The Approval Rate Playbook: How to Prevent Failures Before They Happen

Introduction: Why Your Payment Approval Rate Deserves Attention

Your payment approval rate is one of the most critical drivers of recurring revenue because it tells you how many payments have successfully gone through. If a customer’s transaction isn’t approved by their bank and

the payment fails, it directly impacts how much you earn, how long the customer sticks around, and how seamless your subscription

experience feels.

However, most companies only focus on what happens after a payment is declined—customer outreach, recovery campaigns, or even trying to win the customer back once they’ve churned. But by then, the damage

is already done. A proactive strategy means preventing failed payments from happening in the first place.

In this playbook, we’ll show you how to move beyond reactive recovery and toward a prevention-first strategy — one that increases successful payments, reduces churn, and boosts customer lifetime value. If you’re

ready to unlock meaningful growth without overhauling your billing system, success starts here.

What Approval Rates Really Mean for Your Business

In the payments industry, approval rate refers to the percentage of payment transactions that are successfully authorized by the card issuer (usually a bank) when a customer tries to make a purchase. It’s a direct measure of how many customer payments go through on the first try. Whenever a customer submits a credit or debit card payment, the transaction goes through an authorization process where the issuing bank checks for things like:

• Is the card valid and not expired?

• Is there enough credit or funds available?

• Is the transaction consistent with the cardholder’s typical behavior (fraud check)?

• Does it meet compliance and risk rules?

If the issuer approves the transaction, it goes through. If not, it’s declined.

For example, if you attempt 1,000 transactions and 900 are approved, your approval rate is 90%.

Why Approval Rate Matters

• Revenue Impact: Higher approval rates mean more successful payments and subscription renewals.

• Customer Experience: Declined payments cause friction and frustration at checkout.

• Retention: For subscription businesses, failed recurring payments (often called involuntary churn) are a major threat to customer lifetime value.

Why Good Customers Get Declined

Even if a customer has a good payment history and plenty of available credit, a valid credit card can still be declined — especially for subscription or recurring payments. Here’s why that happens:

1. Card-Not-Present (CNP) transactions are riskier

When a card is used online or for recurring billing without being physically present, it’s considered a Card-Not-Present (CNP) transaction. These carry a higher risk of fraud than in-store purchases because:

• There’s no chip or tap to validate the card.

• Identity verification relies on data (like CVV or billing address) that can be

stolen.

Because of this added risk, banks and issuers use much more sensitive fraud filters for CNP transactions — especially if:

• The merchant is new or unfamiliar.

• The billing descriptor is unclear.

• The transaction happens in a different country or at an odd time.

Even a “good” cardholder can get flagged if the payment appears even slightly unusual.

2. Overly aggressive fraud detection by issuers

Banks and card issuers use sophisticated machine learning models to detect fraud in real-time. These systems evaluate thousands of signals in milliseconds — and sometimes they’re too cautious.

A legitimate transaction might be declined if it:

• Deviates from the customer’s typical purchase pattern.

• Looks similar to a known fraud trend (e.g. rapid-fire charges).

• Comes from a merchant category (MCC) that’s prone to fraud.

3. Outdated card data or card lifecycle issues

Cards expire, get reissued, or are updated by banks — often without the customer notifying the merchant. If your system doesn’t use an account updater service or doesn’t have tokenization in place, the next payment attempt might fail, even if the cardholder is in good standing.

4. Incomplete or mismatched transaction data

Sometimes, a small error in the data you send to the processor can cause a decline:

• Address doesn’t match billing info on file

• Name formatting issues

• Missing CVV code

• Incorrect merchant category code (MCC)

These might seem like technicalities, but issuers use them as risk signals.

5. Retry timing and velocity

If a payment fails and your system retries it too soon or too often,

issuers might automatically block future attempts. Some merchants

unknowingly create “decline loops” by retrying with fixed logic that

doesn’t adapt to the specific decline reason or card issuer behavior.

The True Cost of Failure

Failed payments don’t just cause momentary dips in cash flow — they quietly erode your business from the inside out. Each declined transaction represents revenue you expected but never collected, and in the subscription world, even a single failed renewal can sever the relationship entirely. When a customer’s payment fails and they’re unaware or unable to fix it in time, that once-loyal subscriber often churns without warning. And unlike voluntary churn, where a customer makes a conscious decision to leave, these silent exits are preventable — yet they go largely unnoticed.

