Failed Payment Solution Guide:

Evaluating and Selecting Technology for Top Results

INTRODUCTION

Changes in the economy and consumer buying habits are making it more difficult to acquire and keep subscribers. Subscription businesses are seeing slower customer acquisition rates, while the costs of acquiring new customers have become more expensive. Plus, voluntary churn rates have increased across the board because inflation has forced subscribers to cut back on expenses. Slowing growth rates and higher customer acquisition costs mean that increasing retention is the easiest and most economical way to increase revenue and profits. It’s all about working smarter, not harder.

This economic shift has moved subscription company priorities from “acquisition at all costs” to “optimize retention at all costs”, a profound change of mindset. The need to reduce failed payment rates has become a priority due to the direct relationship between failed payments and customer churn. Using a failed payment recovery solution is no longer a nice to have, it’s essential.

This guide is intended to help subscription businesses understand the importance of using a failed payment recovery solution, and it will provide an overview of the best practices to follow as you set up your own internal recovery team and evaluate solution providers.

Unsolved Failed Payments: The Biggest Source of Customer Churn

The starting point of any retention program is to identify all drivers of churn. Voluntary churn is caused by customers choosing to end their subscription and accounts for 52% of all churn. Involuntary churn (also called passive or accidental churn) is caused by false decline decisions by the customer’s credit card issuing bank; involuntary churn causes up to 48% of all churn. Unrecovered failed payments result in lost revenue and lost customers.

According to a 2023 joint study by PYMNTS and FlexPay, 50% of companies viewed declined card payments as the cause of their customer churn, with a full 26.5% of them stating that it was the top reason for their customer churn, and another 23.5% saying declined payments were a significant cause of their churn. Savvy companies understand the impact that failed payments have on their business. Companies that understand the problem know they need to use the most effective tool to solve it. The same PYMNTS study showed that top performing companies are 12X more likely to use a third-party payment recovery software specially designed to achieve the highest rates of recovery and to minimize churn.

Voluntary churn rates have increased across the board because inflation has forced subscribers to cut back on expenses.

Best Practices in Failed Payment Recovery

The objective for any recovery solution should be to achieve a high recovery rate while preserving customer satisfaction and achieving maximum retention following recovery. How you recover a failed payment can mean the difference between a customer that stays with you for months to come and one that leaves because of a bad brand experience. In order to improve retention, it’s important to recover failed payments in a way that doesn’t harm the customer relationship or satisfaction. This is relevant whether or not the customer is engaged with the recovery process. You can do this by using a recovery solution that works directly with the payments system — the issuing bank that declined the payment — so that the customer never knows their payment failed and isn’t involved in the recovery process. It’s like the failed payment never happened as far as the customer is concerned. This type of behind-the-scenes recovery should always be the first step taken because it quickly achieves the highest recovery results.

Sometimes a payment can’t be recovered without customer involvement, such as when the credit card has expired or has been lost or stolen. In this type of situation, strategic, empathetic communications are needed to motivate the customer to provide new credit card details. These communications must be carefully crafted to ensure customer cooperation though — any language that puts them on the defensive could reduce their willingness to solve the problem and cause your relationship to end prematurely. Remember, the quality of the customer experience is just as important as the recovery rates you achieve. A customer is still a customer even when their payment fails, so providing a great customer experience is vital to retention.

How you recover a failed payment can mean the difference between a customer

that stays with you for months to come and one that leaves due to a bad brand experience.

Optimizing the Declined Payment Solution

Recovering a failed payment is more than just recovering a transaction — the entire lifecycle of the customer before, during, and after recovery must be considered. How you treat the customer during this time can make or break your entire relationship. To ensure the customer remains a customer, your recovery process must be both technically effective — meaning the payment is recovered successfully — and the customer must go on to bill for many more months to achieve full LTV. Customer satisfaction must be your focus throughout the process.

