Mastering Retention

The Top Growth Hack for Subscription Companies

INTRODUCTION

Until 2023, the cost of cash was essentially zero for companies and investors. Then, almost overnight, cash became both more expensive and more scarce. This end of easy cash access has shifted the mantra for companies from delivering growth through customer acquisition to simply delivering efficient growth. This has resulted in a renewed focus on retention for subscription companies because of the challenges created by a slow-down in new subscriber growth and the steep increase in the cost of acquiring customers. Yes, retention has always been a priority for subscription businesses, but the need to substantially improve retention has become the only way to both increase revenue and deliver the profit returns investors demand.

Good news! Reducing involuntary churn is an easy way for subscription companies to drastically increase retention. Reducing involuntary churn by recovering failed payments (the source of involuntary churn) improves customer retention by targeting the largest source of churn. In fact, many

companies have found that implementing a payment recovery technology achieves most of the retention goals outlined in their business plans and also generates the revenue needed to increase profit margins. Improved customer retention provides these measurable business benefits because revenue growth earned through customer retention is more profitable than growth earned from customer acquisition.

This report will provide insights and actionable steps all subscription companies can follow to increase overall customer retention and achieve the revenue and profit gains their business plans call for. Keep reading to learn:

- Why customer acquisition has become so difficult.

- Why multiple recovery solutions are needed to deliver the best results.

- Why companies must measure both recovery rates and lifespans following churn recovery.

- The blueprint of the ideal retention solution

Why customer acquisition has slowed and become more expensive

New subscriber growth has slowed dramatically since the end of the pandemic. Additionally, inflation has caused many households to make difficult decisions to manage their budgets, resulting in both slower adoption of new subscriptions and higher voluntary churn rates. Whole subscription categories — such as media and publishing — are facing real survival challenges as they try to maintain a profitable business model on an increasingly shrinking subscriber base. These challenges have resulted in more competition between subscription companies as customers have to carefully choose who they want to buy from on an ever-shrinking budget, causing higher customer acquisition costs. Slower growth and higher costs mean it’s more important than ever to retain the customers you already have. But to do this, you need to understand the different types of churn and how to fight them.

Understanding and measuring churn

There are two kinds of churn and each one requires its own retention and recovery program

How to measure involuntary churn

Measuring your involuntary churn rate is simple to do and it’s often an eye-opening exercise for companies. Once a company realizes how much they are losing to involuntary churn, they quickly prioritize reducing this source of customer loss.

Here are the steps to start tracking your rate of involuntary churn:

• QUANTITY OF INVOLUNTARY CHURN CUSTOMER LOSSES: The number of unrecovered failed payments where the subscription also ends.

• MONTHLY SUBSCRIPTION DOLLARS LOST TO INVOLUNTARY CHURN: The sum of subscription billings from unrecovered failed payments where the subscription also ends.

• PERCENTAGE OF CHURN FROM INVOLUNTARY SOURCE: Quantity of involuntary churn customer losses / Quantity of total subscription losses.

The problem with using voluntary churn tools to solve involuntary churn

How subscription businesses view payments often correlates with how they approach involuntary churn. Typically, the payments function in subscription companies is viewed as a “back office” service, so payment systems and processes are usually managed by the operations, technology, and finance teams. This org structure would make sense if the payments system worked perfectly, meaning all legitimate payment requests were approved and all fraudulent payment requests were declined. Unfortunately, involuntary churn proves that this isn’t the case, and this structure hampers the effectiveness of involuntary churn programs because these teams don’t recognize the need to apply CX best practices to the payments experience.

