Payments Experience Design for Retention and CX Leaders

Solving the Last Major Subscription Churn Source

Subscription Revenue and Profitability – New CX Strategy Delivers Rapid Reduction in Churn

The direct connection between retention, revenue, and profits in the subscription business model creates the need to maintain high levels of customer satisfaction and loyalty. Retention and CX leaders in subscription businesses understand that a subscriber’s satisfaction with the overall experience plays a key role in the decision to keep their subscription month after month. However, what is often missed is the critical connection between the payments experience and customer satisfaction, and its contribution to customer churn when the experience is negative. This blind spot to the role that the payments experience plays in customer satisfaction and churn often leads subscription businesses to incorrectly view the design and management of the payments experience as a purely operational, back-office function.

If this concept is new to you, the first questions typically asked are:

This report will provide answers to these questions. Most importantly, this report will also provide a blueprint all subscription businesses can use to expand the responsibilities of CX and retention leaders to include management of the payments experience, and the programs that solve the failed payments problem (which causes unnecessary churn).

The Subscription Payments Experience

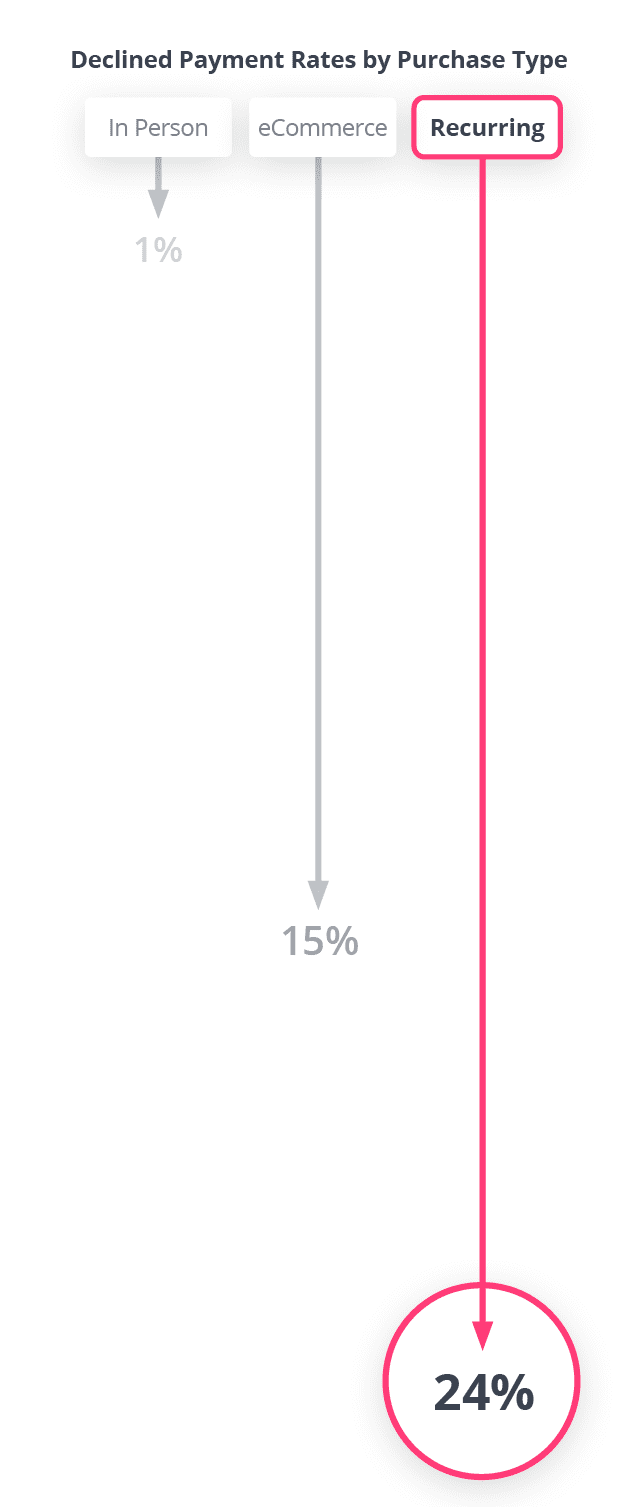

Subscription businesses face some unique challenges, including a significantly higher rate of declined payments. Data from Visa shows that only 1% of in-person transactions are declined, but the decline rate jumps to over 20% for recurring payments on subscription products and services. These declines aren’t the result of fraud or insufficient funds but are false declines or inaccurate decisions made on legitimate transactions. And of course failed payments that are not solved lead directly to customer churn. In fact, FlexPay’s own research study shows 25% of subscribers who are made aware of their failed payment choose to cancel their subscription, making the payments experience the single largest churn source for subscription companies.