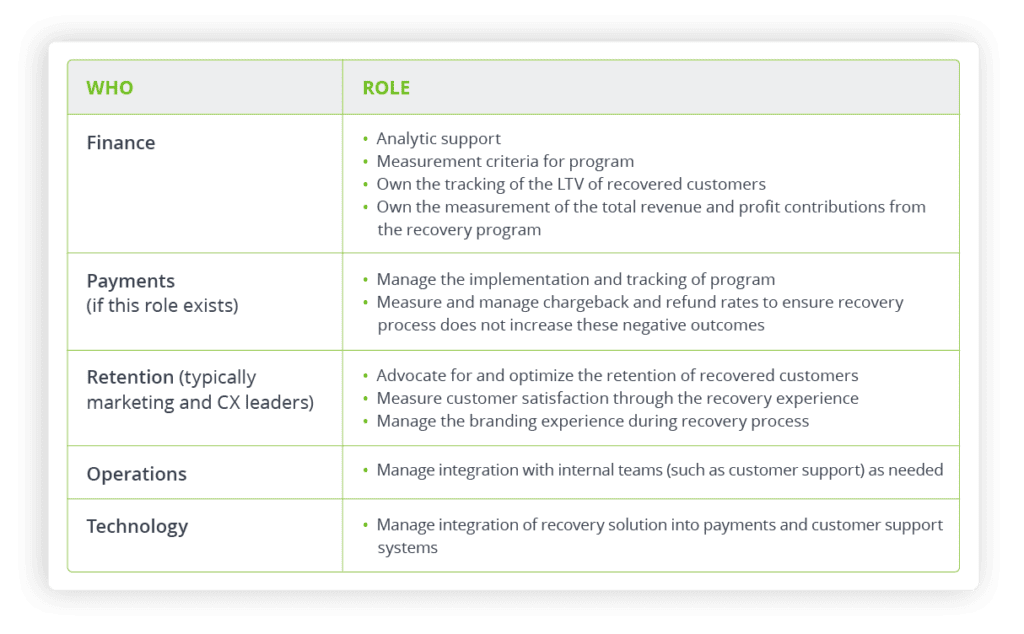

To do this, failed payment recovery should be a concern of everyone in the company and not viewed as simply a back end or a customer service responsibility. A cross-functional team made up of finance/payment experts, operations, technology, and CX/retention leaders should be created to solve the problem together with each team holding responsibility for a successful outcome. When people from across the company work together, it shows a deep understanding of just how important failed payment recovery is to the success of the business and it improves the likelihood of a successful recovery process.

When building out a recovery team, each member should represent their objectives and expertise so that the recovery solution, recovery experience, and retention following recovery are all measured, actively managed, and optimized. Here are the suggested members of an effective cross-functional payment recovery team and their individual responsibilities:

