Aligning Subscription Organization for Top Success

Organizational Principles of Top Performers

Introduction

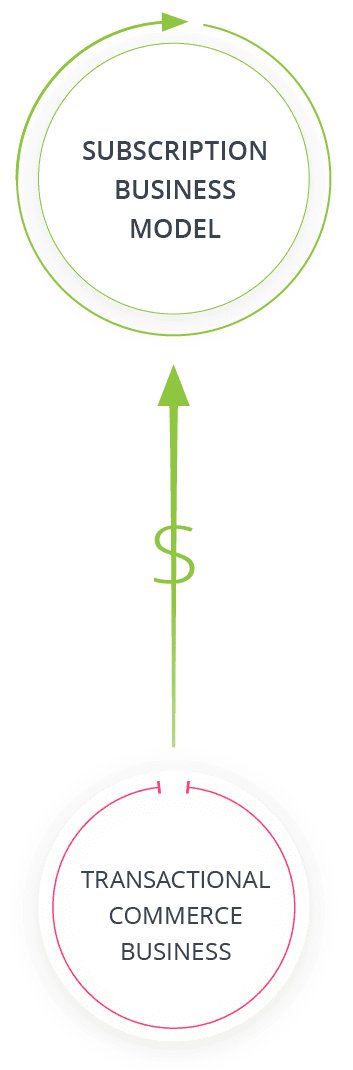

Thousands of companies have built their businesses around the subscription model, and many thousands more have extended their traditional commerce business into subscription models. The subscription business model is attractive because of the high value that subscription customer relationships deliver.

Subscription customers can deliver exponentially more revenue and profits than transactional customers because of they make regular recurring purchases. The higher profit potential delivered by subscription customers becomes clear when recognizing that one of the largest costs for all companies, whether they are selling to consumers or businesses, is the cost of acquiring customers. Subscription customer’s recurring purchases create a much higher potential profit threshold once the cost of acquisition is earned back.

It should be noted that customer acquisition costs for subscription and traditional single-transaction merchants are often quite similar, which makes it clear why the subscription model is so attractive. This also means that a relentless ongoing focus on increasing customer retention is paramount to all subscription businesses because increasing customer retention directly delivers higher revenue and profitability.

While the link between subscriber retention and profitability has always been understood, we have found from our research that subscription companies often miss opportunities to optimize their operations and management organization to maximize retention.

FlexPay and PYMNTS released the results from an industry benchmark study in January of 2023. This study surveyed 200 subscription executives. We have identified critical drivers of company performance within operations, organizational structure, and processes. We learned that too many subscription companies designed their operations and organizational structure for a transactional commerce business model, rather than applying specific design principals tuned to optimize the subscription business model.

This eBook identifies key insights from this study and provides direct recommendations every subscription company can apply to improve their management of customer retention, resulting in enhanced financial performance.

Sources of churn are not uniform

The starting point of maximizing customer retention is to identify all drivers of churn. There are two main categories of churn.

VOLUNTARY CHURN

Voluntary churn is caused by customers choosing to end their subscription. Drivers of voluntary churn are typically known by subscription companies, and includes reasons such as pricing, product quality, competitive options, and customer service experience.

Once voluntary churn drivers are identified, feedback tools can be applied to identify potential solutions to customer cancellations. These tools can include surveys, customer feedback, data gathering, and data analysis.

INVOLUNTARY CHURN

Involuntary churn, also called passive churn, is not caused by customers choosing to end their subscription, but rather by a decline decision on the customer’s credit card when submitted for payment.

The optimal solution to solving involuntary churn is to deploy specialized solutions optimized for recovering failed payments regardless of the reason for the decline, using multiple strategies to potentially recover all failed payments not caused by fraud.

It should be clear that there are multiple sources of churn, and that optimizing the subscription business model requires specialized solutions and strategies to reduce or eliminate each source of churn. The good news is that our research validates that companies that have put the most effort into solving churn have translated these efforts into top financial performance.

Measurement and management of subscription KPIs

Our study uncovered informative insights about the metrics typically used by subscription companies, and the gaps in measurement most companies have that leave them vulnerable to churn.

