How to Calculate Failed Payments

The Problem with Churn

How churn contributes to lost revenue

Customer churn is the enemy of subscription businesses because each lost customer eliminates revenue from all future billing cycles.

Most causes of customer churn are well understood and well-managed. In fact, most properly run subscription businesses invest significant resources to minimize the churn created by these factors:

- Customer fatigue – The customer no longer sees value in the product or service and decides it’s time to end the subscription

- Competitive loss – The customer finds another provider they believe is better or finds a lower price point than their current vendor and decides to switch

- Customer service issue – The customer has a negative experience with the product or brand and decides to cancel or not renew their subscription

Failed Payments Definition

What do we mean by failed payments?Failed payments are legitimate credit card transactions that are falsely declined by card-issuing banks.

What Causes Failed Payments?

The problem with the payments industryCard-issuing banks want to reduce their credit card fraud losses because they are obligated to fulfill any transactions they approve, even the fraudulent ones. Unfortunately, their well-intentioned efforts to reduce their fraud losses have created the false decline/failed payment problem because the algorithms used to approve payment requests are programmed to look for potential fraud, which is highest in card not present (CNP) transactions. This includes recurring billing and eCommerce transactions.

Issuing banks would rather risk losing the small amount of revenue generated on successful approved transactions than lose the large dollar amounts associated with fraudulent transaction approvals. While banks want to minimize credit card fraud losses, merchants and customers want all legitimate transactions to be approved. This misalignment of goals creates friction because payment systems have only milliseconds to approve a transaction, which limits the accuracy of the authorization algorithms. Approval decisions happen in a split second, but these decisions are often wrong.

How to Think about Failed Payments

It’s not the customer’s faultFailed payments aren’t unique to any one subscription merchant, and they aren’t caused by fraudulent transactions, customer credit issues, or the subscription business itself. Failed payments are a structural problem within the payments industry.

Since failed payments aren’t caused by customers and they aren’t due to credit issues, triggering the collections or dunning processes isn’t the solution. These tools won’t fix the problem. While dunning solutions will recover some lost transactions, accusing customers of having bad credit and forcing them to solve the failed payment problem creates a bad brand experience and churn.

There are many reasons why failed payments can happen. Consider the fact that there are over 8,000 card-issuing banks in North America alone, and they all use their own unique algorithms to decide which payment transaction requests are approved and which are declined. There are also hundreds of reasons why a payment might fail, as shown by the hundreds of reason code values returned after a failed payment. There are literally billions of permutations to consider when creating a recovery strategy for each failed payment. Simple rules-based systems that resubmit failed payments will recover some transactions, but they aren’t optimized to achieve ideal recovery rates.

