Payment Insights: Why Fraud Teams Must Address Failed Payments

Introduction

Merchant fraud teams focus on the critical areas of fraud prevention and chargeback management, but their scope of responsibility often misses managing another enormous cost caused by card industry fraud. These are the revenue losses inadvertently caused by card issuers declining legitimate transactions (false declines) in their efforts to reduce fraud losses. This oversight by merchant fraud teams contributes directly to both revenue losses and significant involuntary churn for recurring revenue businesses.

This paper will show how your existing merchant fraud team—which is already equipped with technical payments expertise and collaboration skills—is uniquely positioned to mitigate these losses. We believe that expanding the scope of fraud teams to include the management of specialized failed payment recovery solutions will reduce this unwanted impact of fraud on your subscription business to its lowest possible level and dramatically strengthen your bottom line.

Reducing the impact of payment fraud on your business

The cost of payment fraud is so high that most large subscription merchants have created teams of people responsible for managing their payment fraud programs. These fraud teams try to prevent fraudulent transactions from being submitted into the payments system through their merchant account and work to limit exposure to the high costs of chargebacks and refunds.

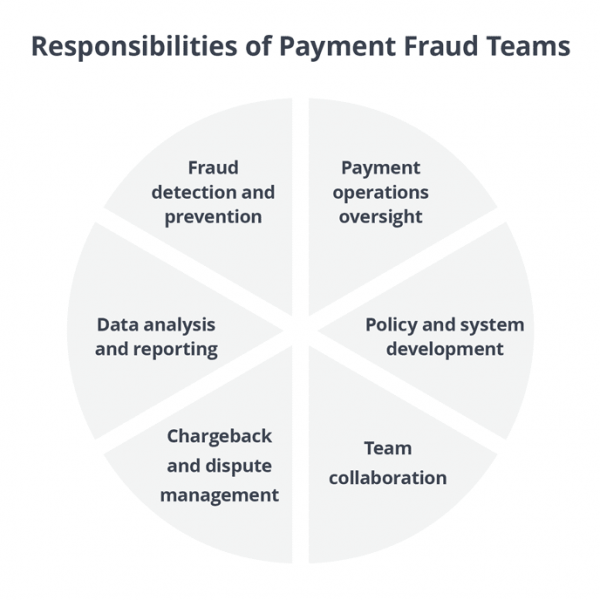

Merchant fraud teams typically prioritize six areas:

1. Fraud detection and prevention

Developing and implementing strategies to identify and prevent fraudulent activities

2. Payment operations oversight

Managing partners and compliance across the payments system to ensure secure transaction processing

3. Data analysis and reporting

Analyzing and reporting fraud rates, prevention effectiveness, and cost impacts

4. Policy and system development

Optimizing and configuring fraud detection systems, fraud prevention policies and procedures

5. Chargeback and dispute management

Streamlining chargeback management and chargeback dispute management

6. Team collaboration

Partnering with customer service, legal, compliance, and engineering teams on fraud-related threats and resolution processes

Traditional fraud management is incomplete

Most merchant fraud teams focus on trying to prevent fraudulent transactions from being submitted into the payments system through their merchant account, and work to limit the high costs of chargebacks and refunds. Their attention is mostly focused on pre-transaction efforts (fraud detection, prevention, and compliance) and post-dispute efforts (chargeback and refund management). Of course, these efforts provide real value by managing the potential fraud losses flowing through your business, but they don’t directly help reduce the quantity of false decline decisions made by issuing banks—and the lost revenue associated with it. But the good news is that reducing the losses from false declines is completely within your control. This can be accomplished by expanding the scope of fraud team’s responsibility to include post-authorization actions to recover failed payments and avoid the customer churn it creates. In fact, this is very similar to the post-auth actions taken by fraud teams for chargeback management.

Most merchant fraud teams focus on trying to prevent fraudulent transactions from being submitted into the payments system through

their merchant account, and work to limit the high costs of chargebacks and refunds. Their attention is mostly focused on pre-transaction efforts (fraud detection, prevention, and compliance) and post-dispute efforts (chargeback and refund management). Of course, these efforts provide real value by managing the potential fraud losses flowing through your business, but they don’t directly help reduce the quantity of false decline decisions made by issuing banks—and the lost revenue associated with it. But the good news is that reducing the losses from false declines is completely within your control.

