A Solution for Every Type of Churn

Solving Involuntary Churn with the Combined Power of

Invisible Recovery™ and Engaged Recovery™

Solving churn requires multiple specialized solutions

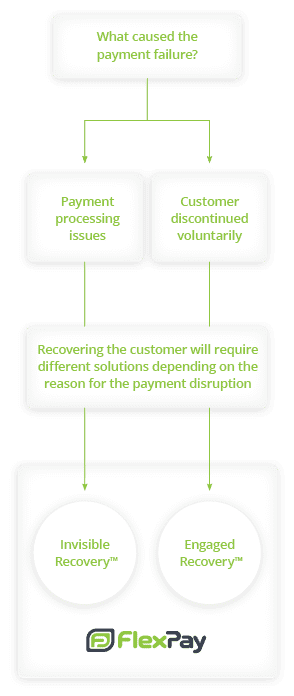

While some subscription churn is going to be inevitable, reducing customer churn rates to their lowest possible values is only possible if you understand the sources of the two kinds of churn that plague subscription companies: voluntary churn and involuntary churn, and implement solutions best suited to lower each kind.

• Voluntary churn is caused by customers who actively choose to end their subscription.

• Involuntary churn is caused unintentionally by the customer when the authorization request for their subscription payment is declined by their bank.

Understanding the sources of your churn is the first step to lowering your churn rates and increasing customer retention. It is critical to recognize that a customer request to cancel a subscription, or a declined payment, marks the beginning of the recovery cycle, or when you need to deploy your recovery strategies and tools.

Most companies understand the opportunity to recover customers who have given notice to end their relationship. The cancellation notice is followed by a series of actions by the customer support team to try to save the customer. This is often an uphill battle as the customer has already made the decision to end their relationship, so strong promotions and other expensive tactics are often necessary to save the customer.

While subscription companies typically spring into action to save customers who ask to end their relationships, subscription businesses don’t often recognize that they can also recover a very high percentage of customers that would otherwise be lost to involuntary churn. The good news for subscription businesses is that the cost to recover customers otherwise lost to involuntary churn is quite low, especially when you consider these customers didn’t intend to cancel. This insight is critical because it means that the lifetime value (LTV) of these customers is high if they can be recovered, and so is the revenue earned from successful billing cycles after a failed payment is recovered.

But it’s what you do when (not if) a payment fails that can set you apart from other subscription businesses. Customers need to be treated with respect and understanding even when their payment fails — they’re still your customers. This means you need to use recovery strategies that both reduce involuntary churn to its minimum level and deliver a great brand experience to your customers.

The ideal involuntary churn customer experience

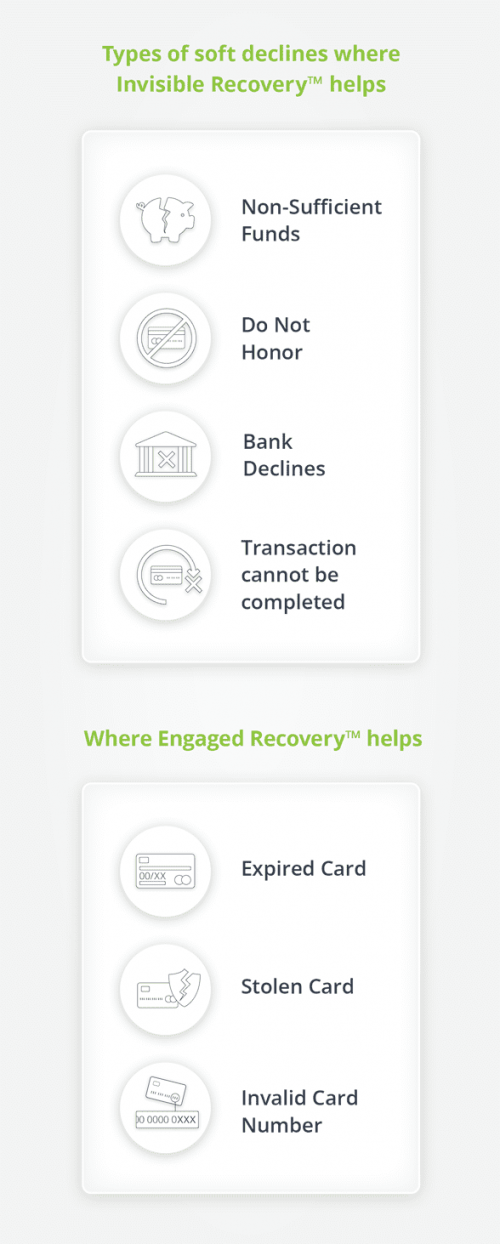

The best solution for eliminating involuntary churn involves working directly with the payments system to recover a failed payment without the customer ever knowing there was a problem. An example of this is FlexPay’s AI-powered Invisible Recovery™ solution.

