Card Payments Fail for Many Reasons

Technology Options to Solve All Decline Types

BACKGROUND

It’s commonly believed that the card payments system runs smoothly and the authorization systems that approve or deny transactions work well. Unfortunately, this is not true.

SOFT DECLINES VS HARD DECLINES

TOP REASONS

FOR

PAYMENT DECLINES BY PERCENTAGE

Soft Declines

- Bank Decline (31%)

- NSF (22%)

- Refer to Card Issuer (9%)

- Do Not Honor (6%)

Hard Declines

- Invalid Card Number (9%)

- Transaction Not Permitted to That Cardholder (7%)

- Expired Card (6%)

THE BEST WAY TO RECOVER FAILED PAYMENTS AND SAVE CUSTOMERS

Subscribers expect great overall experiences, and they expect their card payments to work. This means how you go about recovering failed payments is extremely important. Your goal should be to resolve the payment without any customer involvement when possible, and to create a positive experience when customer engagement in unavoidable.

A research study with PYMNTS found that 27% of customers churned after they were made aware of a failed payment. These were customers who appeared to be happy with their subscription but left when given the opportunity. This shows how important it is to employ the right recovery strategy.

TWO TYPES OF FAILED PAYMENTS,

TWO TYPES OF PAYMENT RECOVERY

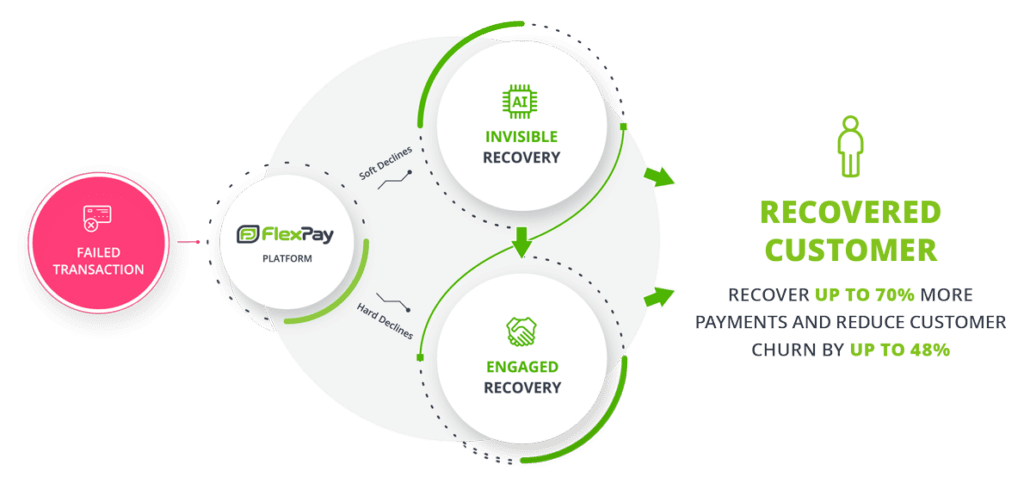

When recovering a failed transaction, you should always begin by using a solution that is invisible to the customer. The best way to do this is by using technology powered by AI and machine learning, a system that uses billions of transactions records and decades of payments expertise to create the optimal failed payment recovery strategy.

There are over 8,000 card-issuing banks in North America alone, which all use their own unique algorithms to decide which payment transaction requests are approved, and which are declined. There are also hundreds of reasons why a payment might fail, as shown by the hundreds of reason code values returned with a failed payment. Plus, every different type of card, such as corporate cards, rewards cards, and ATM cards, are all evaluated for approval using different rules. There are literally billions of permutations of factors that must be optimized to create a unique recovery strategy for each failed payment.

Simple recovery methods, such as rules-based systems, cannot achieve the highest rates of recovery given the complex recovery strategies required for each failed payment.

While you may have collections teams on hand to help recover failed payments, or have a third-party service on contract, customer outreach should not be the first step in the recovery process. Remember, customers usually aren’t aware there is a problem with their payment unless contacted, and involving them creates the opportunity for them to churn.

When you absolutely must involve the customer, such as when there is a hard decline, the best option is to use a personalized customer outreach strategy that collaborates with the customer. This type of outreach can use channels such as SMS and email messaging that can be personalized to suit the communication preferences of each unique customer and be delivered at the ideal time to ensure the best response rate.

Customer engagement also needs to take the customer’s demographics into consideration and show understanding of their financial situation. It should use the right tone of voice to appeal to that person and offer options to help them complete their payment. Each person’s unique situation must be considered to find the best way to reach a successful outcome. Treating the customer in a positive, empathetic way will make them feel appreciated and valued.

SUMMARY

The payments ecosystem mistakenly blocks many legitimate recurring card transactions because banks are trying to minimize their fraud losses. This means that subscription businesses must use optimal methods to recover failed payments to avoid the revenue losses and churn they create, while minimizing customer involvement in the recovery process. The first step in failed payment recovery should always use techniques that avoid any customer awareness of the failed payment. When customer engagement is required, avoid creating a negative customer experience that can create opportunities for customers to churn.

Introducing

THE COMPLETE

FLEXPAY PLATFORM

FlexPay announces Engaged Recovery to further enhance its AI-powered Invisible RecoveryTM failed payment solution. Engaged Recovery adds a critical new capability to collaborate with customers to solve failed payments, using a positive outreach strategy that delivers great results and a great customer experience.

Engaged Recovery uses powerful AI algorithms trained by behavioral science and psychology to engage with customers using empathetic language. Engaged Recovery motivates the customer to help solve the problem with their failed card by providing updated card information, ensuring their subscription continues without interruption.