This can be accomplished by expanding the scope of fraud team’s responsibility to include post-authorization actions to recover failed

payments and avoid the customer churn it creates. In fact, this is very similar to the post-auth actions taken by fraud teams for chargeback management.

Unrecognized cost of declined payments

The banks that issue credit cards to consumers and businesses underwrite the risk of issuing credit during every card authorization decision, so it is not surprising they are risk-averse to fraud losses: their money is on the line. However, their fraud avoidance efforts directly lead to large numbers of declined payments on legitimate transactions from willing customers. Subscription businesses face some of the highest false decline rates because banks treat subscription payments as particularly risky and prone to fraud, leading to the high rates of recurring payment decline decisions on legitimate subscription payments that we see today.

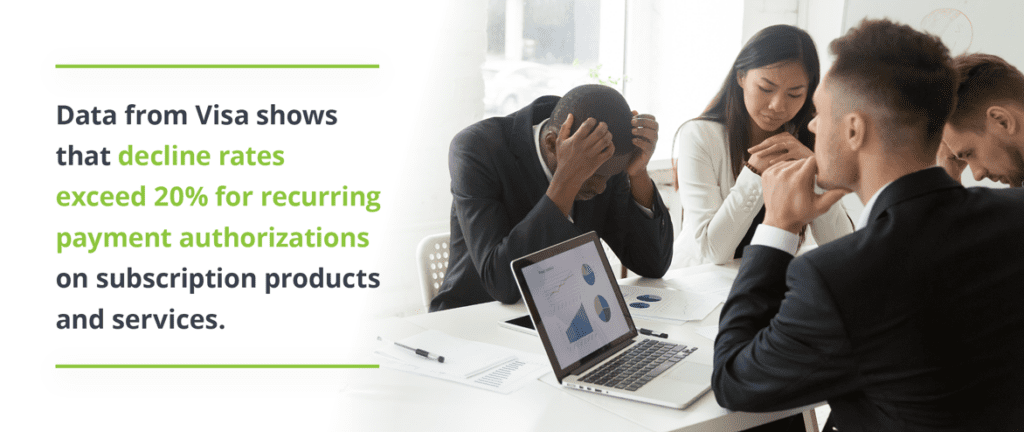

Data from Visa shows that only 1% of in-person transactions are declined, but the decline rate jumps to over 20% on authorization requests for the same group of cardholders for their recurring payments on subscription products and services. This can even happen after a customer has previously billed successfully multiple times.

These declines aren’t the result of fraud or insufficient funds but are false declines or inaccurate decisions made on legitimate transactions. And of course, failed payments for subscription customers that are not solved lead directly to churn. In fact, even the awareness by a subscriber that their payment was declined increases the risk of the subscriber choosing to end their subscription. FlexPay’s research study shows that 25% of subscribers who are made aware that their payment failed choose to cancel their subscription, which means the failed payments experience is the single largest churn source for subscription companies. This is why it is so vital that failed payment recovery solutions are optimized for payment recovery, customer

satisfaction during the process, and overall retention following a recovery experience. There are simply too many customers at risk.

Optimizing failed payment recovery rates is mission critical. Reducing the involuntary churn caused by failed payments creates a measurable positive

gain in LTV and company revenue because recovered customers continue to deliver monthly payments following recovery as their natural lifespan continues. Increasing failed payment recovery rates also improves company profitability because the extra revenue earned from recovered customers delivers much higher margins than revenue from new customers, which has to make up heavy acquisition costs before profitability is realized.

When a subscriber is lost to an unrecovered failed payment, the total cost is not the single declined payment, but also the stream of revenue that the lost subscriber would have delivered over the remainder of their natural lifecycle. Subscribers are just too valuable to be lost unnecessarily to involuntary churn

Optimizing failed payment recovery rates is mission critical. Reducing the

involuntary churn caused by failed payments creates a measurable positive gain in LTV and company revenue because recovered customers continue to deliver monthly payments following recovery as their natural lifespan continues. Increasing failed payment recovery rates also improves company profitability because the extra revenue earned from recovered customers delivers much higher margins than revenue from new customers, which has to make up heavy acquisition costs before profitability is realized.

When a subscriber is lost to an unrecovered failed payment, the total cost is not the single declined payment, but also the stream of revenue that the

lost subscriber would have delivered over the remainder of their natural lifecycle. Subscribers are just too valuable to be lost unnecessarily to involuntary churn.