Calculating the Cost of Failed Payments

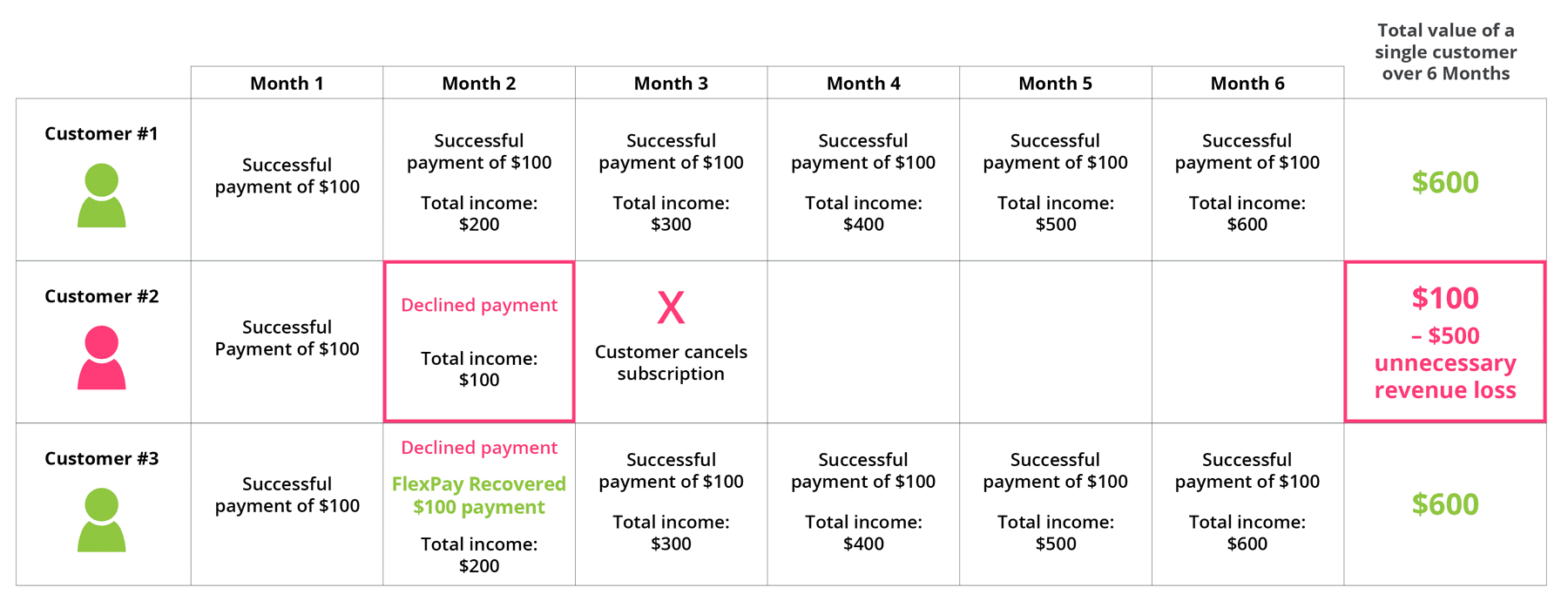

The huge impact of lost revenueAn unrecovered failed payment stops the customer’s subscription prematurely and costs the subscription business the total sum of payments that would have been made over the natural lifecycle of the customer. In other words, the total cost of failed payments must be calculated by adding up the value of all the lost payments.

Calculating the total cost of failed payments requires a bit more math but understanding the total cost — and making failed payment recovery a priority — is incredibly strategic for subscription businesses.

Let’s use the example of a business that has 10,000 active customers who each pay $50 per month for their subscription. Let’s also assume this business has a failed payment rate of 15% per month (Note: Mastercard estimates that the monthly failed payment for subscription businesses averages almost 24%). The average customer lifespan for this business is 10 billing cycles, which means the cumulative monthly cost of lost customers is $450,000 if the average lifespan following recovery is 6 months.

Why so high? That’s because $450,000 is the cost of all the lost revenue from failed payments when each month of declined payments is measured at $75,000 (10,000 X $50 X .15). It’s never just one month of lost revenue — it’s the loss of revenue each month added to the loss of revenue the next month and so on for 6 months. The losses snowball and become an avalanche.

In the end, this business loses more than 50% of its current revenue due to the cumulative cost of failed payments.

This example proves how looking at a failed payment as only the loss of one transaction is short-sighted and doesn’t consider the total amount of revenue a business loses over time. The cumulative impact of failed payments on overall revenue is hidden in plain sight.

How to think about failed payment recovery

It’s about customers, not transactionsFailed payment recovery should be viewed as customer recovery and not transaction recovery, which is a new way of thinking for most subscription businesses. Viewing failed payment recovery through the lens of customer recovery recognizes that a recovered customer will continue to make regular billing cycle payments after recovery. That’s the value of a recovered customer.

As you can see, a 50% failed payment recovery rate will generate $37,500 in the month of recovery. However, the total value of customer recovery must be measured over the lifecycle of all the payments the customer will make after recovery. In this example, a customer maintains their subscription for 6 months after recovery, so each recovered customer is worth a total of $300 ($50 x 6).

When you do the math, the additional revenue added to this business with a 50% failed payment recovery rate totals $225,000 after 6 months, or a 24% overall revenue growth rate.

Thinking of failed payment recovery as only the billing from a single transaction misses the total value delivered over the lifecycle of the customer. It ignores the cumulative revenue delivered by customers following recovery.

Introducing

INVISIBLE RECOVERYTM

The FlexPay Invisible Recovery™ platform is an AI-powered solution that optimizes customer recovery from failed payments and delivers proven long-term customer retention following recovery.

Invisible Recovery™ delivers the highest rate of customer recovery by creating an individual strategy for each failed payment, resulting in optimal total customer and revenue recovery.

Plus, Invisible Recovery™ works quickly while completely avoiding customer visibility to the failed payment, thereby avoiding the customer churn created when subscription customers are made aware of the payment issue.

FlexPay research shows Invisible Recovery™ delivers the highest recovery and sustained retention.

- Up to 70% improvement in failed payment recovery rates compared to other recovery solutions

- Up to 54% longer customer retention following recovery compared to other failed payment recovery solutions

You can use FlexPay’s calculator tool to estimate the additional revenue and the number of active customers Invisible Recovery™ can deliver for your subscription business. Measure the results for your company now and contact us to schedule a consultation with one of our payment recovery experts.