The study delivers conclusions that are easy to unpack, and some that are more subtle.

As a reminder, our study conducted direct feedback from live interviews of C-level executives in Finance, Operations, or Marketing, from companies with subscription revenue of at least $100M annually. Thus, the study participants should have clear visibility to operations and control processes within their companies.

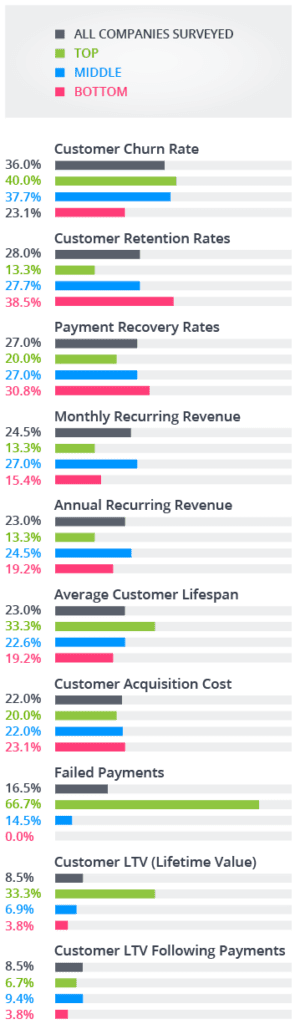

The study shows the metrics that are “outcome” metrics are tracked at high rates. For example, companies commonly track customer churn rates, retention rates and recurring revenue. These metrics track the outcomes of results, after results are earned. For example, LTV is a critical metric to track, but it is a measurement of many processes and drivers that impact the numeric value that is calculated.

The study also found the metrics that measure the inputs that lead to outcomes are not well understood, and often are not tracked. For example, involuntary churn caused by failed payments is one of the single largest sources of churn, but only an average of 16% of companies are tracking this metric (ranging from 66% of top performing companies, and 0% of bottom performing companies). If one of largest drivers of a KPI is not being tracked, the outcome cannot be improved because the company doesn’t have visibility to the impact that input values are having on outcome values, nor visibility to whether initiatives are improving the values that lead to better business outcomes.

It is interesting to note the concentration of companies who track failed payments in the top performing segment. These companies understand the connection between failed payments and churn, and are actively working to minimize the involuntary churn created.

There is a more subtle conclusion that can be reached from the data results, as well. We are confident that some of the metrics are tracked by 100% of all subscription companies. For example, customer churn and retention must be known values in these companies for their billing systems to work properly. Therefore, this data is available somewhere in the company. It is telling however that 64% of the executives surveyed replied that their company doesn’t track customer churn. This means those metrics that are directly tied to their company’s performance are not being shared and managed at the executive level.

