The Power of Compounding Recovered Revenue

The Problem of Customer Loss

How churn affects revenue

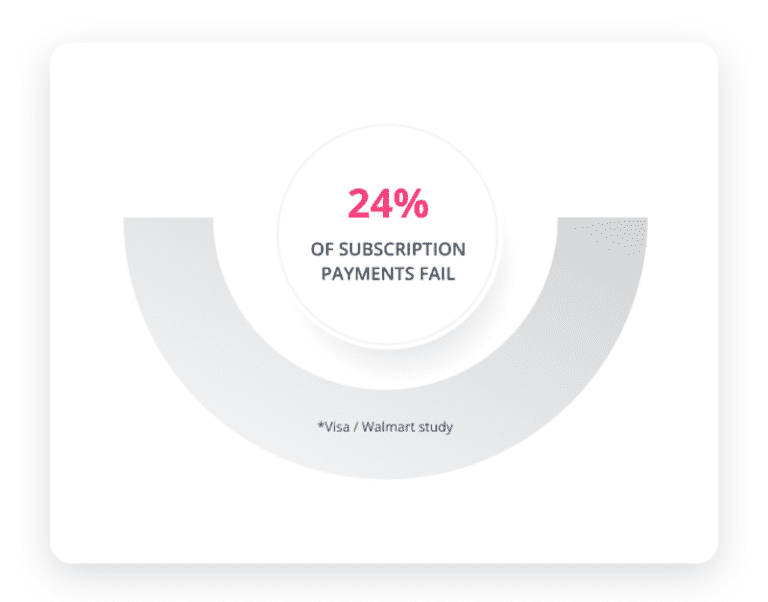

Subscription businesses need to think about failed payments in a new way.

Involuntary churn, or churn caused by payments issues preventing your customer from completing their payments, accounts for up to 48% of all churn. This is why a failed payment can mean so much more than simply the loss of one month’s payment. The actual cost of unresolved failed payments is the full calculated loss of all future billing cycles which won’t be earned. You don’t just lose a transaction when a card payment is declined, you lose customers.

This is a whole new mindset for many subscription businesses.

Calculating Recovered Revenue and the Cost of Failed Payments

The huge impact of lost revenueFlexPay research confirms subscription companies that track failed payments and measure the LTV of failed payments are 8.2 times more likely to be top performers than those that don’t. Calculating the total LTV losses of customers lost to failed payments is a game changer because it accurately measures how much your business has been harmed and creates a sense of urgency to solve this problem.

Companies that optimize both the recovery of customers otherwise lost to failed payments and the retention of these customers after recovery are top performers because they recognize the value of a recovered customer is more than just a recovered transaction. Recovered customers can continue to deliver revenue for multiple billing cycles, so the value of a recovered customer is compounded by the length of the customer’s lifespan.

Failed payment recovery radically improves your company’s overall customer numbers and revenue growth — some companies have seen a 33% increase in annual revenue growth after implementing a strategic failed payment recovery solution.