How Failed Payment Recovery Practices

Affect Retention

The importance of a positive customer experience

Eliminate the churn created by payment issues

The payments experience you deliver is just as important to customer satisfaction as the product and support you provide. Subscribers put a huge amount of trust in your business, and they are expecting a seamless payments experience. A positive customer experience is essential for the long-term success of your business, and this includes how you your failed payment recovery practices.

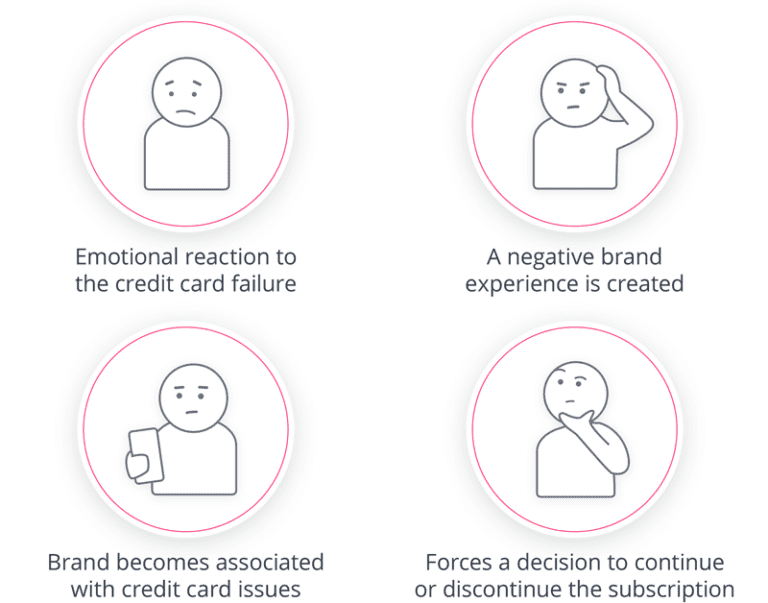

Customer reactions to failed payments are inherently negative, so subscription companies must avoid causing brand and churn harm which can be created in the methods used to solve failed payments. For example, confronting the customer and asking them to solve a failed payment typically creates a negative emotional reaction, because the customer will know their credit card is valid, and they will be confused as to why their payment was declined. The way that subscription companies solve failed payments has a direct impact on whether their customers decide to continue or end their subscription. There is even a term for this — involuntary churn. Most subscription companies don’t know that involuntary churn is the largest cause of subscription cancellations or that it’s responsible for up to 48% of customer losses.

If you are leading a subscription program, your failed payment recovery practices can harm your customer experience if not done the right way and can lead to avoidable churn. You always want to use techniques that will improve your retention rates. Some recovery methods, such as intelligent solutions that work directly with the payments system and avoid customer visibility to the failed payment, can deliver high levels of failed payment recovery without harming retention.

When working to recover failed payments, it’s best to use a specialized retry solution that creates individual retry strategies for each failed payment. This type of solution can recover a payment in days versus weeks and without customer visibility, which eliminates the churn created when subscription customers are made aware of their payment issue.

How customer involvement decreases satisfaction

Awareness of the problem means more cancellationsFlexPay’s research shows that traditional dunning methods that tell the customer their payment has failed prompts 27% of account holders to cancel their subscription instead of providing an alternate or updated credit card. These are customers who were satisfied with a product or service until they found out about the failed payment and decided to cancel their subscription when somebody reached out to them.

Although 68% of customers updated their payment information when contacted through email, text, or phone, 35% of these customers reported a decrease in satisfaction afterwards. Drawing attention to the failed payment creates the opportunity for additional cancellations, which would have not occurred otherwise. This situation can be avoided by designing your failed payment recovery process with the customer experience in mind.

The ideal payment recovery solution

How to solve both hard and soft declinesSubscription companies that work to create great customer experiences will see higher customer retention rates, even when failed payments interrupt the payment process.

When implementing a failed payment recovery program, it’s important to begin by recovering as many payments as possible without involving the customer directly. By using a recovery method without customer visibility, you can avoid putting the customer in a position where they are forced to help you solve the problem of the failed payment. If it’s absolutely necessary to involve the customer in the recovery process, you should use an outreach technique that treats the customer with respect and empathy to create a problem-solving collaboration.

The FlexPay Invisible Recovery™ platform is an AI-powered solution that creates individual strategies for each failed payment. Invisible Recovery™ works quickly behind the scenes while completely avoiding customer visibility to the failed payment, which eliminates the churn created when subscription customers are made aware of their payment issue. It’s perfect for soft declines.

If you have a situation where customer contact is needed, the best option is to use a personalized customer outreach strategy that encourages the customer to work with you. This type of Engaged Recovery™ outreach uses SMS and email messaging personalized to suit the communication preferences of the customer and is delivered at the ideal time to ensure the best response rate. These messages use a tone of voice that appeals to the customer’s communication style and offer a variety of options to help them complete their payment. Treating the customer in such a positive, empathetic way makes them feel appreciated and valued, which makes them want to help solve the problem.