Accountability to improvement

Organizational design

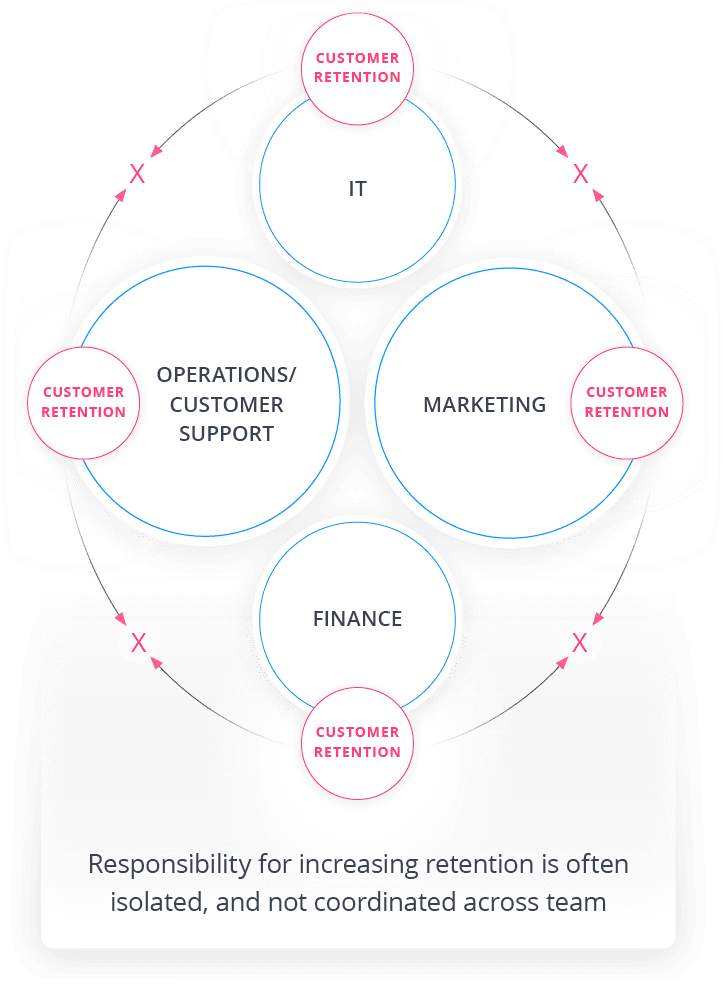

We learned in our research study that most subscription companies use traditional organizational models, where the company is divided into common functional departments: finance, operations, IT, marketing, etc.

It is ironic that the product and billing models of subscription companies have been optimized for the subscription relationship, and yet in most cases, the companies have not organized around this same concept.

The need to align organizational structure, including roles, responsibilities, and accountability to the subscription business model is probably both the most challenging change our research has uncovered, but also the most impactful in delivering profound improvements in business success.

The traditional company org structure aligns function disciplines across teams which operate mostly independent of each other. Of course, there is collaboration across functions, but the ownership and accountability for each function is still isolated. This traditional org structure model creates a ceiling that limits the results of the company. This may be hyperbolic, but let’s use some real-life examples to prove this point.

Customer retention is typically owned by either operations/customer support or sometimes marketing. This ownership makes sense if the belief

is all customer churn is voluntary, since customer support owns the customer experience, and marketing has some ownership of retention program.

As we identified above however, involuntary churn is caused by declined payments that are not recovered. If a customer is unable to pay for their subscription, the subscription will end. In fact, our data shows us that up to 50% of all customer churn is involuntary. At the very least a significant percentage of customer churn is due to friction in the payments system, rather than by reasons that customer support or marketing programs can solve.