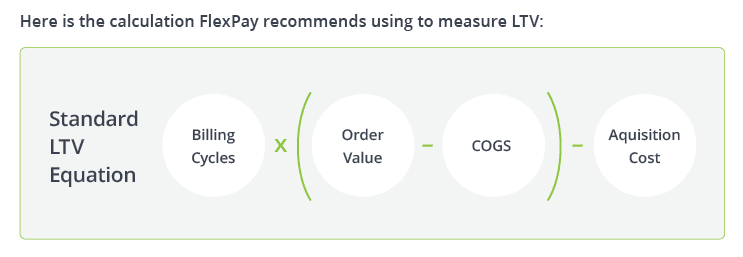

The ripple effect is substantial. Higher involuntary churn drags down your customer lifetime value (LTV), which in turn hurts your return on acquisition spend. You’re investing heavily to bring customers in, only to lose them through avoidable billing issues. Over time, this leads to inflated CAC:LTV ratios, weaker retention metrics, and missed growth targets — all because your billing infrastructure isn’t optimized for success. Addressing failed payments isn’t just a finance problem, it’s a revenue strategy.

Recovery vs. Prevention

Payment recovery and failure prevention are two sides of the same coin — but prevention is far more powerful. Recovery kicks in after a payment has already failed, relying on retries, dunning emails, or customer outreach to try to save the transaction. While important, this approach is reactive and often incomplete, especially when customers are unaware of the issue or fail to respond in time.

Prevention, on the other hand, focuses on optimizing the initial approval, ensuring more transactions succeed on the first attempt. That means fewer churn risks, fewer support tickets, and more predictable revenue. Simply put: every payment you don’t

have to recover is a win.

What You Can Control: Actions That Move the Needle

Several common payment failure triggers are well within your control — and even small improvements in these areas can significantly boost your payment approval rate.

Data quality: When you submit a transaction to the issuer, you’re essentially asking them to trust that it’s valid. That trust is built on clean, complete, and consistent data. Poor-quality data — like a mismatched billing address, incorrect cardholder name, or missing security code — can raise red flags and lead to declines, even if the customer has funds and wants the transaction to go through.

Merchant category code (MCC): This code tells the issuer what kind of business you are. If it’s missing, outdated, or inaccurately assigned (for instance, if your business is classified as “high risk” when it’s not), approval rates can suffer.

Retry timing: Most billing platforms use fixed retry rules (e.g., same interval, same logic), regardless of the decline reason. But not all failures are created equal. Some require waiting a day or two for a hold to clear. Others benefit from a retry within seconds.

Smart retry timing, tailored to the type of decline and issuer behavior, can make the difference between recovering a payment and losing a customer. Repeated attempts without strategic timing can also flag your business as suspicious and reduce your chances of success on future retries.

Incomplete transaction flags: Some failures happen before the transaction even reaches the bank. For example, incomplete or improper transaction requests with missing authentication data, incorrect formatting, or expired tokens may be rejected outright by your processor. These invisible errors

can quietly erode your approval rate without ever showing up in typical reporting dashboards.

Examples of avoidable failures:

• A loyal customer’s card fails because their billing address was entered with an extra space and the issuer can’t verify the information.

• A payment attempt is retried every 12 hours for three days even though the decline code indicates the card is over limit and won’t be approved until the next billing cycle.

• A transaction is submitted without a valid CVV code because the system assumes it’s already vaulted but the issuer requires CVV for fraud scoring.

Each of these examples is preventable with the right tools, data hygiene, and retry logic. And each one is a reminder that failed payments aren’t always inevitable — many are preventable.

Your Key to Success: Network Intelligence

The most powerful driver of payment success is your access to network intelligence — data drawn from millions of transactions across banks, card types, and geographic regions. When leveraged effectively, this intelligence reveals patterns that help you tailor transaction routing, retry timing, and submission formatting.

For example, some issuers might be more sensitive to missing address verification data, while others may prioritize fraud scoring from the customer’s historical behavior. Understanding these differences — and adjusting your processing strategy accordingly — can mean the difference between a failed renewal and a saved subscriber.

How FlexPay approaches approval rate optimization

FlexPay takes a prevention-first approach to failed payments. Rather than waiting for a transaction to fail and then reacting, we optimize for approvals by

analyzing:

• The specific decline reason

• The issuer’s historical behavior with that BIN

• Retry success patterns from similar customers

• Card type and velocity signals

Our AI models analyze millions of data points to determine the best course of action, from adjusting retry timing to reformatting requests and more.

The result? Higher approval rates, lower churn, and more revenue — all by optimizing what’s already within your control.

Building a Prevention-First Strategy

A prevention-first strategy is the missing link in many subscription billing operations. Most companies focus their efforts on recovering failed payments after the fact by sending dunning emails, retrying cards, or offering discounts to win back lost customers. But by the time a payment fails, the damage is already in motion: friction is introduced, trust is diminished, and the risk of churn skyrockets. Recovery is important — but it should be the fallback, not the foundation of your revenue strategy.

Every failed payment creates a moment of risk: your customer may not notice the failure, may hesitate to fix it, or may abandon their subscription altogether. This means you need to focus on preventing the failed

payment from happening in the first place so you can minimize friction and maximize revenue.

Signs your team is being reactive, not proactive

Your business might be operating reactively if:

• You only notice payment issues after churn has already increased.

• Your support team spends time fielding billing complaints or failed renewal questions.

