Online dating and dating apps have revolutionized the world of romance. Without these dating solutions, we’d still be shuffling awkwardly on the dance floor trying to catch the eye of that special someone, or even worse…having our mothers fix us up. But did you know that technology has had its proverbial hand in the dating scene for decades before the first dating website went online?

Computer Matches Begin

Let’s hop in our time machine and rewind back to the fall of 1965. Jeff Tarr and Vaughan Morrill, two Harvard students, used an IBM 1401 computer and a 75-question survey to create the first computer-based matchmaking service in the United States. Interested singles sent in their completed questionnaire along with a $3 fee and in return received a list of computer-generated romantic matches. By 1966, Operation Match had over 90,000 users. Seems like Tarr and Morrill were onto something.

Make a quantum leap to the 80s when singles began using video dating services. Clients of the dating service would go to a brick-and-mortar storefront and record a personalized video describing their hobbies and interests. Other clients then reviewed a catalogue of potential dates and chose which people they were interested in. All for a fee, of course.

And how could we forget phone dating where hundreds of hot singles were standing by for your call? It was like a party in your phone every day of the week.

With an app to suit any interest or demographic, dating solutions mean big money for their parent companies

Love Goes Online

Now we’re up to 1995 and Match.com, the first dating website, is launched. For the first time you could simply pay a monthly subscription fee and scroll through thousands of potential partners any time of the day. It opened a world of opportunity for singles, and hundreds of similar online dating businesses soon followed.

Which brings us to 2009 and the introduction of Grindr, just six months after Apple launched its iPhone 3G. Not only was Grindr the first gay dating app, but it was also the first of its kind to use geolocation technology which allowed users to find potential partners wherever the subscriber was at that very moment.

Today, swiping right has become part of our vocabulary — everybody knows what it means. Dating superstar Tinder launched in 2012 and now has over 75 million active users each month*, making it the most popular dating app in the world. While many apps became popular because their Millennial users were looking for a casual hook up, more serious relationships are coming out of these connections. This makes sense as the original users have grown older and are now looking to settle down.

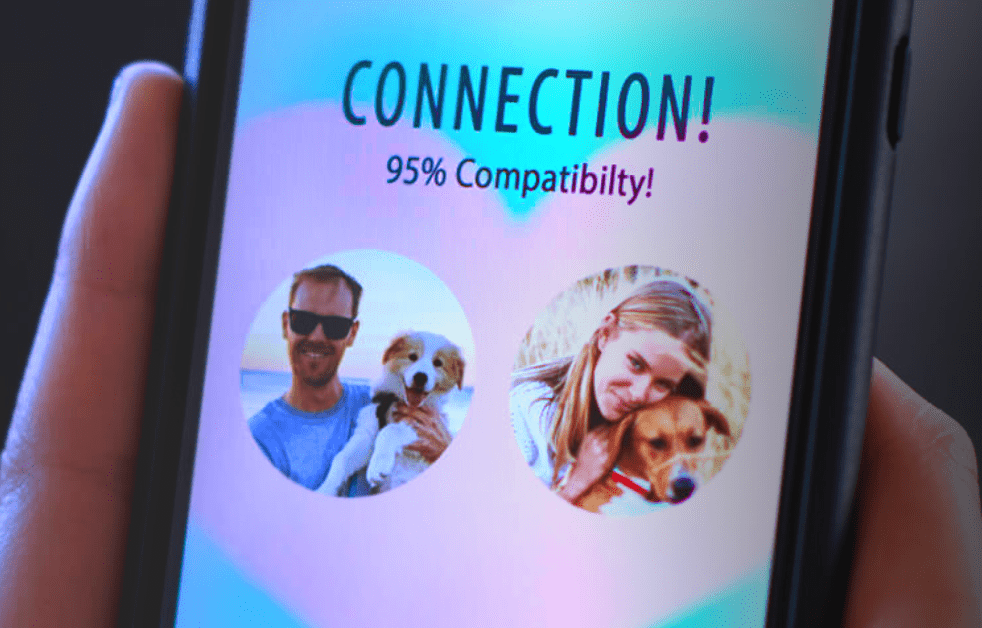

With an app to suit any interest or demographic, dating solutions mean big money for their parent companies. Match Group is worth $45B as the operator of Tinder, Hinge, Match, OKCupid and Plenty of Fish, while Grindr is now valued at $2.5B *. This level of success all comes down to the subscribers — over 15% of Americans have used online dating** and it’s the second most popular way to meet a partner.

The Problem with Failed Payments

Of course, with subscribers comes the problem of failed payments, which are typically caused by false declines. False declines occur when legitimate credit card submissions from good customers are falsely declined by payment authorization systems.

Payment authorization systems have milliseconds to decide if they should approve a transaction or not, which puts banks in a difficult spot. Banks incur huge losses when they approve fraudulent transactions, so they end up being overly cautious when deciding which transactions to approve. They will often decline legitimate credit card transactions. To them, it’s better to be safe than sorry. Because almost all credit card fraud is conducted online, the false decline problem hits eCommerce and subscription merchants the hardest.

Unfortunately, failed payments cause involuntary churn for subscription businesses by bringing the subscription to a hard stop. The churn problem is worsened by the well-intentioned recovery methods many merchants use. Additional subscriber churn is created when the customer is made aware of their failed payment by outreach conducted through SMS, email, or a phone call because this moment of contact forces the customer to decide if they want to continue their subscription or not.

To reduce churn, dating subscription businesses must choose the right failed payment recovery method that both optimizes the recovery of customers and the lifespan of the customer following recovery. Why is this so important? Because if you don’t recover a failed payment, you’ve lost a customer and all the money they would have spent with you in the coming months. It’s not just one month’s subscription fee that’s on the line.

The Invisible Recovery™ Solution

Payment Authorization Management is the name of the category of solutions that minimize the rate of failed payments and optimizes recovery when they do occur. As the leading failed payment recovery system in this category, Invisible Recovery™ uses AI and machine learning to create a unique strategy for each failed payment, adapting to the hundreds of reasons a payment could have failed, delivering the rates of payment and customer recovery.

Invisible Recovery™ improves recovery rates by up to 70% over other methods without engaging customers in the recovery process. And because the recovery is invisible to customers, the customer lifecycle averages 45% more billing cycles following recovery. Customers are recovered faster and stay customers longer with Invisible Recovery™.

If you’re looking for a failed payment recovery solution for your dating subscription business, learn more about Invisible RecoveryTM or book a demo today.

* https://www.businessofbusiness.com/articles/how-dating-apps-make-money-tinder-bumble/