Why Subscriptions Are Vulnerable to Failed Payments

The Subscription Business Model

Creating a steady stream of income

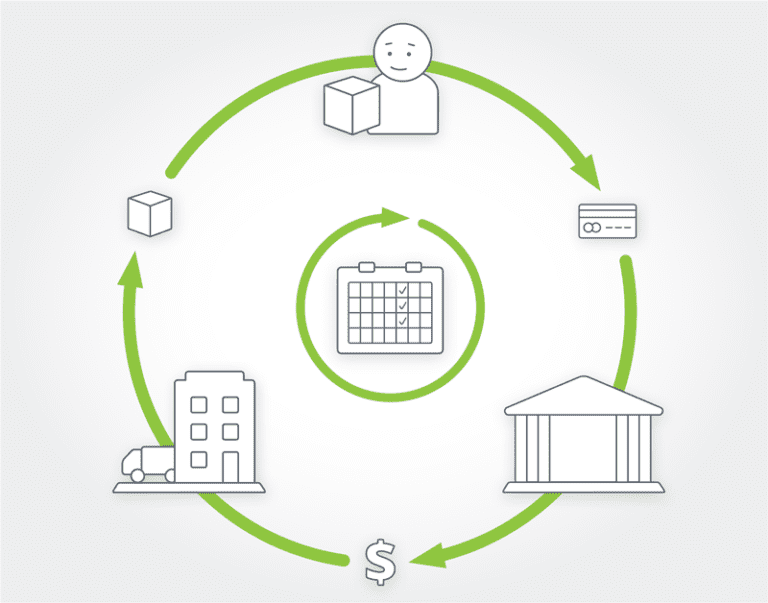

The subscription business model creates recurring revenue from customers who pay an ongoing, repeated fee to purchase your products or services on a regular basis. This model allows you to create a steady stream of income from these customer relationships.

While this business model began in the publishing industry, the subscription business model is now widely used for many types of businesses, such as SaaS, entertainment, personal care items, and even some automotive add-ons. People love the convenience and reliability of getting the items they want without having to shop for them over and over again.

The Subscription Difference

Shifting customer buying habitsSubscriptions are all about having a committed relationship with your customers, not a one-night stand.

Customer buying habits have shifted from being a one-off exchange of goods/services where a customer buys an item from you once and you never see them again to a recurring exchange that develops into a deep relationship between you and your customer. Instead of being focussed on acquiring new customers, businesses need to keep their existing customers happy for as long as possible.

Robbie Kellman Baxter, author of The Forever Transaction, has found that today’s customers want a sense of belonging and they get that through their subscription memberships. Customers want to feel like they are part of an important group, but they don’t get this feeling by being a regular customer at a store. However, they do get this feeling from the relationships they have with their subscriptions.

This is great news for subscription businesses.

To be profitable, subscription companies need a customer to stay with them for several billing cycles to recover their acquisition costs. The KPIs a subscription-based company typically measures reflect this ongoing relationship:

- ARR or MRR: Annual or monthly recurring revenue.

- Churn: The number of customers who have left the company during a certain period.

- Churn be split into voluntary churn where the customer wants to leave and involuntary churn where the customer didn’t intend to leave but the relationship ended anyway.

- Customer Lifetime Value: The Average Order Value multiplied by the average time a customer stays with a merchant.

How Payment Issues Can Disrupt the Subscription Experience

The risk of card not present transactionsPayment failure disrupts the customer journey. According to a study by Visa, in-person/card present transactions fail 1.5% of the time; eCommerce transactions fail 15% of the time; and recurring transactions fail 24% of the time.

This last number is so high because the fraud detection systems used by banks are very sensitive and often makes mistakes. The bank errs on the side of caution and flags a transaction as fraudulent even though it really is legitimate. While this is inconvenient for the merchant and the customer, the bank would rather block a true transaction rather than risk letting a fraudulent one get through.

Since a subscription payment is submitted by the merchant as a card-not-present transaction, the customer isn’t right in front of the seller to provide another payment method if their transaction isn’t approved. This failed payment can be lost forever unless the business has a failed payment recovery strategy in place.

If the subscriber becomes aware of the failed payment, they could feel shame or anger, both very strong negative reactions. These emotional responses can negatively affect the business because the customer then associates the payment problem with the brand and may decide to cancel their subscription or move to a competitor. In fact, a 2021 study by PYMNTS found that 35% of people that go ahead and update their payment information after a decline felt a decrease in satisfaction.

Feeling shame or anger about a brand is the opposite of a positive customer experience and must be avoided. Subscription companies need to use a failed payment recovery method that doesn’t interrupt the customer journey in a negative way so they can achieve maximum Customer LTV after recovery.

The Importance of a Positive Customer Experience

Key points to remember- Subscriptions rely on maintaining long-term relationships with customers to ensure full Customer LTV is achieved. This means a positive customer experience is essential.

- Subscriptions models are uniquely vulnerable to payment issues because they are card-not-present transactions which are more likely to be flagged by a bank’s fraud detection system.

- Failed payments create disruptions in the customer journey, which means churn reduction must be a priority.

- Subscription companies need to use a failed payment recovery method that doesn’t interrupt the customer journey so they can achieve maximum Customer LTV after recovery.