The Importance of Calculating Recovered Revenue

The Cause of the Problem

Systemic problems in the payments ecosystem are the culpritThe failed payments problem is unintentionally caused by issuing banks in their efforts to combat the $30B annual losses they incur each year from credit card fraud. As a result of these large fraud losses, issuing banks will often decline legitimate transactions in their attempt to avoid approving fraudulent ones. The banks have decided that the costs to them to decline legitimate transactions are lower than giving approvals on fraudulent transactions. These false declines on legitimate transactions cost merchants more than $455B in lost revenue on single transactions around the world each year.

Unfortunately, the cost to any business with a recurring billing model is even higher. This is because failed payments cause customer churn, both directly and indirectly. Direct subscription churn occurs when a subscription immediately comes to a hard stop due to an uncovered failed payment. Indirect subscription churn occurs when customers are made aware of the failed payment and then choose to end their subscription.

How to Optimize Subscription Revenue

Recover failed payments and reduce churnA recent study from PYMNTS found that 27% of consumers decided to cancel their subscriptions or switch to a competitor due to the payment decline when they were made aware of it. This means that awareness of the failure is also a driver of churn, so companies must choose the failed payment recovery method that both recovers failed payments at a high rate, but also avoids creating indirect churn.

Many businesses believe a failed payment is simply the loss of one month’s payment, because the failed payment is measured as a single lost transaction. In reality, the actual cost of churn to subscription businesses is the total loss of all future billing cycles the customer would have made. Subscription businesses must recognize that failed payments cause customer churn, measured as the total customer lifetime value (LTV) that would have been earned. For subscription businesses.

Shifting the understanding of failed payment recovery from a transactional recovery to customer recovery, is a profoundly different mindset for subscription businesses. Recovered customers deliver continued revenue for subscription businesses in the months of additional successful billing, ultimately delivering accelerated growth in both active customer counts, and total subscription revenue. This acceleration in revenue growth is especially profitable because it is generated without spending any additional dollars on customer acquisition, typically the largest expense for subscription businesses. No other investment can increase subscription revenue growth, or more profitably, more than failed payment recovery.

While it’s clear that subscription businesses must recover customers from failed payments, these businesses need to avoid recovery methods that interrupt or shorten the natural duration of the customer lifecycle. Why is this so important? That’s because when a failed payment is successfully recovered, it creates a recovered customer who would’ve otherwise been lost.

Methods to Recover Failed Payments

Discover the best way to optimize subscription revenueThere are several methods subscription businesses can use to recover failed payments and increase their subscription revenue. We will review the recovery options here and analyze the pros and cons of each.

Rules-Based Recovery

Rules-based recovery is a simplistic approach to failed payment recovery that is based on a set of predetermined rules that are applied when a payment failure occurs. It involves a series of steps where the failed payment is retried multiple times on a different day or time to get an approved authorization. Rules-based systems do not look at each transaction to evaluate how it can be recovered. Instead, they apply a one-size-fits-all approach or simplistic rules to every failed transaction in an attempt to get authorization approvals.

The challenge with rules-based systems is that failure reasons are complex. A payment may fail for hundreds of reasons, and there are more than 8,000 issuing banks in North America alone that each use their own rules for payment decisions. Thus, the best recovery results for any single transaction requires a recovery strategy that optimizes for the literally billions of possible permutations possible, across the many failure reasons, individual bank rules, and card types. Plus, rules-based recovery systems that use high rates of retry attempts also can create unintended damage to merchant account health, by training the issuing bank’s algorithms to treat the merchant account as a high-risk account, increasing future declined payment rates.

It should be clear that the complexities of optimizing recovery results, and the constraints on increased retry attempts, is simply too complex for rules-based recovery systems to deliver optimal results.

Many companies will start to try to recover failed payments by building their own rules-based system. While retry solutions are a good first step to take, specialized technology solutions that are more specialized and deliver higher performance are needed to optimize subscription revenue.

Email and SMS Messaging

Another common retry method subscription companies deploy to recover failed payments send texts or emails to customers, alerting them that their credit card was declined. In their messages they ask the customer to update their payment details or to contact the company to make the change for them.

The challenge with this solution is that many subscribers don’t understand why their payment failed, forcing the customer to solve a problem they didn’t create. Unless you phrase your customer communication in a positive, empathetic way, you risk annoying your customer or even angering them. As mentioned earlier, 27% of consumers actively canceled their subscription or changed to a different provider after awareness of failed payment, so it’s clear that companies must reduce visibility whenever possible to avoid churn and optimize subscription revenue.

There are circumstances where the customer needs to be involved in the payment recovery process and using email and SMS as an outreach method can work. An example of this is if the credit card is reported lost or stolen. The customer will need to update their credit card information to continue using the product or service. Email and SMS solutions can be used as part of your recovery strategy but should never be used as the first step in your attempt to optimize subscription revenue.

Customer Service Recovery

Customer service recovery works by activating the customer service team to reach out to the subscriber to discuss the failed payment with the goal of trying to resolve it by working with the customer directly – usually by calling the customer.