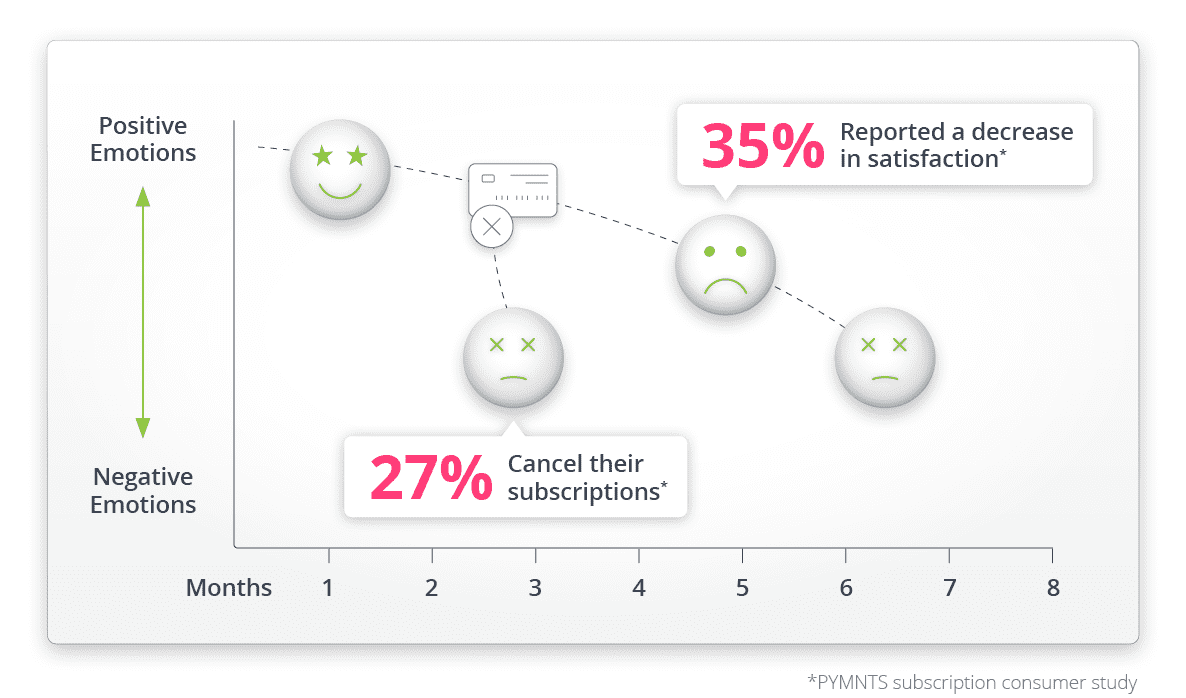

Failed payments cause enormous pain for CX leaders who are tasked with improving subscriber retention because a payments problem creates a moment of reckoning for the customer. If the customer is forced to help solve the failed payment, it creates the moment where the customer must decide whether they want to help solve the problem or decline to take part, which ends the subscription.

The limitation many subscription companies run into is organizational: finance and operations teams own payments processes, which limits the ability of CX and retention leaders ability to design and manage the payments experience. But the hard truth is that there are some types of experiences customers simply expect with their subscription, and having their payment go through is one of them. So, while a failed payment impacts the financial department and financial leaders do care about the payment losses, CX & Retention leaders should own the solutions to solve failed payments because 1) they have responsibility for retention results that are harmed by the involuntary churn caused by failed payments 2) careful payments experience design will both recover the customer and deliver a positive experience that will maximize retention and LTV following the failed payment.

The Emotions of Failed Payments

A customer may need a certain product or service and so they pick your business, sign up, and begin using what you offer, but when a payment fails their basic need isn’t being met. They aren’t getting what they signed up for any longer and they are dissatisfied. Customers expect their credit card to work and when it doesn’t their emotional state changes: they could be angry and upset or ashamed. Making a purchase is a very emotional endeavor for many shoppers and when their credit card fails, they take the failure personally.

This emotional roller coaster can create strong negative feelings about the brand because the customer associates the card failure with the brand. How a subscription business deals with the failed payment can mean the difference between a customer churning and the business having the opportunity to build loyalty and improved customer satisfaction.

