Mastering Subscriptions CX:

The Optimal Failed Payment Recovery Strategy

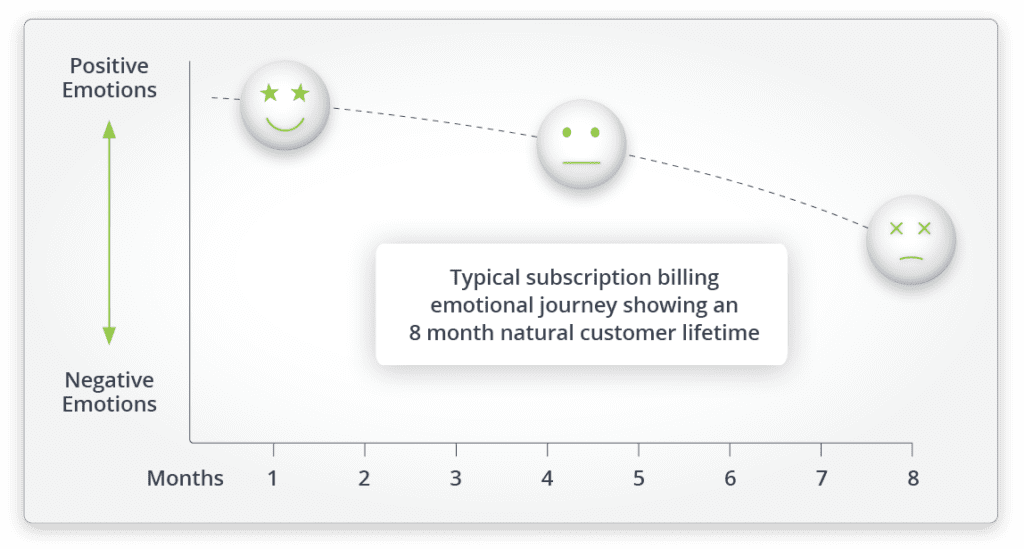

Customer satisfaction translates directly into revenue when you’re providing services or products on a subscription model. Happy customers stick around for longer and your hard work pays off through profits. However, the subscription customer experience (CX) can easily be disrupted when a customer’s credit card payment fails. Stopping this failed payment from causing churn is a challenging problem to solve. The trick is to continue in accordance with your customer experience strategy and deliver an optimal journey for clients affected by failed payments. Here are the overarching best practices you can start applying today in your organization.

How failed payments disrupts the customer experience

Failed payments interrupt the usual customer journey, souring the overall experience. You have carefully designed an ideal flow for your subscribers: you created effective acquisition initiatives, retention campaigns, and support programs, only to have the experience fall apart when a payment fails. This gets worse if the type of payment recovery strategy you use treats your customers like they are a business risk — unable to pay or

uninterested — just because their payment didn’t go through. Instead of assuming a failed payment is the beginning of the end of the relationship with the customer, subscription companies need to reframe this problem and see it as a distinct branch of the customer journey — a part of the overall customer experience strategy. For subscription companies, failed payments are inevitable because the payment system is hypersensitive and will often decline a perfectly legitimate payment. This can happen because the system was designed for in-person purchases instead of today’s automated recurring billing models. Failed payments are not always the customer’s fault, and they don’t mean the customer is less valuable.

The good news is that the smart companies that do give careful attention to the customer journey after a payment fails will gain a strategic edge that will improve customer retention and profitability. The cost of failed payments can be minimized when all departments collaborate. Often, different departments within an organization are each trying to solve the problem in their own way. Your retention marketing team will send emails to customers when a payment fails, your client success team will repurpose their call center to make recovery calls, your tech team will look to fix the payment gateway, and your finance team will see it as a collections issue. Instead, your entire company needs to work together to bring it all back to the customer experience and focus on delivering a frictionless and consistent journey.

Subscriber customer experience takeaways

- Failed payments are not the customers’ fault, and they shouldn’t be blamed for it.

- Creating the ideal flow for a customer that is affected by a failed payment, requires strategic thinking, not just tactics.

- Recovering the customer after a failed payment greatly improves profitability, both from the successful current billing as well as future lifetime value.