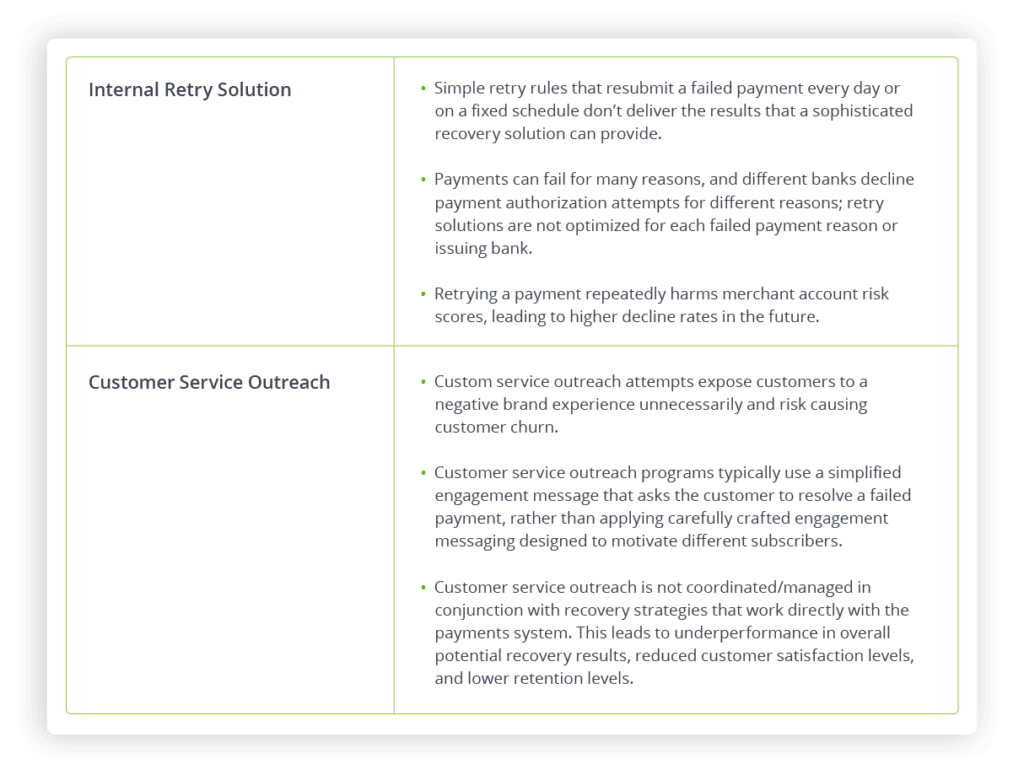

Let’s examine a sample company, we’ll call it Harper’s Readers, that realizes they have a failed payment problem but approaches it as an operational problem. Harper’s Readers assigns their technology team to build a retry solution that will automatically resubmit failed payments for authorization on a rules-based schedule. They also decide to use their customer service team to engage with customers whose payments were declined. Each affected customer is sent a series of emails asking them to provide a new card number to allow their subscription to continue.

The good news for Harper’s Readers is that they recognize the failed payment problem and are taking steps to reduce the churn it creates. By doing their recovery in-house, they recover 21% of their failed payments, which is good.

However, there are two limitations to the retention results Harper’s Readers earn because this approach to payment recovery only measures success in terms of recovery rates.

- A rules-based payment retry system can only perform so well. Specialized technology now exists that dramatically outperforms internal solutions. A 2023 PYMNTS study* found that companies using specialized third-party payment recovery solutions were 12x more likely to be top financial performers than companies using home-built solutions.

- The most common subscriber reaction to a failed payment is negative and this causes harm to the brand. Unfortunately, while bad bank decisions are the cause of most failed payments, customers blame the brand that informs them about the failed payment and not the bank that made the mistake. By telling the subscriber their payment has failed, customer service outreach programs bring unnecessary awareness of the problem to the customer and create a negative emotional reaction. This negative brand experience must be avoided whenever possible.

* https://flexpay.io/resources/2023-state-of-subscription-business/

Applying NPS and customer satisfaction principles to involuntary churn programs

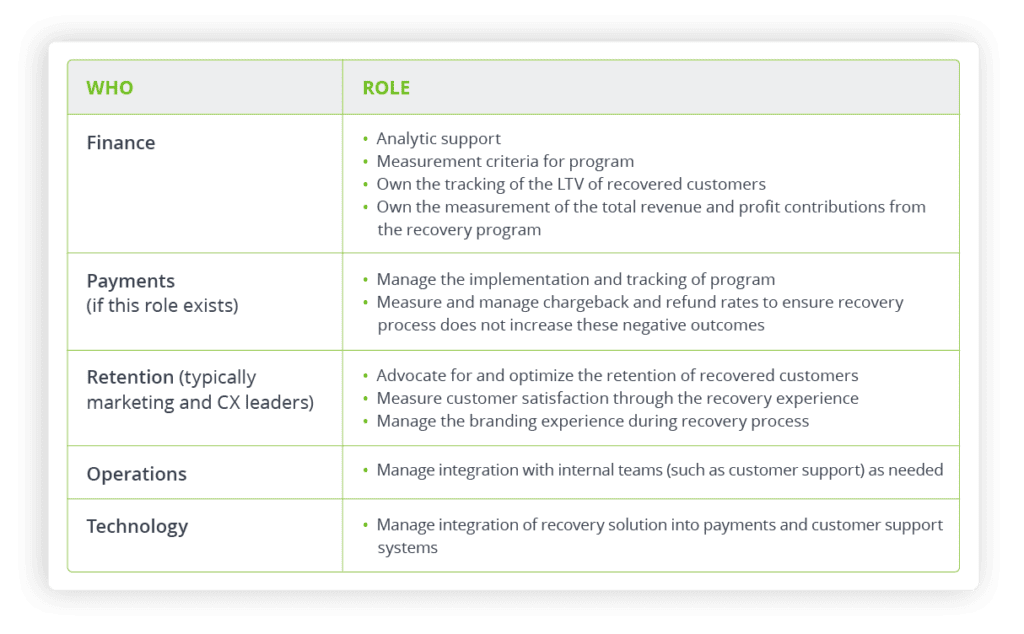

The best organizational approach to solving involuntary churn is to create a partnership between the retention and CX leaders and the payments teams. This allows for the selection and management of a payment recovery solution that will achieve ideal recovery rates, maintain customer satisfaction during the experience, and retain the recovered customers.

