Credit Card Decline Codes:

Understanding How They Impact Failed Payment Recovery

Introduction

Failed credit card payments are a problem for every subscription company, and for all businesses with recurring billings paid by credit card. While failed payments may seem like a nuisance problem, the truth is far more severe — failed payments that aren’t solved are usually the single largest source of subscriber churn. Only companies that understand this treat the problem with the proper level of seriousness.

Unfortunately, many subscription companies try to solve the failed payment problem with overly simplistic in-house solutions. They believe that home-built solutions are an inexpensive way to recover failed payments and use this logic to justify their approach.

But minimizing recovery cost is absolutely incorrect when solving failed payments. Instead, companies should be laser focused on reducing involuntary churn because of the compounded growth in revenue and profits that is created when retention is increased. The proper way to measure the ROI of involuntary churn programs is to measure the billings from customers that are saved from involuntary churn for all billing periods following recovery.

Plus, home-built solutions — such as rules-based retry and customer service outreach programs — usually can’t solve the full complexity of the failed payment problem. When companies view all failed payments as a single problem, they treat all failed payment recovery with the same approach. The truth is more complicated: issuing banks can decline payments for hundreds of reasons and unlocking top recovery performance requires solutions designed to achieve results for each decline reason.

In this guide we will discuss the different types of reason codes given when a payment fails and show how understanding your business’s unique pattern of failed payments can help you find the most effective failed payment recovery solution.

A deeper dive into payment declines

When an issuing bank declines a payment authorization request, they provide a reason code and send it to the payment gateway. Unfortunately, many payment gateways complicate this by simplifying the reason codes they receive into a smaller set of summarized decline reasons and give this to the merchant instead of the full list of codes. This makes tracking the exact decline reason challenging and makes optimizing for decline codes even more complicated. Some specialized payment recovery solutions, such as FlexPay, can manage this complexity for you, but it is very hard for companies to build a sophisticated enough solution for themselves. Even some specialized recovery solutions fail to deliver top results if they aren’t designed to work at this level of detail.

Not all specialized payment solutions are the same

When evaluating failed payment recovery providers, it is vital to know how to properly evaluate your options. We have created a comparison tool you can use to compare your internal solution to specialized solutions or to compare different specialized solutions against each other. This evaluation tool will help you know which questions to ask solution providers and help to identify whether an option is sophisticated enough to recover all types of

failed payments.

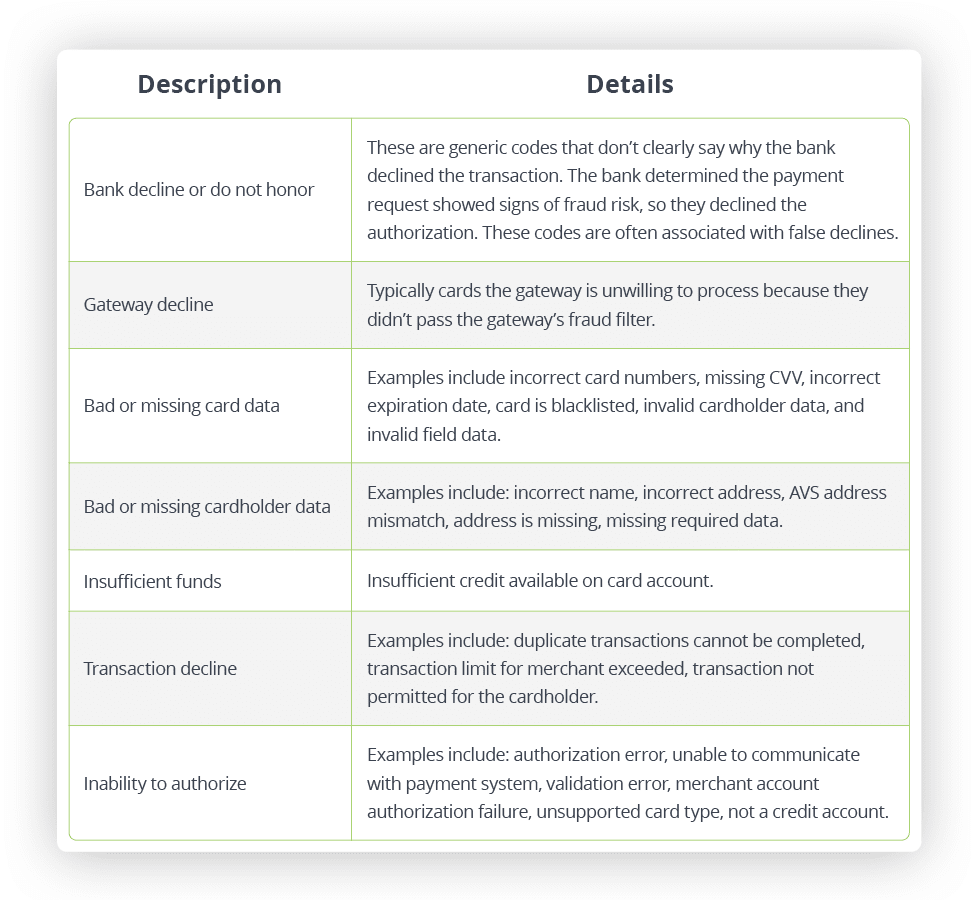

Major categories of decline reasons

The descriptions for why a payment was declined can be vague (e.g., do not honor), or they can be specific

(e.g., expired card or CVV is missing).