How over-reliance on outreach can harm the relationship with the customer

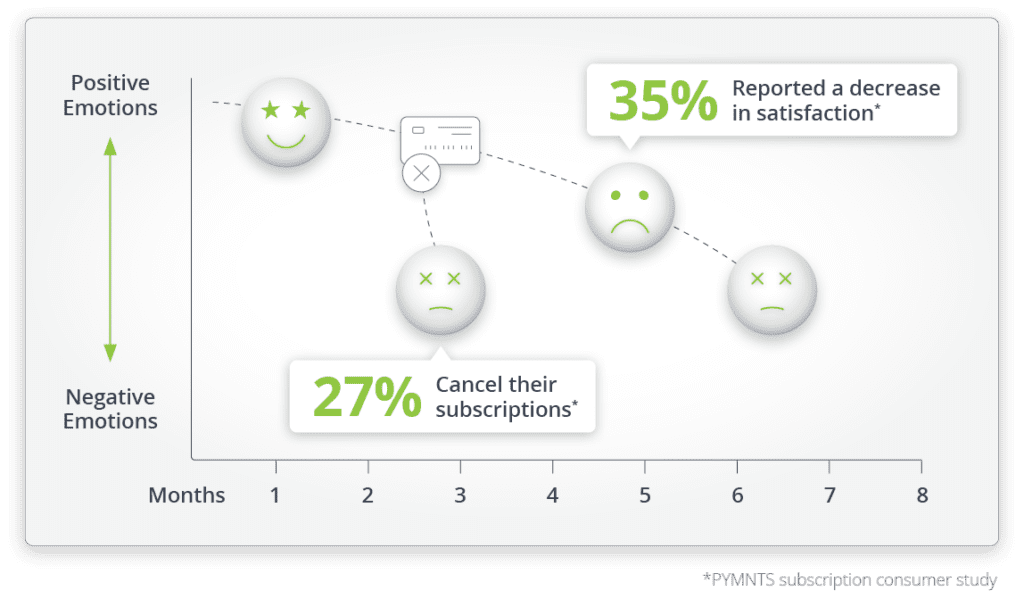

RA smooth payment experience is expected by every subscriber. It’s an implied brand promise, and therefore should never be broken. FlexPay and PYMNTS consumer research from 2021 shows that when customers are told their payment has failed, this prompts 27% of account holders to cancel their subscriptions instead of providing an updated credit card. These are customers who were satisfied with a product or service until they found out about the failed payment and decided to cancel their subscription when someone from the company reached out to them. Furthermore, although 68% of customers updated their payment information when contacted, 35% of these customers reported a decrease in satisfaction, making it more likely that they’ll look elsewhere and churn in the future.

Based on the data we’ve outlined, customer visibility should be avoided whenever possible to minimize the impact of failed payments on satisfaction. When the customer needs to intervene to fix the payment, great care should be taken in crafting the tone and overall approach to continue a positive

brand experience. Subscription professionals know that monitoring failed payments is essential for maximizing customer lifetime value, but only 44% of those surveyed in a 2022 PYMNTS study thought a seamless payment experience was valued by customers. This could mean that subscription

professionals are underestimating the importance of payments for their customers since a subscription implies a flawless payment experience.

The ideal payment recovery process

Payment recovery that happens invisibly in the background doesn’t negatively affect the customer journey. In fact, you will get the best recovery results when you use your highest-performing method first while the decline is still fresh. Simply doing retries in-house is a waste of time and money because you are missing the best chance for a successful recovery. Our AI-powered solution recovers 45% more failed payments than simple in-house solutions, which means you are missing out on your customer’s full revenue potential by using less performant solutions. FlexPay recovers a payment in 2.9 days, on average, which is great for cash flow. Some customers might notice their payment was charged a couple of days later than normal, however, this won’t harm your relationship, and the subscription will continue as if nothing had happened.

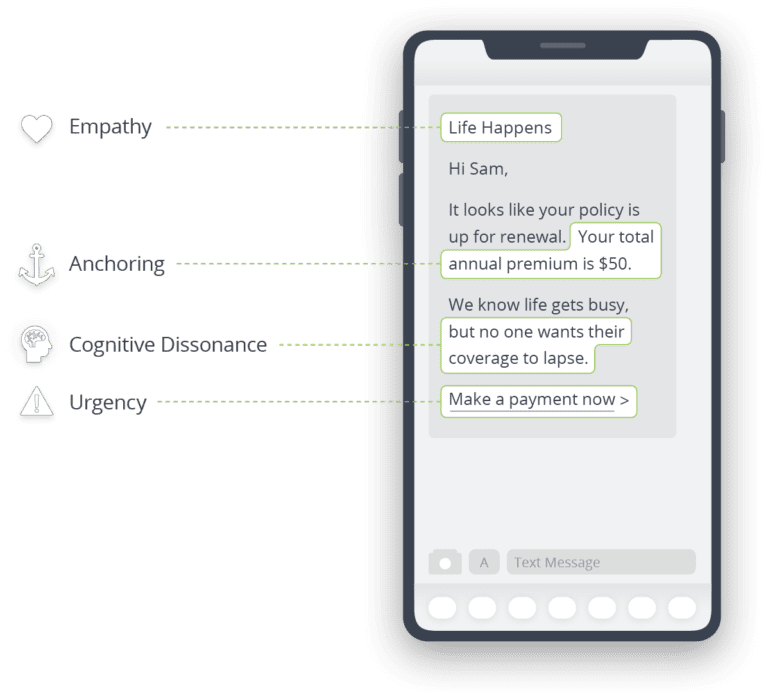

However, there are some types of failed payments that can’t be recovered behind the scenes, such as an invalid card number. This is the correct time to enlist the help of the subscriber through carefully crafted automated outreach like emails or SMS. At this point, you must be very conscious of the negative impact outreach could have on your subscription relationship if implemented wrong. The tone and approach you use need to be positive and encouraging, while still being convincing enough to motivate the subscriber into acting.