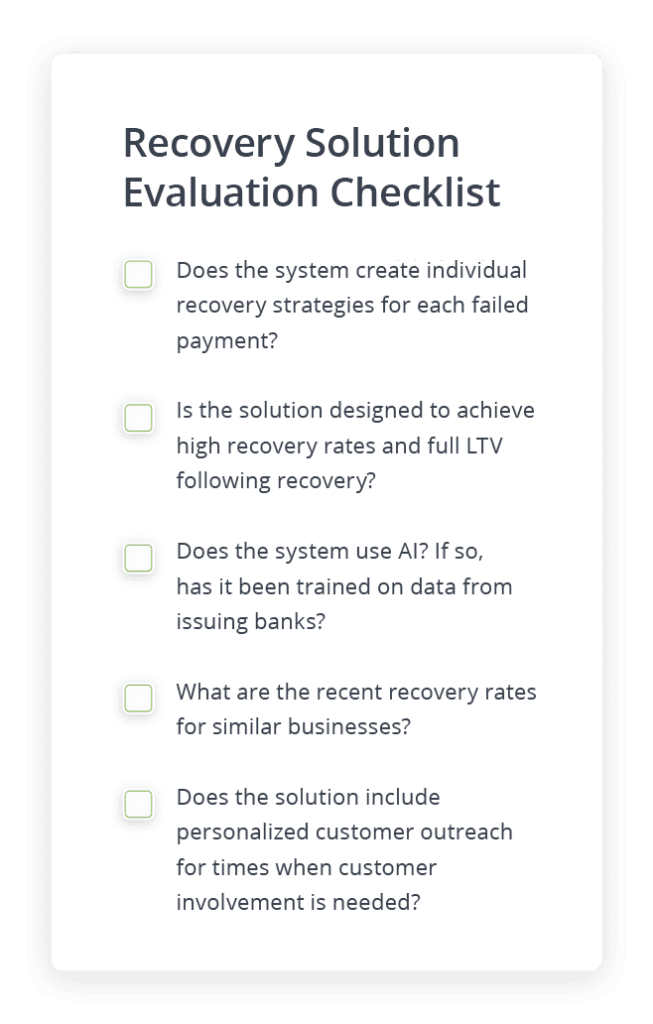

The ideal failed payment recovery solution applies sophisticated technology that works directly with the payments system and makes recovery invisible to the customer. This is the ideal customer experience because as far as the customer knows the failed payment never happened, which avoids a negative brand experience and eliminates the possibility that the customer might not help recover the payment.

Of course, there are times when recovery with the payments system is not possible, and customers will need to be involved in the resolution process. This is when CX and customer satisfaction principles should be used to create a positive engagement experience. Applying behavioral science techniques to identify the approach that works for each individual customer delivers top recovery results for those times when customer engagement is needed. This customer engagement solution has the potential to deliver dramatically better recovery results than customer service outreach. It also avoids negative brand experiences and achieves top customer retention and LTV following recovery.

Using an innovative failed payment recovery solution

To achieve longer customer retention and higher LTV values, subscription companies need a payment recovery experience that works within the payments system to directly resolve the failure and also delivers a positive customer experience when the customer’s help is needed to solve a payment issue. This is exactly what you get with FlexPay’s solution, which applies either Invisible Recovery™ or Engaged Recovery™ to achieve ideal recovery and retention.

Invisible Recovery delivers failed payment recovery rates as high as 70% while maximizing customer retention following recovery. Using Engaged Recovery results in an additional 30% in recovery rates beyond Invisible Recovery, allowing you to achieve the highest rates of recovery success. While individual company results will vary, FlexPay’s users typically save one in three customers from involuntary churn, often for the price of a cup of coffee..

Summary

Since revenue earned through customer retention is more profitable than revenue earned from customer acquisition, improved retention is the powerful growth hack subscription businesses need to become more profitable. Using a failed payment recovery solution to reduce involuntary churn can dramatically improve customer retention and lower operating costs by reducing the need to rely on new customer acquisition to fuel growth. It’s all about working smarter, not harder.