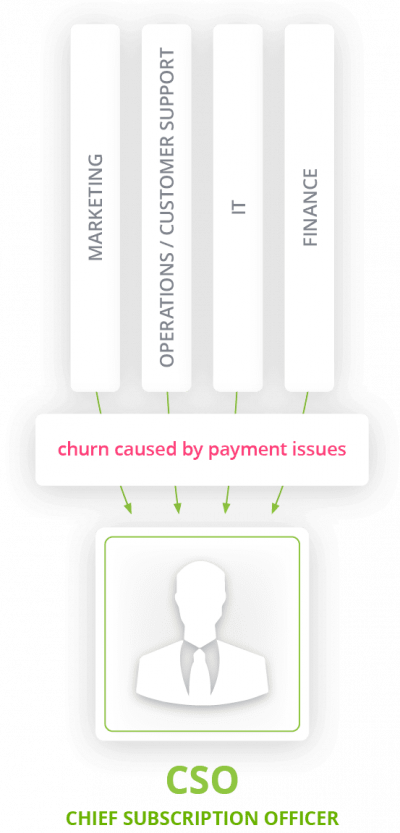

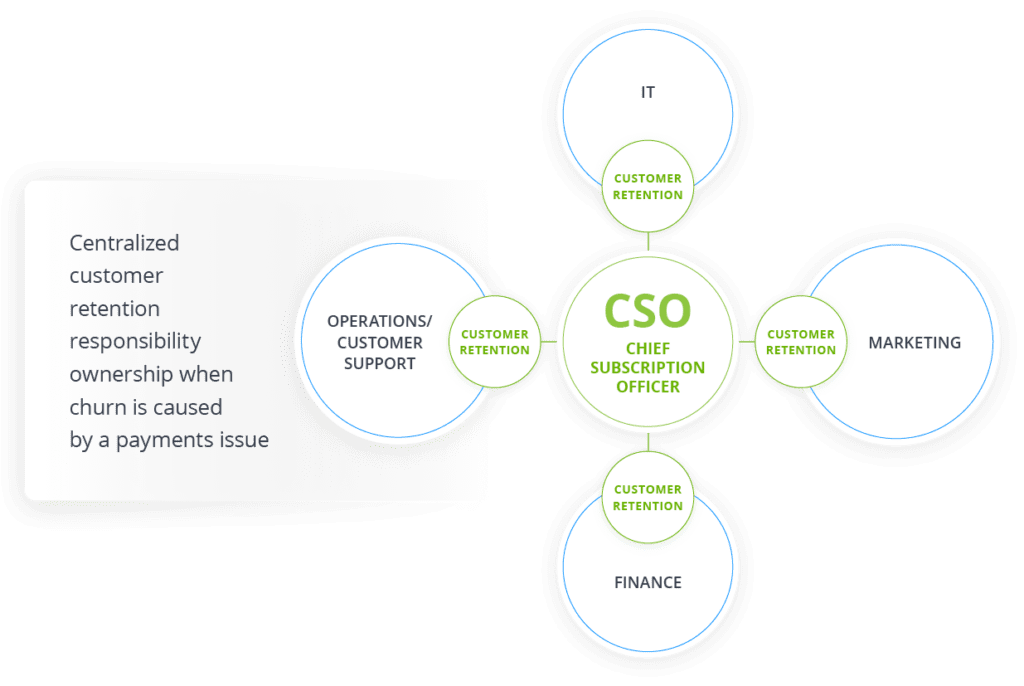

The payments tech stack is typically owned by finance and implemented by IT, and managed as a back-office, infrastructure system. So, who owns customer retention when churn is caused by a payments issue?

Curious about how your company’s org design stacks up? Here are key questions to ask yourself.

1. Is the relationship between failed payments and customer churn understood?

2. Is involuntary churn measured separately from voluntary churn?

3. Who owns overall responsibility for customer retention, and is their scope of responsibility wide enough to solve involuntary churn?

4. Is the owner of customer retention getting reporting that identifies all sources of churn?

5. Is the charter of the payments tech stack to minimize the cost of operations, or to optimize billing success and minimize involuntary churn?

6. Where are customer retention and churn metrics reports created, and which teams have access to them?

7. Are customer retention and sources of churn shared broadly across the organization?

Organizational design best practices

Our study showed us that the most progressive subscription companies have created a new C-level executive called the Chief Subscription Officer, or CSO.

The purpose of the Chief Subscription Officer role is to create a single person, or organization, with ownership of the customer experience, and accountability towards maximizing customer LTV (which inherently creates a single entity owning product experience, customer satisfaction, acquisition, and retention). The benefit of this single point of customer ownership becomes clear when contrasted with typical org merchant org structures, where this scope of responsibility are managed in silos by operations, IT, marketing, finance, and customer support.

Whether a formal CSO role is created or not, identifying a person or team with a wide enough scope of responsibility to identify and manage the metrics tied to performance is critical. When the scope of responsibility for this role is properly defined, it eases and speeds initiatives across functional teams to increase customer retention and LTV, which drives company performance.

While virtually all functions within a subscription business have processes to enhance the customer experience to improve the product experience, customer satisfaction, customer retention, and customer LTV, the lack of a unifying org structure to align all functions into a team dedicated to improving customer relationships has a direct tie to financial performance.

Summary

This report identifies the problems and challenges created by subscription companies when they use organizational and operating structures built for transactional customer relationships, rather than subscription relationships.

The good news is that creating reporting and org structures that are optimized for customer retention will create more visibility to the core drivers of customer retention, and help reduce churn drivers that are not well understood or managed, such as involuntary churn.

Top performing subscription companies have take the leading-edge step of creating an organizational role to align on customer profitability by creating a role called the CSO, or Chief Subscription Officer. This is recommended as a best practice because of the potential this role has in building stronger operational controls to optimize retention and profitability.

If you are interested in learning more about organizational best practices, or reducing failed payments (the single largest source of customer churn), contact us at [email protected], and we can share more best practices that you can apply to improve your customer retention, which can quickly lead to accelerated revenue and profit growth.