A failed payment solution that quickly delivers a high recovery rate is ideal because, as far as the customer knows, the failed payment never occurred. Product or service delivery continues with little or no interruption, the customer isn’t notified of the failed payment, and their subscription continues on like normal. A quick and successful recovery is also beneficial because your customer doesn’t have the opportunity to question whether they want to continue with their subscription, like they do when they are asked to help solve the problem, or accused of having a bad card.

Payment failure reasons ideally suited for Invisible Recovery include false declines, NSF, and other soft decline types. However, some failed payments do require involving the customer in the recovery process. Examples of these kinds of failed payments include hard declines — such as stolen cards — or any failed payment that could not be recovered through a direct recovery method like Invisible Recovery.

Remember, a customer is still a customer even when their payment fails, so providing a great customer experience is vital to retention. In fact, the worst possible step you can take is to send your hard-earned subscription customers to collections or into dunning processes when their payment fails. Imagine how damaging the negative experience is to your brand when you have a collections agent try to recover a failed payment.

Sending your hard-earned subscription customers to collections or into dunning processes when their payment fails is the worst step you can take.

What should you do instead? Work collaboratively and respectfully with the customer to preserve your relationship.

FlexPay’s Engaged Recovery™ uses email and SMS channels to engage with customers and create a sense of partnership to help recover the failed payment. Engaged Recovery uses multiple branded engagement themes to find the message that is ultimately successful at recovering the payment, including education (letting them know their payment has failed), empathy (showing that you understand they didn’t cause the problem), self-agency (giving them the power to fix the problem on their own), reminders, and creating an increasing sense of urgency to save the subscription before service is discontinued.

Why the customer experience and recovery rates matter in the long run

Your goal should be to get your rate of involuntary churn as close to zero as possible. And while your customer recovery rate is a metric that measures short-term wins, long-term company revenue and profits are powered by the combination of high recovery rates and long customer lifespans following recovery. In other words, the longer a customer is retained following recovery, the higher the LTV of the recovered customer. Profits created by reducing involuntary churn aren’t earned through minimizing the cost of recovery, but rather through the LTV and full revenue generated by these recovered customers who continue to actively bill cycle after cycle.

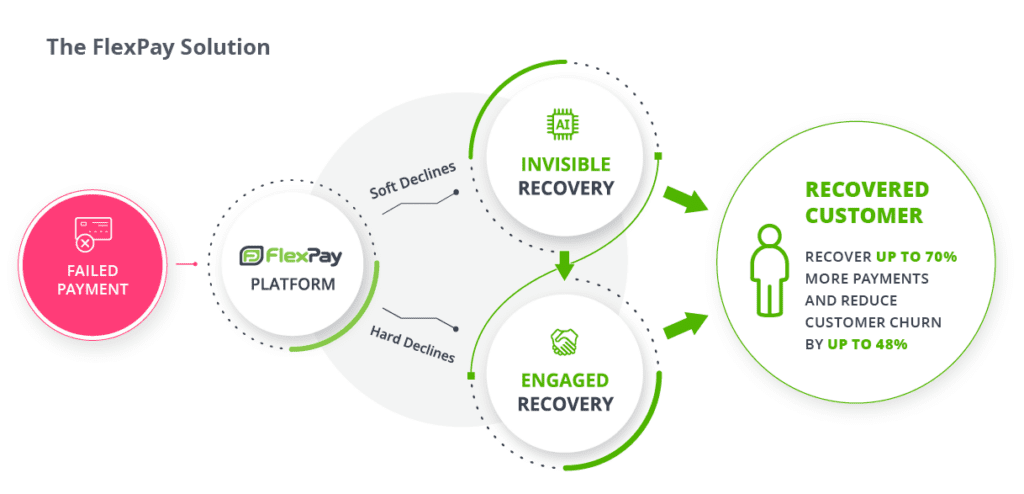

The combined power of Invisible Recovery™ and Engaged Recovery™

To achieve longer customer retention and higher LTV values, subscription companies need a payment recovery experience that’s either invisible to the customer or delivers a positive customer experience that creates a partnership with the customer to successfully solve a payment issue. This is exactly what you get with the combined power of FlexPay’s Invisible Recovery + Engaged Recovery solutions.

The ideal payment recovery experience

is either invisible to the customer or

creates a partnership with them

to successfully solve the failed payment.

Invisible Recovery delivers failed payment recovery rates as high as 70% while maximizing customer retention following recovery. Using Engaged Recovery results in an additional 30% in recovery rates beyond Invisible Recovery, allowing you to achieve the highest rates of recovery success. While individual company results will vary, only FlexPay offers this level of top performance to help subscription companies of all sizes reduce their rate of involuntary churn.