• You’re relying heavily on email reminders or SMS nudges to chase down failed transactions.

• Finance and product teams are siloed, with no shared ownership of approval rates.

These are all symptoms of a system focused on fixing problems rather than preventing them.

Where Approval Rate Fits in Your Billing and Revenue Stack

Think of approval rate as a frontline performance metric — it belongs alongside your key conversion and retention metrics. A high approval rate means your payment system is doing its job well: keeping revenue flowing without creating unnecessary interruptions in the customer experience.

It’s not just a finance or payments metric, either.

Approval rate directly affects:

• Marketing (by preserving customer acquisition ROI)

• Customer experience (by reducing friction and frustration)

• Product (by keeping users engaged and active)

• Finance (by stabilizing revenue forecasts)

The earlier approval optimization becomes part of your billing process, the better your outcomes will be across the board.

The Mindset Shift: From Chasing Declines to Optimizing Success

Ultimately, this is a mindset shift. Instead of asking, “How do we recover when payments fail?”, start asking, “How do we increase the odds of success before a payment is even attempted?” A prevention-first mindset leads to fewer declines, better customer experiences, and more predictable revenue — it’s the difference between constantly playing defense and building a system that runs smoothly, quietly, and profitably in the background.

Turning Insight into Action

Understanding the approval rate problem is only the first step. To reduce failed payments and drive long-term growth, you need to turn that insight into meaningful action — supported by the right tools, the right partners, and the right questions.

What to look for in a partner or tool

Not all solutions are created equal. Many platforms offer basic retry features or surface level analytics, but few are purpose-built to prevent failures before they happen.

If you’re looking to improve your approval rate, here are key capabilities to prioritize:

• Dynamic retry logic based on issuer behavior, decline reasons, and card type

• Machine learning or AI capabilities that evolve with new data

• Seamless integration with your existing billing infrastructure

• Visibility into performance metrics, such as approval uplift, recovery rate, and incremental revenue

• Domain expertise in card-not-present and recurring payments

• Compliance and security standards that match your industry requirements

You want more than a vendor — you want a partner who understands your business model and proactively works to increase your revenue

and reduce churn.

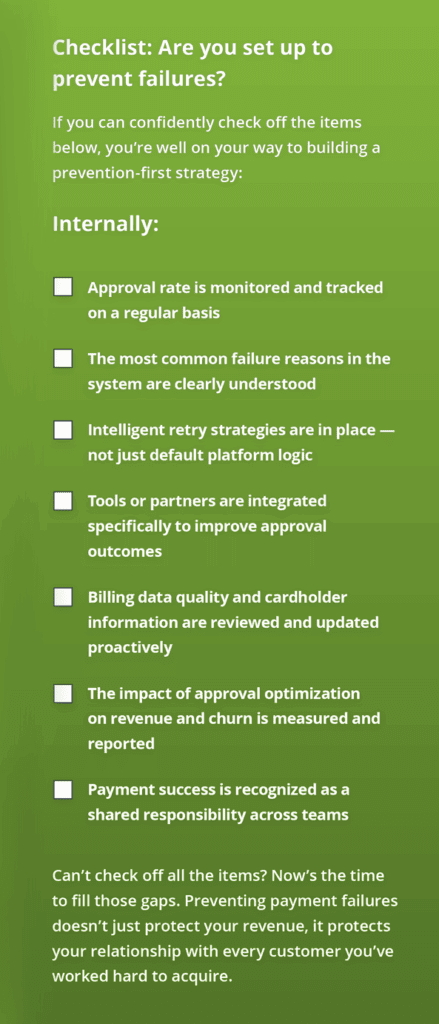

Smart questions to ask

Before you commit to a solution, it’s worth holding up a mirror to your current process. Use these questions to evaluate your readiness

and identify gaps.

Internally:

• Who owns payment success in our organization?

• Do we track approval rate consistently and do we know what “good” looks like?

• How do we currently handle retries and failed transactions?

• How many of our support tickets stem from payment issues?

• Are we treating payments as a revenue lever or a backend task?

Externally (to potential partners):

• How do you determine the optimal retry strategy for each failure?

• What kind of uplift can we expect in approval rates?

• How do you measure success and report performance?

• Will we need to switch billing platforms or disrupt our customer experience?

• How long does implementation typically take?

These conversations help ensure alignment and set realistic expectations, which means fewer surprises and faster wins.

Conclusion: A New Standard for Subscription Revenue

When it comes to failed payments, the best recovery strategy is to prevent them from happening in the first place. Too many businesses wait until after the decline to act, but by then, you’ve already risked losing the customer and the revenue that comes with them.

Optimizing approval rates isn’t just a smart financial move—it’s a better experience for your customers. Every successful transaction keeps them engaged and more likely to stick around for the long term.

It’s time to move beyond reactive recovery. Take action to reduce churn, grow LTV, and build a subscription business that runs more smoothly — without adding friction to your user journey. Prevention-first is the new standard. Will you meet it?