Involuntary Churn

From Good to Great: Upgrading Your Subscription Performance

INTRODUCTION

It is a well-known truth that subscription companies strive to build deep relationships with their customers, because they know loyal customers exhibit the longest retention. High retention creates strong revenue and profitability, which is core to success in the subscription model.

Most subscription companies have a clear understanding of why their customers churn and are relentlessly focused on reducing churn. Involuntary churn, or cancellations caused by failed payments, accounts for up to half of all customer churn.

Many companies are now recognizing this alerting problem and its link to churn, and are taking steps to create systems to recover failed payments.

Typical first steps companies take include building programs to automatically retry payment requests, or using customer service collections team to try to recover a payment.

From Good to Great

A 2023 report conducted by FlexPay, in collaboration with PYMNTS, surveyed 200 senior executives from larger subscription companies. The report concluded that the companies that earn the strongest financial performance have optimized both failed payment recovery performance, and the retention of customers following recovery. Top performers have applied people, process, and technology to meet this challenge, and it has resulted in top financial results for them. The top performers recovered up to 59% of their failed payments. For most companies, the conclusion is clear: your failed payment recovery can get better, which takes your financial performance from good to great.

Often, the failed payment problem is viewed as a transactional problem. For example, most companies say that we had x number of payments fail this month, and we are recovering y% of them, so we recovered y/x of our lost revenue.

This simplistic approach leads to under-reporting of the full cost because it fails to report that every failed payment that is not recovered results in a churned customer, causing the loss of all future payments the customer would have made.

What Does Good to Great Mean?

The connection between failed payments and churn provides the clue to how improving failed payment recovery can transform financial performance from good to great.

Every subscription company is impacted to some degree by failed payments, but the ones that maximize failed payment recovery can earn outsized financial performance. Let’s explore this in more detail.

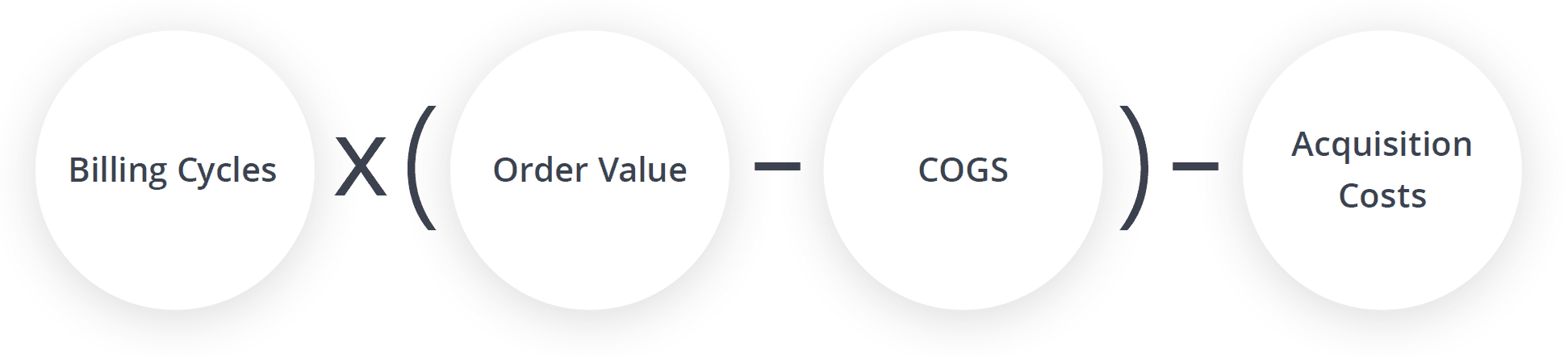

On the following page is the standardized equation to calculate customer Lifetime Value (LTV). This equation provides a powerful tool to calculate the total average LTV of a business’s customers, or the LTV of individual customers. This equation also unlocks direct visibility to the drivers of customer LTV, and ultimately, every subscription company’s financial performance.

FlexPay recommends that every subscription company program this calculation, and store a current LTV value for every customer. This will unlock powerful insights into which acquisition sources are most profitable, which retention programs deliver the most profits, and other ways to optimize operating metrics.