Call center customer outreach should only be used as a last resort when you have exhausted all other methods because it is the most expensive form of recovery and is intrusive to the customer, which could negatively affect your relationship.

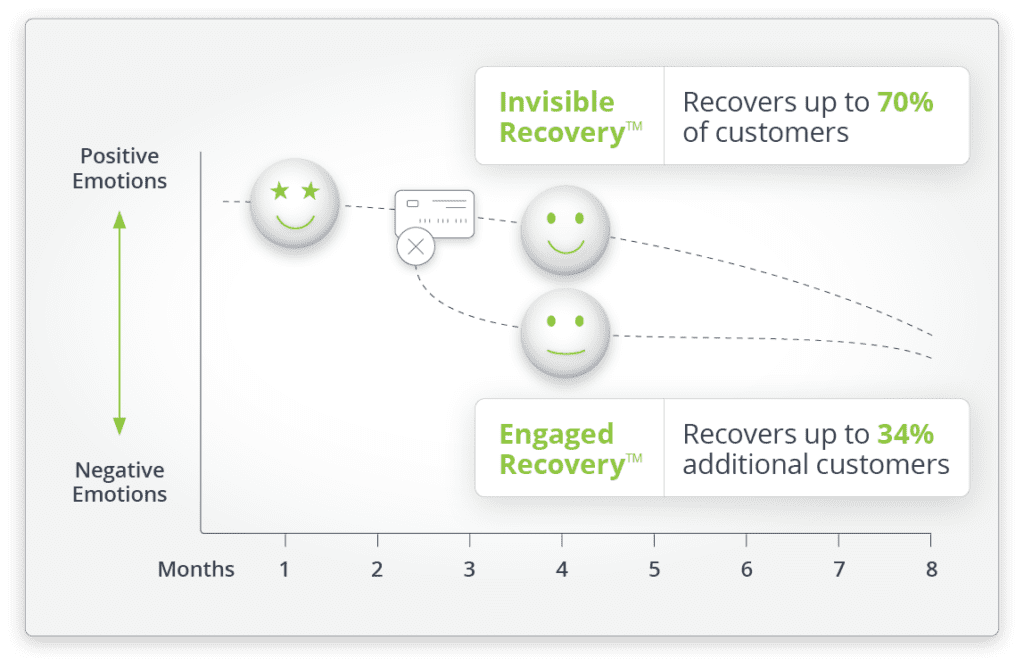

The FlexPay solution: Invisible Recovery ™ + Engaged Recovery™

FlexPay combines different approaches to offer the highest-performing failed payment solution, optimized for long-term subscriber retention. It layers both a technical approach with Invisible Recovery™ that works in the background within the payment ecosystem to fix the failure reason, followed by Engaged Recovery™, an automated outreach flow, carefully crafted with behavioral science to enlist the help of the subscriber.

FlexPay’s highest rate of recovery happens behind the scenes within the payments system itself, thereby avoiding customer visibility. Invisible Recovery is an AI-powered system that addresses all the technical reasons why a payment can fail and determines the right recovery strategy specific to that failure reason. This approach is ideal because the customer never knows there was a problem with their payment and there is no interruption in product or service delivery: the relationship simply continues as if nothing had happened.

When a payment failure can’t be fixed by Invisible Recovery — such as a stolen card — Engaged Recovery takes over. The affected subscriber is enrolled in a campaign across email and SMS to enlist their help in solving the problem and suggesting the right solution for that failure type. Behavioral science is used to find the balance between maintaining the highest satisfaction levels and using the most effective messaging. The outreach messages are crafted in a way that encourages the customer to resolve the payment issue, using different messaging strategies that resonate with different personality profiles. Some customers need a reminder, others need assistance in finding where to update their payments, and those with a tendency to procrastinate might need a sense of urgency before they take the time to act. The messages are consistent in look and tone with the merchant’s brand, customized to highlight the unique value of the product or service the organization offers. Those few accounts that aren’t successfully recovered at that point can be sent back to your customer success team for further outreach — usually through a call center.

These messages are consistent in look and tone with the merchant’s brand, customized to highlight

the unique value of the product or service the organization offers.

How FlexPay delivers on CX best practices

Subscription customers expect a smooth payment experience month after month — that’s what they signed up for. However, failed payments are an inevitable part of the subscription lifecycle and must be dealt with quickly to prevent involuntary churn.

To deliver the best experience for subscribers, every subscription provider needs to implement a payment recovery experience that’s either invisible to the customer or connects with them in a positive manner, successfully solving the problem of failed payments.

FlexPay follows these best practices closely, where Invisible Recovery is the highest-performing solution that recovers most fresh declines in the background, and wherever customer involvement is needed then transfers them to Engaged Recovery where carefully crafted outreach gently collaborates with the customer to reactivate the payment.