At a high level, decline reasons fall into these major categories:

Top failed payment recovery solutions like FlexPay adapt to each decline reason, and can even apply different technologies and processes, working directly through the payments system when possible, or engaging directly with customers when required.

Decline reason code patterns

Every company will experience a different mix of decline reasons driven by factors unique to that business, including customer demographics and the type of product or service sold.

Defining your company’s decline reason profile can be a useful diagnostic to assess your payment operations. It also helps you to compare your business to industry averages and to your peers by vertical, company size, and other criteria. Most companies simply measure their payment decline rates, but understanding how your reasons for declined payments compare to similar companies can be very informative.

For example, you might discover that a significant percentage of your payment declines are centered on a particular set of reason codes. This important insight can often be used to find ways to reduce the incidence of your highest volume of declined payments.

Analyzing your payment recovery rates for each decline reason is also useful. Companies often approach FlexPay when they realize the results they’re getting with their existing home-built internal systems aren’t good enough. Common home-built solutions, such as a rules-based retry program or customer service outreach, are good places to start, but usually cannot deliver the same results as purpose-built solutions using more specialized technologies and insights.

For example, while using an automatic card updater tool can prevent some hard declines (e.g., expired cards), it can’t prevent other types of hard declines (e.g., lost or stolen cards) or recover them after they have failed. We have also seen some companies try brute-force approaches, resubmitting failed payments for payment every day for a month or so. Unfortunately, these simplistic solutions can cause other issues, beyond the sub-par results they deliver. Issuing banks will often penalize merchant accounts for overly aggressive retry practices by increasing merchant account risk scores in response to high retry counts, leading to increased decline rates in the future. To achieve top recovery results, it’s best to apply a sophisticated, purpose-built solution to failed payments as soon as they are declined.

The hidden costs of low-cost recovery solutions

Companies want to reduce recovery costs, so they’ll try to recover a payment on their own for a few days and then send it to a specialized solution when they aren’t successful. While this seems like a reasonable way to reduce costs, this is a flawed approach because the chance for a successful recovery goes down with every recovery attempt. Our data analysis validates that we deliver higher recovery rates than our clients’ internal efforts, even on the first recovery attempt. When evaluating the results of your recovery program, the focus should be on the amount of revenue earned in the month of recovery and the LTV value delivered by recovered customers, rather than short-term costs. You need to be looking at the long-term financial benefits instead.

The key to top recovery results

Creating an effective payment recovery strategy for each payment’s decline reason is the key to achieving top recovery results and this can’t be done with an in-house solution. However, failed payment recovery solutions designed to recover all types of decline codes can intelligently apply different types of recovery strategies and deliver positive recovery results for every decline reason associated with legitimate payment transactions. Failed payment recovery is difficult to do on your own, but finding a solution isn’t.

Achieve peace of mind with FlexPay

FlexPay delivers the highest recovery rate for all decline reasons through the most sophisticated and mature failed payment recovery solution on the market today. Our solution uses multiple machine learning models for those failed payments that can be solved directly through the payments system. It applies the best machine learning model needed to recover each particular type of failed payment and is mapped to individual codes returned by all the major payment gateways. For failed payment recovery that requires customer involvement — such as a lost or stolen card — the solution uses specialized customer engagement outreach messaging powered by behavioral science to motivate the customer to solve the problem while preserving customer satisfaction and retention following recovery. And because card-issuing banks can change their treatment of hard and soft declines over time, FlexPay is continually making improvements to our failed payment recovery solution to ensure our clients always achieve the highest recovery rate possible.

When you understand the complexities of failed payments, you can see why partnering with a solution like FlexPay is the best choice for your business. With FlexPay, your failed payment problem — and the involuntary churn that goes along with it — will be minimized to the absolute lowest rates possible. That’s peace of mind.

Sample company results

Need proof? FlexPay has a SaaS customer that increased their failed

payment recovery by 69%. We’ve been able to deliver this remarkable result by optimizing recovery on their largest source of declines, which accounts for 53% of all their failed payments. FlexPay delivers a 78% recovery rate to them for this decline reason alone. Even more remarkable: over 80% of the customers saved from involuntary churn continue to bill one year after recovery, confirming the high LTV value of recovered customers.

Imagine how much churn you could eliminate if your company achieved this level of failed payment recovery! Subscription companies typically invest very significant resources in reducing the voluntary churn but fail to commit the same level of effort and resources to fighting involuntary churn caused by failed payments. Knowing that reducing involuntary churn will quickly and easily increase your overall retention rates — often at a cost dramatically lower per saved account than the costs associated

with reducing voluntary churn — makes using a specialized third-party failed payment recovery solution the logical choice.

Conclusion

Understanding your company’s pattern of decline codes is the first step in a successful recovery plan. Knowing this helps to forecast the potential retention and revenue gains that can be unlocked by solving the problem of failed payments and involuntary churn. And while your current in-house recovery process may work okay for some failed payments, it’s obvious you’re missing out on substantial financial gains. Instead of trying to do it all on your own, you need a sophisticated failed payment recovery solution like FlexPay.