Customer Lifetime Value (LTV) Equation

The LTV equation identifies the factors that increase lifetime value and the costs that reduce it. Let’s review these factors and identify which ones subscription companies have control over.

The order value, or price you charge your customers, can be increased to grow LTV. However, competitors’ pricing and your customers’ willingness to accept price increases limits the range of pricing changes.

Most subscription companies have only a limited ability to lower their cost of goods sold (COGS), which is the cost required to deliver your product or service. In fact, most businesses are facing increasing COGS as inflationary pressures have raised costs, which is putting downward pressure on LTV.

Businesses have some ability to fine-tune customer acquisition to reduce higher cost channels as a way to improve LTV, but taking this path will slow growth rates and reduce total revenue which is not desired. In fact, most companies have seen their acquisition costs increase over the past year which is hurting LTV.

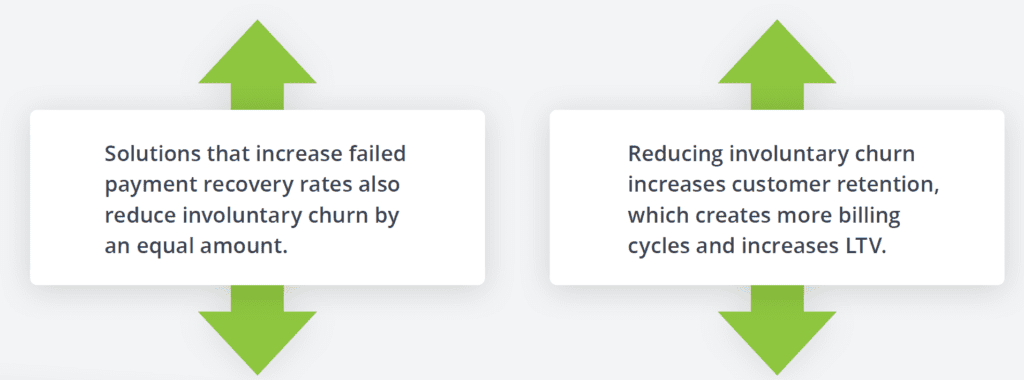

This leaves the number of billing cycles as the most effective lever to increase customer LTV, and this is where the connection between failed payments and increasing LTV is created.

As we know, failed payments that aren’t recovered are the sole cause of involuntary churn. This creates two concurrent conclusions:

Reducing involuntary churn creates a leveraged positive gain in LTV and company revenue because recovered customers continue to deliver monthly payments, which wouldn’t occur if they had churned. Company profitability also increases because revenue from recovered customers delivers higher margins than revenue from new customers, which comes with heavy acquisition costs.

High margin revenue is the goal of every subscription company because profits drive the ability to reinvest, scale growth, and outpace competitors. Our 2023 report told us that the top performing companies recover an average of 59% of their failed payments.

This is what we mean when we say going from Good to Great.

Unlocking the revenue and profits that are already inherently in your business by increasing your failed payment recovery helps you build an insurmountable lead over your competition.

Customer Lifetime Value (LTV) Equation

As noted above, many subscription companies have recognized the failed payments problem, and have deployed home-built solutions to recover them. Our research study confirms however, that the subscription companies with the highest financial performance are using specialized, purpose-built failed payment recovery solutions like FlexPay. In fact, the research concluded that top-performing companies were 12.3 times more likely to use 3rd party solutions than bottom-performing companies. These top performers were layering in other methods, but they start with the specialized solutions that deliver the strongest performance on fresh declines in order to optimize recovery and retention.

Top-performing companies apply these 4 strategies to achieve their results:

Maximize recovery rates

Maximize retention of customers following recovery

Maximize LTV earned from recovered customers

Maximize solutions that deliver highest retention and revenue, rather than lowest cost of recovery

State of the Art Failed Payment Recovery, Lifetime Revenue Dollars, and Profits

As mentioned previously, the top performing subscription companies are recovering an average of 59% of their failed payments. This performance represents the state of the art in recovery results. It can be a useful benchmark to compare to your results, and to identify if your customer recovery can be increased to unlock LTV revenue and profit growth.