Evaluating Failed Payment Recovery Solutions

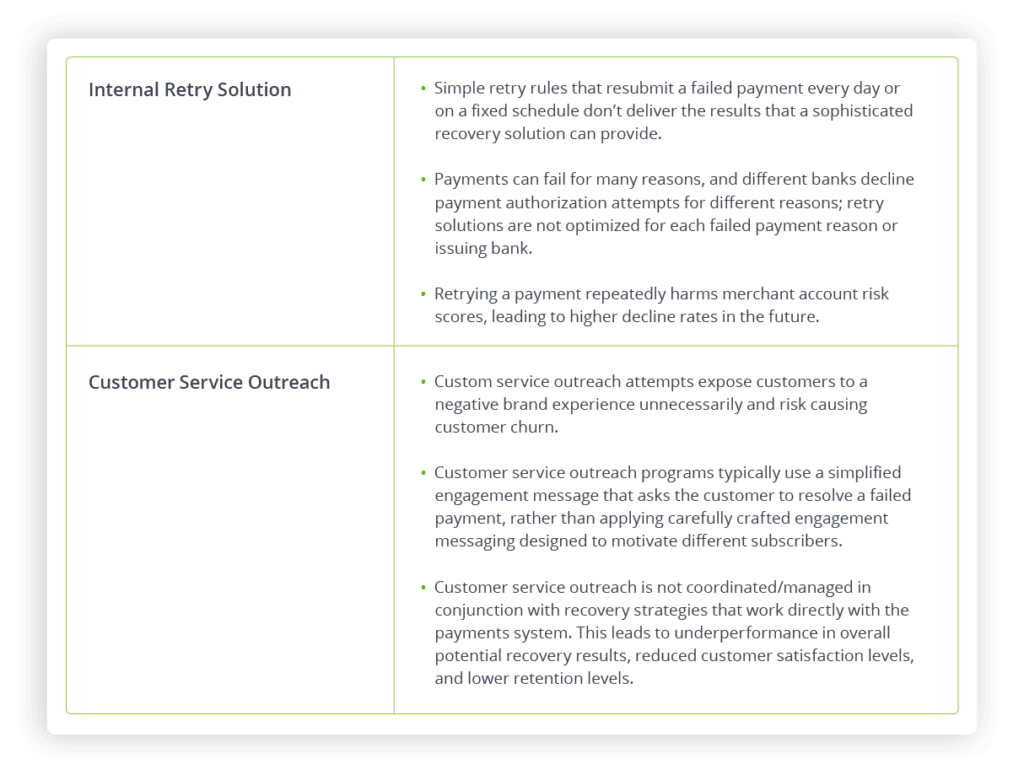

Many organizations build their own internal recovery solutions, often with the assumption that since they know their customers and their business best, they can build an effective recovery solution. These are good first steps to take, but internal solutions have performance limitations compared to the top specialized solutions, and they often cause unwanted challenges. The following chart summarizes the inherent limitations and unintended problems caused by internal solutions.

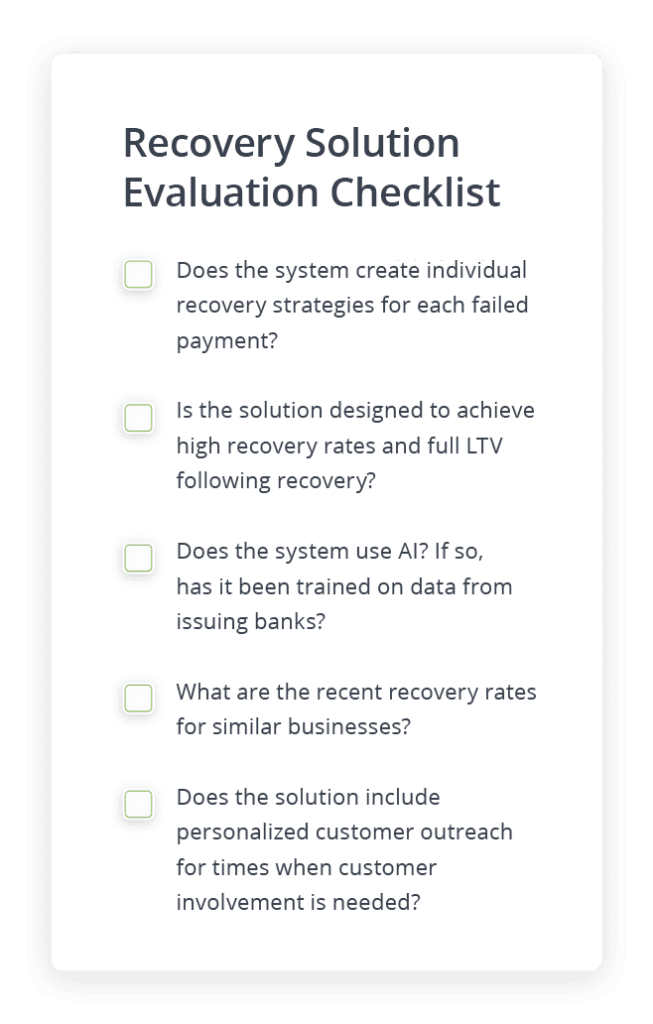

A sophisticated technology solution designed to achieve high recovery rates and top customer retention should be used to ensure both best results and a positive customer experience. Advanced features such as AI are useful but be sure to question providers to learn why and how their AI is suited for this application. Has their system been trained on suitably large data sets with data from issuing banks, which is crucial for achieving high recovery performance for each decline type and issuing bank? Where are they getting their data from?

When speaking with recovery companies, make sure they give you their recent recovery rates for businesses like yours. Each provider should be able to evaluate your current failed payment data and provide you with an analysis forecasting your expected recovery performance. It’s also important to find out if the provider has any customer outreach programs in place that will ensure high levels of customer satisfaction through the engagement process, in addition to high recovery rates.

Conclusion

Slower growth and higher acquisition costs mean it’s more important than ever to keep the customers you already have. But many subscription companies underestimate the full impact failed payments and involuntary churn have on their business and don’t have a plan to effectively solve the problem. Researching failed payment recovery solutions and developing an effective retention strategy will ensure your business thrives in a challenging changing market.