Merchant fraud teams are uniquely positioned to fight failed payments

While the link between subscriber retention and profitability has always been understood, companies often miss opportunities to optimize their operations and management organization to maximize retention. Companies can improve their retention efforts by integrating failed payment recovery into the responsibilities of their existing fraud team and giving the team the ability to track, measure, and report on recovery performance to ensure business alignment. As we’ve shown, merchant fraud teams should expand their scope of responsibility to manage solutions that can deliver the absolute top failed payment recovery results — the cost of this lost revenue is often many times higher than the cost of chargebacks and refunds the fraud team is usually focused on.

Subscription companies aren’t starting from scratch when they implement a failed payment recovery strategy. Their existing fraud team already possesses the technical expertise, cross-departmental collaboration skills, and analytical capabilities needed to optimize failed payment recovery. In particular, they can coordinate with customer experience and retention teams to create tailored recovery strategies that deliver top recovery rates, maximize customer LTV following recovery, and protect the brand experience.

This is a logical move since fraud teams are already skilled at evaluating and vetting specialized third party software and solutions and they already drive collaboration across multiple teams to solve fraud problems. These easily transferable skills are vital for optimizing failed payment recovery.

Plus, fraud teams already provide analysis and reporting on pre-transaction fraud efforts and post-transaction chargeback mitigation. Strategic failed payment recovery often requires the creation of new tracking systems and metrics designed to measure both the performance of recovery systems and the full value of recovered customers (LTV benefits) and fraud teams already have the skills needed to track recovery performance.

FlexPay’s failed payment recovery solution

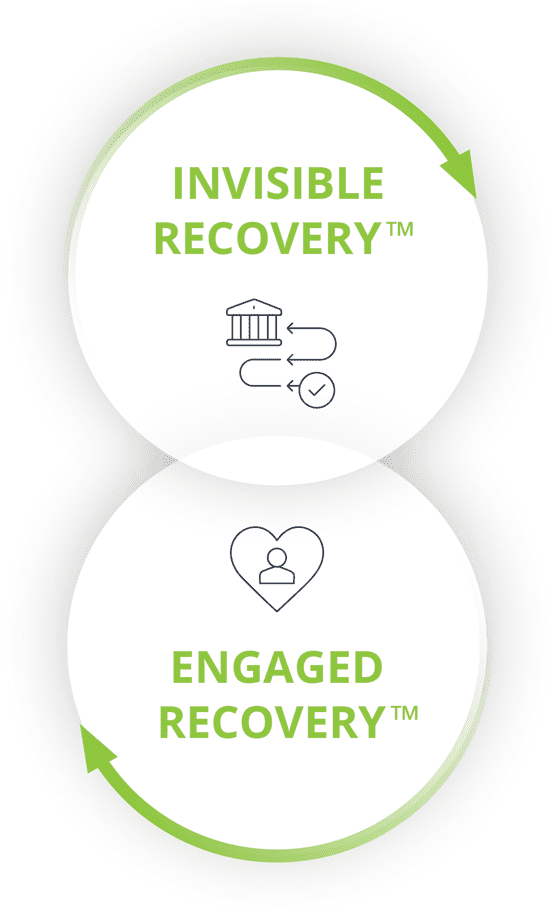

The most effective way a fraud team can

improve their failed payment recovery rate is by implementing a sophisticated recovery tool like FlexPay. FlexPay combines different approaches to offer the highest-performing failed payment solution, optimized for long-term subscriber retention.

Invisible Recovery™ is an AI-powered system that works directly with the payments system to address all the technical reasons why a payment can fail and determines the right recovery strategy specific to that failure reason. This approach is ideal because the customer never knows there was a problem with their payment and there is no interruption in product

or service delivery: the relationship simply continues as if nothing had happened.

When Invisible Recovery can’t fix a payment problem— such as a stolen card — Engaged Recovery™ takes over to enlist the subscriber’s

help in solving the problem through a series of SMS or email messages. These outreach messages are consistent in look and tone with your brand and use aspects of behavioral science to encourage the customer to resolve the payment issue. By showing your customers empathy, providing education on what has happened, and empowering them to act independently, Engaged Recovery results in greater customer satisfaction and higher retention.

Conclusion

You no longer need to risk losing a subscriber when a payment fails—your existing fraud team is already positioned to fight this involuntary churn. Expanding the scope of your fraud team to include failed payment recovery will help your subscription business combat financial losses and achieve the best possible outcome: a positive subscriber experience, reduced involuntary churn, and top recovery results.