Similar to what happens with Email and SMS outreach, the customer is being made aware of the failed payment, which could contribute to more churn if it’s not handled properly This puts your subscriber relationships at risk. Plus, customer service outreach is costly, and solving failed payments is not their core competency. Customer service teams should respond to customer inquiries and deliver an exceptional customer experience when customers need support.

AI and Machine Learning Recovery

A category of FinTech solutions called Payment Authorization Management (PAM) uses AI and machine learning technology to solve failed payments and help complete more legitimate transactions.

The FlexPay platform is an AI-powered solution that optimizes customer recovery from failed payments and delivers proven long-term customer retention following recovery. The FlexPay platform delivers the highest rate of customer recovery by creating an individual strategy for each failed payment, resulting in maximum subscription revenue recovery.

Customer retention should never be an afterthought—it’s an essential metric that your company needs to be closely monitored because it has a tremendous impact on your company’s growth and profitability. If you’re unsure what your failed payment rate is, you must start looking into this immediately and begin using a strategy that will optimize subscription revenue.

Different Types of Failed Payments Need Different Solutions

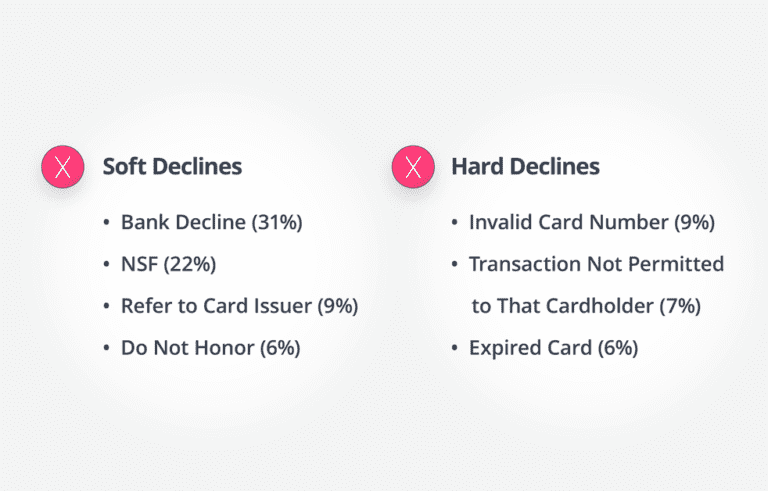

Exploring soft and hard declines

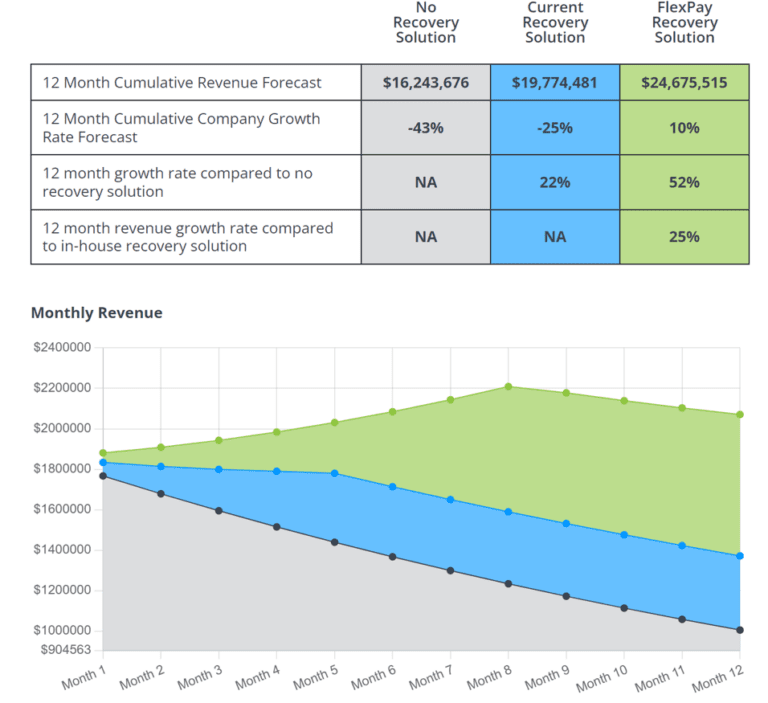

FlexPay Revenue Recovery Calculator

Discover the impact failed payment recovery has on your business

As you can see, this customer’s rate of failed payments was outpacing its new customer growth. Even with some recovery happening, their growth was shrinking. Using FlexPay to recover failed payments, however, resulted in revenue increases that allowed them to go from negative annual growth to 25% positive annual growth.

This translates to $4.9M in extra revenue for the business. Plus, because the FlexPay platform works directly with the payments system and avoids customer interaction most of the time, the company could avoid the high amount of churn that can occur when the customer is forced to solve the problem with their payment. This is seen as a 52% growth in active customers after 12 months.

If you’re concerned about customer churn and want to optimize subscription revenue, this would be a great time to schedule a consultation to get feedback on your current customer retention strategies and try our Revenue Recovery Calculator to forecast how FlexPay can help your business grow and become more profitable.