered customer.

- Calculate the cost of your failed payment solution by comparing the cost of the solution to the total LTV of customers following recovery.

SUMMARY

With rising inflation and its associated rising costs, many consumers are facing financial hardship and are cutting their subscriptions to reduce spending. While voluntary churn may be hard to control, subscription businesses do have the power to improve involuntary churn by strategically investing in technology that upgrades their payments tech stack. Using a failed payment recovery solution, such as FlexPay, will reduce churn and grow revenue and customer LTV.

The Complete FlexPay Platform

The FlexPay platform maximizes revenue recovery, delivers the longest retention rates following recovery, and the highest customer LTV.