The Ideal Payments CX Strategy

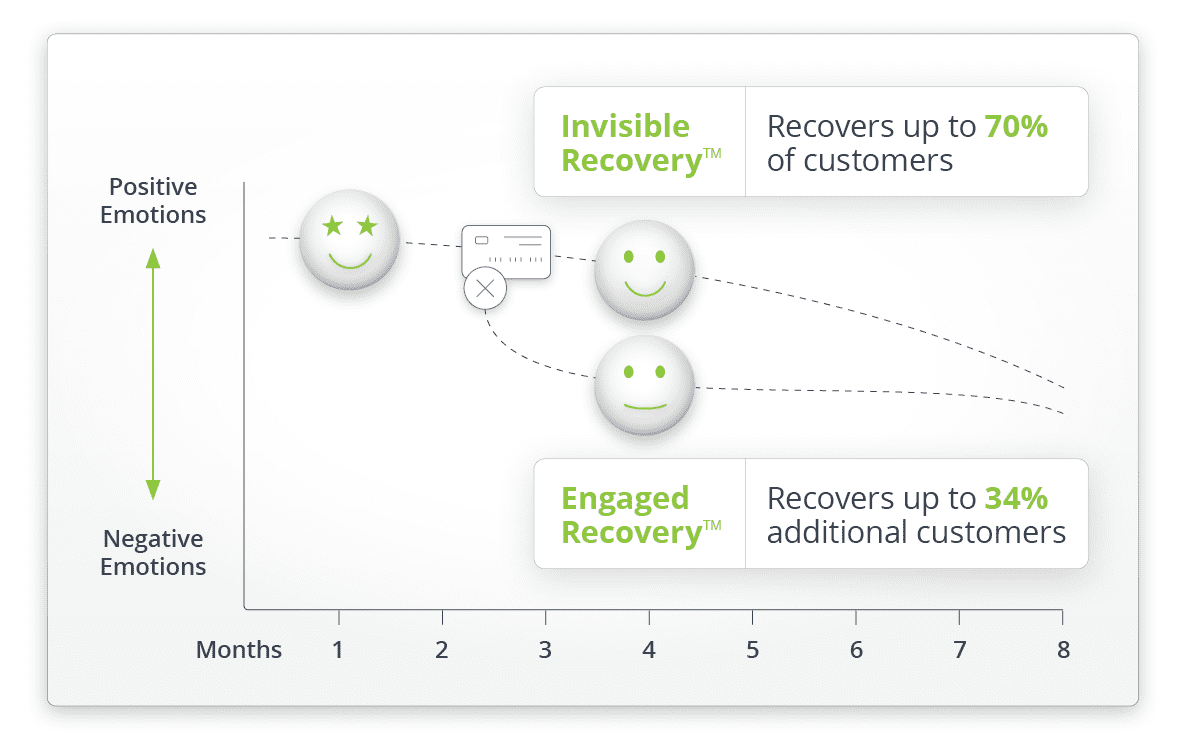

The optimum CX strategy for payments eliminates all customer awareness of failed payments, meaning they are resolved with the payments system without any customer involvement, and they are resolved quickly to avoid interruptions in subscription delivery. As far as the customer is concerned, the issue never happened — they still have access to what they wanted, and they are happy. However, when the customer is required to resolve the problem, delivering a purposeful program that engages them in a positive way is essential. In fact, the most effective programs can actually improve customer satisfaction and build loyalty because you are helping the customer resolve the problem in an empathetic way.

CX Recovery Playbook

1. Focus on retention to help keep customer acquisition costs in line

and achieve maximum customer LTV.

2. Approach the payment recovery process as a CX challenge and

manage the customer’s emotional response.

3. Focus on customer satisfaction and use recovery strategies that

will keep the customer happy.

4. Use invisible recovery strategies whenever possible to reduce the

opportunity to churn.

5. When you do have to engage the customer in the recovery process,

make the experience as positive as possible.

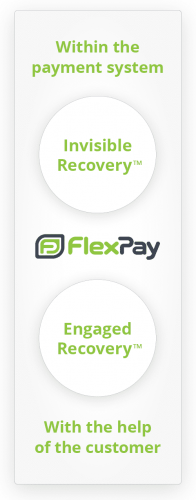

Invisible Recovery™ + Engaged Recovery™

When subscription customers pay for a product or service, they expect their credit card to work, making payment declines a critical moment in the customer experience that puts the customer relationship at risk. Implementing FlexPay into a brand’s customer experience design helps CX and retention leaders maintain customer satisfaction and improve retention and profitability.

FlexPay’s failed payment recovery solution begins with Invisible Recovery™. Invisible Recovery is an AI-powered system that addresses all the technical reasons why a payment can fail and determines the right recovery strategy specific to that failure reason. It works behind the scenes within the payments system itself, avoiding customer visibility completely. This approach is ideal because the customer never knows there was a problem with their payment and there is no interruption in product or service delivery: the relationship simply continues as if nothing had happened.

When a payment failure can’t be fixed by Invisible Recovery — such as a stolen card — Engaged Recovery™ takes over. The affected subscriber is placed into a highly effective behavioral sciences designed program that creates engaging and positive branded experiences, specifically crafted to help the customer understand the problem and how to solve it. Multiple messaging themes are applied to deliver the desired customer behaviors, while maintaining high levels of customer satisfaction.

Conclusion

Failed payments are one of the largest sources of customer churn, a metric that CX leaders are responsible for reducing, and how a company deals with the failed payment can genuinely make or break the customer relationship. Using a combination of technology that either works behind the scenes within the payments system or engages with the customer in a positive way will improve the customer experience, reduce churn, and increase retention.