Optimizing Customer Retention in Subscription Businesses

Identifying and reducing major causes of customer churn is critical for subscription businesses.

Customer retention and customer LTV are critical metrics for subscription businesses to optimize because they directly impact revenue growth and profitability. Subscription businesses invest extensive resources to avoid customer churn and extend customer tenure by managing customer satisfaction and delivering great experiences.

The most common drivers of customer churn are well understood:

The most common drivers of customer churn are well understood:

Customer Fatigue:

The customer no longer sees value in, or no longer has a need for, the product or services they are paying for

Competitive Loss:

The customer finds another provider that either offers a similar product or service for a lower price, or they find an alternative they like better

Customer Service Issue:

The customer experiences a negative experience with the company which causes them to churn and cancel

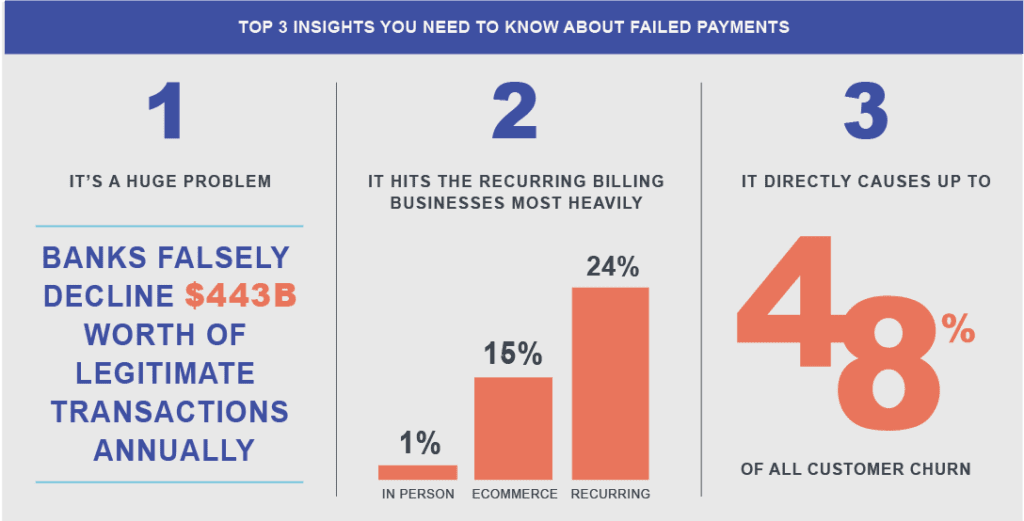

However, a fourth cause of churn exists which is not widely recognized but is in fact the single largest cause of churn in subscription businesses. Up to 48% of all customer churn is caused by payment authorization errors, but because this is not well understood, it is often not actively managed.

The unfortunate result of this blindspot is that businesses invest significant resources to increase retention and reduce churn, but fail to address the cause of almost half of all churn they face.

Closing the Churn Gap

The relationship between payment authorization system errors and customer churn may not seem obvious. But inaccuracies in payment system authorization processes are one of the largest drivers of customer churn for eCommerce, subscription businesses, and companies with recurring billing.

A research study by FlexPay has found that up to 48% of customer churn is caused by declined transactions and failed payments. This means that almost half of all customer churn is caused by declined payment issues, and not by the customer proactively ending or cancelling their recurring services.

This conclusion creates two key questions for subscription businesses:

- What is causing payment authorization errors?

- How can I reduce my payment authorization errors, and by default, reduce my customer churn?

Recommendations

A new Fintech category called Payment Authorization Management (PAM) delivers solutions designed to reduce failed payments and the churn and lost revenue they cause. For those interested in learning more about Payment Authorization Management, read this white paper.

Here is a summary of Payment Authorization Management best practice principles:

Solutions invisible to the end-customer which eliminate the need to force poor experiences on customers, and the need for customers to participate in solving payment problems they didn’t create

AI/Machine Learning technology capable of autonomously creating individualized payment submission strategies, optimized for authorization accuracy and settlement results

Algorithms trained on giga datasets (billions) of authorization records containing both accurate and inaccurate decisions

Algorithms embedded with deep payments ecosystem knowledge to power submission strategies that deliver dramatically improved authorization results

Cloud-based solution supported by broad API integration capabilities into payment gateways and CRM/billing systems, providing industry-wide access to the major networks.

“eCommerce and recurring billing based businesses must adopt a payment authorization management strategy to avoid up to 48% of customer churn”

Introduction to FlexPay

The FlexPay Invisible Recovery™ solution is the leading payment recovery system. Only FlexPay delivers this array of total value.

- AI-powered platform that creates optimized recovery strategies for each failed payment

- Most dollars recovered – Average of 75% increase in declined payment recovery over previous recovery methods

- Reduces churn caused by payment failure service interruptions – FlexPay averages just 2.9 days to recover what was previously taking 30 days to recover

- Invisible recovery removes need for customer intervention in recovery, eliminating churn caused by dunning and customer service recovery methods

- Customer LTV accelerator – FlexPay customers see an average of >2.6 successful billing cycles after recovery

- Risk-free model – Performance based pricing eliminates implementation fees, billing based on actual recovery

Conclusion

Every business with a subscription or recurring billing business model must recognize the cause of almost half of customer churn and adopt a Payment Authorization Management (PAM) strategy. The successful deployment of a PAM solution will optimize the payment authorizations of legitimate transactions, avoid the churn caused by customer visibility to failed payments, and accelerate company growth