While every company’s performance will be different, FlexPay delivers significant improvements in failed payment when customers have upgraded from their internal recovery solutions. The following is a typical result for new FlexPay customers who have made the decision to migrate their failed payment recovery from their internal solution to our specialized AI system, and placed FlexPay first in their recovery process.

15%

55%

These results confirm the study’s conclusions — optimizing recovery rates improves the overall financial health of subscription companies by increasing revenue, customer LTV, and profits.

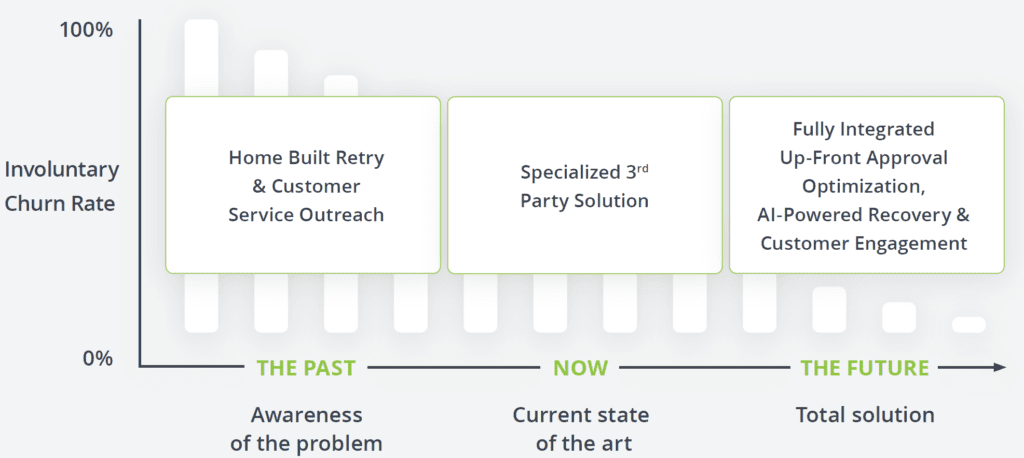

Involuntary Churn Maturity Curve

This chart summarizes the state of the art in failed payment recovery:

1st generation solutions were built internally, utilizing rules-based payment retry systems, and different forms of customer service outreach.

The current state of the art is delivered by 2nd generation solutions, such as FlexPay. These specialized solutions are purpose-built to optimize failed payment recovery and are the prime driver of top performing company’s ability to earn 59% failed payment recovery. In the case of FlexPay, we layer two approaches to maximize recovery:

The current state of the art is delivered by 2nd generation solutions, such as FlexPay. These specialized solutions are purpose-built to optimize failed payment recovery and are the prime driver of top performing company’s ability to earn 59% failed payment recovery. In the case of FlexPay, we layer two approaches to maximize recovery:

- Invisible RecoveryTM – works directly with the payments system to recover failed payments quickly and effectively without any knowledge from the customer — in turn, optimizing retention following recovery. Invisible RecoveryTM utilizes AI and machine learning trained on data sets of over 6B payment transactions to power its performance.

- Engaged Recovery – works to collaborate with customers when their involvement is required, creating a partnership with the customer to help solve the problem.

3rd generation solutions, in the future, will integrate both up-front approval optimization to help reduce the rate of failed payments that are experienced, and then apply technologies to optimize recovery when necessary. This is FlexPay’s vision, and where our roadmap is headed.

SUMMARY

Companies that have identified the problem of failed payments and are starting to solve it with 1st generation efforts can do better.

Beyond short term revenue gains, increasing failed payment recovery delivers gains in long-term revenue growth, profit growth, and company valuations.

Top performing subscription companies have recognized the leverage that investing in state of- the-art failed payments recovery solutions delivers by increasing customer retention and LTV.

As an example, one of FlexPay’s customers is a public company. FlexPay generated over $2.5M in recovered revenue in Q4 2022. In this same time period, their quarterly net income was reported as a little under $1.8M. Thus, the revenue FlexPay delivered to this company moved them from a quarterly loss to a quarterly profit, dramatically improving their stock price and company valuation.